Specialist convenience insight agency Talysis has revealed the full impact of the disposable vapes ban as part of its over-arching review into the Convenience sector for 2025. Clarity by Talysis is based on EPoS data from 1000s of independent & symbol group convenience stores, throughout the UK.

Tobacco remains the most important category within convenience and any changes within this category – for example, the banning of disposable vapes – can have a monumental impact on the sector. Clarity data for 2025 has revealed that Tobacco & smoking alternatives’ share of the convenience market (by value) fell 2.1 percentage points year on year (YOY), to 30.3 per cent. This represented an eight per cent fall in value YOY and a 13.4 per cent fall in volume YOY. Although the majority of this decline is in “traditional” cigarettes and tobacco, the disposable vape ban means that the vaping category is no longer replacing any of the lost sales. In fact, vaping is now showing its own decline, with value sales down by 12.7 per cent and unit sales suffering a dramatic 20.8 per cent fall.

Clarity has also revealed some interesting insights pre- and post-ban, showing that retailers are losing out, not because consumption is necessarily less, but because the formats have changed. Previously, customers were paying £5-£6 for one 2ml vape. They can now (if they want to recycle) buy 2x2ml pods for the same price, resulting in a double whammy of reducing store visits/footfall as well as retailer income overall. This is further compounded by the “big puff” (2+10ml) kits. Compared to the previous disposable 2ml vapes, consumers can pay twice as much for the 12ml kit but get 500 per cent more liquid.

Adding to retailers’ woes, merchandising and stock control in the vaping category have become more complex and time-consuming. Retailers now have to stock a wider range of vapes to capture both the new and refill sales, whilst Clarity data has also revealed that over 2000 new vape barcodes were introduced in 2025 alone!

“The heavy reliance on the overall tobacco category within convenience means the disposable vaping ban has had a disproportionate effect compared to other sectors,” said Ed Roberts, MD of Talysis Ltd. “Clarity has laid bare that there are multiple aspects for stores to deal with, during an already challenging time in the sector. This includes a potential reduction in footfall and turnover, due to the new formats, together with the added time and money spent on merchandising this increasingly complex category.

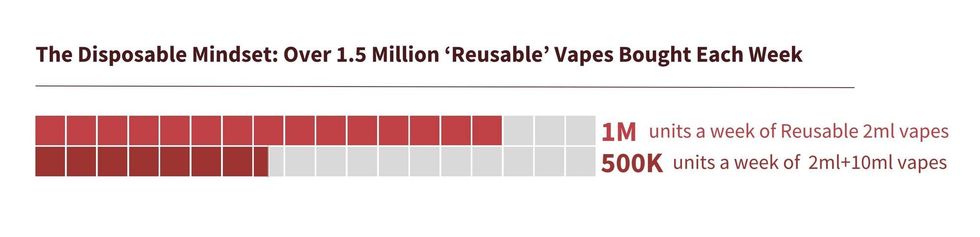

“Whilst the need to reduce single-use plastic is clear, it’s also obvious that this ban hasn’t worked as intended yet. The new formats haven’t discouraged consumption – arguably they’ve done the opposite – and there is still a vast proportion of consumers who are treating reusables as disposables, as indicated by the 1.5 million big and small puff reusable vapes that are sold week in, week out. Vaping appears to have gotten cheaper, at least in the short-term. Whether or not the incoming duty will have an effect remains to be seen. But manufacturers would do well to realise how important they are to this vital sector. A 21 per cent drop in unit sales, for a category that represented strong turnover and drove regular footfall, is a huge hit for stores."