Sustainability is no longer a boardroom buzzword. Rather, it is very much a reality playing out on Britain’s high streets. The conversation around packaging, waste, refill, and energy efficiency is building up from a soft subject into hard metric deciding purchasing decisions.

For years, environmental responsibility was seen as something for big supermarkets to tackle. But the conversation is now shifting.

The UK’s 50,000-plus convenience stores are now at the centre of the sustainability debate.

The local shop has become the daily interface between consumers, brands, and government policy and what happens on those shelves and behind those tills is increasingly shaping Britain’s collective environmental footprint.

At a time when margins are tight and energy costs remain volatile, sustainability in convenience retail is an ethical obligation but also tricky to balance at the same time.

What customers want

The days when sustainability could be addressed through marketing slogans are long gone; shoppers want visible, measurable change.

According to recent research by GoUnpackaged, over two-thirds (68 per cent) of consumers are likely to incorporate reuse and refill system into their weekly shop if it is made convenient, with enthusiasm rising to 77 per cent among younger shoppers aged 18-34.

The report further adds that half of consumers (50 per cent) actively prefer to shop with brands who implement reuse and refill systems while 45 per cent say they would choose retailers prioritising reuse over those that don’t.

If every household in the UK opted to reuse just one item per week, it would eliminate over 1.4 billion items of single-use packaging per year, states the report.

Despite consumer appetite, there are still barriers stopping shoppers from making these simple changes. Over half (54 per cent) of consumers struggle to find reuse or refill options at their regular supermarkets, and 47 per cent find these schemes confusing or difficult to navigate.

“Retailers have a limited window to act,” says Catherine Conway, Director at GoUnpackaged, at the of the release of the report earlier this year.

“Supermarkets that embrace reuse and refill systems now can establish themselves as leaders in sustainable retail, while those that wait risk falling behind in a market that’s increasingly intolerant of wasteful practices.”

This growing shift in consumer sentiment aligns with the goals of The UK Plastic Pact 2025, launched by WRAP in 2018 alongside the Ellen MacArthur Foundation.

The Pact aimed to eliminate unnecessary single-use plastics, increase reuse and recycling, and build a circular economy for packaging. The Pact has achieved mixed success to date, with half of its key 2025 targets set to be missed and plastic packaging only reduced by seven per cent since it began.

However, despite all the talk, cost remains a considerable factor, especially in the current economy. Most shoppers are still not ready to pay significantly more for sustainable options, but are willing to switch to greener alternatives when price parity is maintained.

For local retailers, this is both a challenge and an opportunity.

What brands are doing

If consumers are setting the tone, suppliers are orchestrating the melody.

Suppliers are, anyway, under pressure from both regulators and public scrutiny and the ripple effects are being felt directly in the convenience sector.

Over the past year, some of the most significant packaging and production innovations have come from food and drink manufacturers that dominate convenience shelves.

Cadbury is leading the confectionery charge. From 2025, its core sharing bars will be wrapped in packaging made from 80 per cent certified recycled plastic, among the highest recycled-content flexible packs in the category.

The wrapper features a QR code explaining Cadbury’s mass-balance approach and recycling instructions — transparency that demystifies sustainability for everyday shoppers.

In soft drinks, Coca-Cola Europacific Partners is closing the loop with bottles made entirely from rPET. It's push toward Deposit Return Scheme (DRS) readiness and consumer education campaigns is expected to spill over to the independent trade once DRS goes live in 2027.

Another leading name taking sustainability seriously is crisp brand Fairfield Farm.

Tash Jones, Commercial Director at Fairfields Farm, says, “At Fairfields Farm, we grow our own potatoes which has always meant we carefully monitor the soil health, energy use, and the wider impact of farming on the environment.

“Over the years, this outlook has deepened into a commitment to making crisps that not only taste delicious but also minimise their environmental impact.

“A few key factors include switching to renewable energy to power our potato cold stores, watering the potatoes using our reservoirs wherever we can and planting trees, hedges and cover crops to capture carbon.”

Consumers are increasingly looking for products that support protecting and restoring the environment.

Like Fairfields Farm uses regenerative farming techniques that help to rebuild soil health and sequester carbon, making a positive impact on the surrounding environment.

“There's also rising interest in brands that demonstrate climate-positive credentials, such as being carbon neutral or actively working towards it,” Jones admits. “Shoppers are becoming more conscious of how their purchasing decisions contribute to environmental goals, and they’re choosing brands that align with those values.”

Fairfields Farm has implemented a number of innovative measures to reduce its environmental impact and offset carbon emissions.

This includes adopting “no-plough” regenerative farming practices to improve soil health and carbon sequestration, as well as installing a closed-loop underground piping system to significantly reduce energy consumption for water distribution across the farm using our reservoirs whenever possible.

Jones tells Asian Trader, “We also use digestate, produced as a by-product from our on-site anaerobic digestion plant, and ensure that the cooking oil used to prepare our crisps is collected and repurposed into biodiesel.

“Additionally, our crisps are made using our homegrown potatoes and locally sourced ingredients, all produced right here on our independent farm, giving us complete control over the production process and enabling us to maintain high standards at every stage.”

In cocoa, Tony’s Chocolonely continues to prove ethics can be sweet.

In the latest Chocolate Scorecard 2025, a global ranking of sustainability and ethics in cocoa sourcing, Tony’s achieved the highest rating, marking its fourth consecutive year in the top tier.

The company’s commitment to 100 per cent traceable beans and fair pay for farmers offers a model of ethical sourcing that resonates far beyond the premium segment.

Another leading name among brands taking lead in sustainability efforts is Tilda, a staple of households and independent grocery aisles alike.

The rice brand’s new Alternate Wet and Dry (AWD) cultivation method, adopted across its global supply chain, reduces methane emissions by up to fifty per cent and cuts water usage dramatically.

For a brand that sells more than two million servings of rice a day in the UK, this is a major environmental step and one that retailers can proudly communicate to their customers.

Innovation is also coming through technology.

Polytag’s partnership with the French recycling compliance body Citeo demonstrated a world-first success in detecting one hundred per cent of UV-tagged single-use plastic bottles at a major recycling plant.

That proof-of-concept allows real-time tracking of packaging post-consumption, giving manufacturers data on exactly how much of their plastic is recovered. In an age of EPR fees and transparency obligations, this kind of traceability could soon become standard.

For retailers, it means suppliers can provide verifiable evidence of recyclability rather than vague claims.

Another fascinating development comes from Bio-D, the Yorkshire-based eco-cleaning brand. In just one year, eco-cleaning product manufacturer Bio-D has more than doubled the number of 20 litre product refill containers returned as part of its “No Brainer Container” closed loop laundering initiative.

Bio-D’s model allows customers to bring back empty detergent and washing-up bottles for refill, saving on both cost and waste. The number of customers, consumers and partners returning their empty containers has skyrocketed over the past year, returning twice as many containers in the past year as the previous three years combined.

The scheme, which encourages customers and suppliers to return their empty 20 litre refill containers for cleaning and reuse, has now saved over 20 tons of plastic from landfill, reducing the equivalent CO2 emissions as more than 2,700 trees would absorb in a year.

As well as receiving a King’s Award for Enterprise for Sustainable Development in 2024, Bio-D also secured its B Corp recertification in June this year, significantly increasing its score and positioning Bio-D in the ranks of ‘outstanding’ performers on the B Corp scale.

Retailers report stronger repeat business and higher average basket value from customers using the service, proof that sustainability can drive loyalty as well as conscience.

Taken together, such brand-led initiatives show that the industry’s supply side is moving fast. For convenience stores, the question is no longer whether sustainable products will arrive as they already have. The challenge is how to merchandise them effectively, communicate their value, and build store reputation around them.

What stores are doing

While suppliers are redesigning packaging and policies, the most interesting changes are happening at the shopfloor level. Sustainability in convenience retail is moving from aspirational to operational.

Across the UK, independent and symbol-group retailers are testing new ways to cut waste and build local credibility.

As Jones from Fairfield Farm puts it, “Independents have the advantage of speed and agility, allowing them to trial and introduce sustainability-focused products more quickly and respond directly to local demand.

“They can also champion locally sourced products, which not only supports the local economy but also reduces food miles and waste, all while appealing to customers who are actively seeking more environmentally responsible choices.”

There’s also greater flexibility for independents to partner with low-waste initiatives, such as collaborating with local food banks or using waste-reduction platforms like Too Good To Go.

“These partnerships not only help reduce surplus but also reinforce a retailer’s commitment to community and sustainability, something that resonates strongly with today’s conscious consumer,” Jones says.

To maximise the sales impact of sustainability-focused products, it is essential that the ecological benefits are made visible and are both relatable and relevant to your customers, without greenwashing.

Use clear, eye-catching signage, particularly at shelf level, to highlight key attributes such as “Locally Sourced”, “Carbon Neutral”, or “Recyclable Packaging”. These simple, direct messages help shoppers quickly identify the product's eco credentials.

Jones, advises convenience retailers, “Where possible, include short narratives on POS displays or product labelling that communicate key facts or brand stories and where you can find further information.

“This provides helpful context and can build trust and engagement.”

Some retailers may also benefit from creating dedicated sustainability zones in-store.

Grouping eco-conscious food and drink products together not only makes it easier for customers to spot greener choices but also encourages category discovery and can boost basket spend among sustainability-minded shoppers, Jones adds.

One of the ways through which stores can leap in sustainability is by introducing refill stations.

In fact, the call for stores to embrace refill has grown louder this year. GoUnpackaged’s study warned that retailers who ignore refill systems risk falling behind both in customer relevance and regulatory compliance.

The numbers are persuasive. To repeat, because it is such a stunning statistic: if every household in Britain reused just one container a week, the nation could remove 1.4 billion pieces of single-use packaging annually.

For convenience retailers, even a small refill counter for household goods, snacks or detergents can send a strong signal of modernity.

In fact, the stores that have introduced refill stations are seeing a great response – just like the Premier Talbot Store in Poole that installed refill stations about two years ago. Interestingly, it is both sustainability concerns and lower costs that drive customers to this section.

According to retailer Ehamparam Karunanithy, who owns the store, his shoppers love this concept as they can control the amount they want to buy.

Martek Zero Waste and GoUnpackaged are some of the leading names that are helping convenience retailers to introduce refill retailing concept in their stores.

Consumers are crying out for solutions to the problem of single-use packaging, especially plastic.

Stores need to respond to this to stay relevant to their customers, in a deeply competitive trading environment, as well as to stay ahead of legislative changes.

And the best part about their refill retailing is that local convenience stores will always have an edge over bigger multiples. After all, it is easier to educate a small set of consumers and habituate them into bringing their own set of refill containers to their neighborhood stores. And once those habits are formed, each piece of plastic in the bin becomes an eyesore to them.

Packaging and recycling infrastructure are improving too. A growing number of stores now host soft-plastic collection bins, supported by brand-funded recycling schemes. Others are updating signage to clarify what can be recycled at the kerbside versus in-store.

Energy is another frontier. While less glamorous than packaging, it’s arguably more consequential to the retailer’s balance sheet.

Many convenience stores have invested in doors on multideck chillers, LED retrofits and even rooftop solar panels. Some symbol groups have negotiated green-energy contracts or shared-funding models that allow independent members to modernise without heavy upfront costs.

The Co-op leads the charge with its new showcase store concept in Soham, East Cambridgeshire.

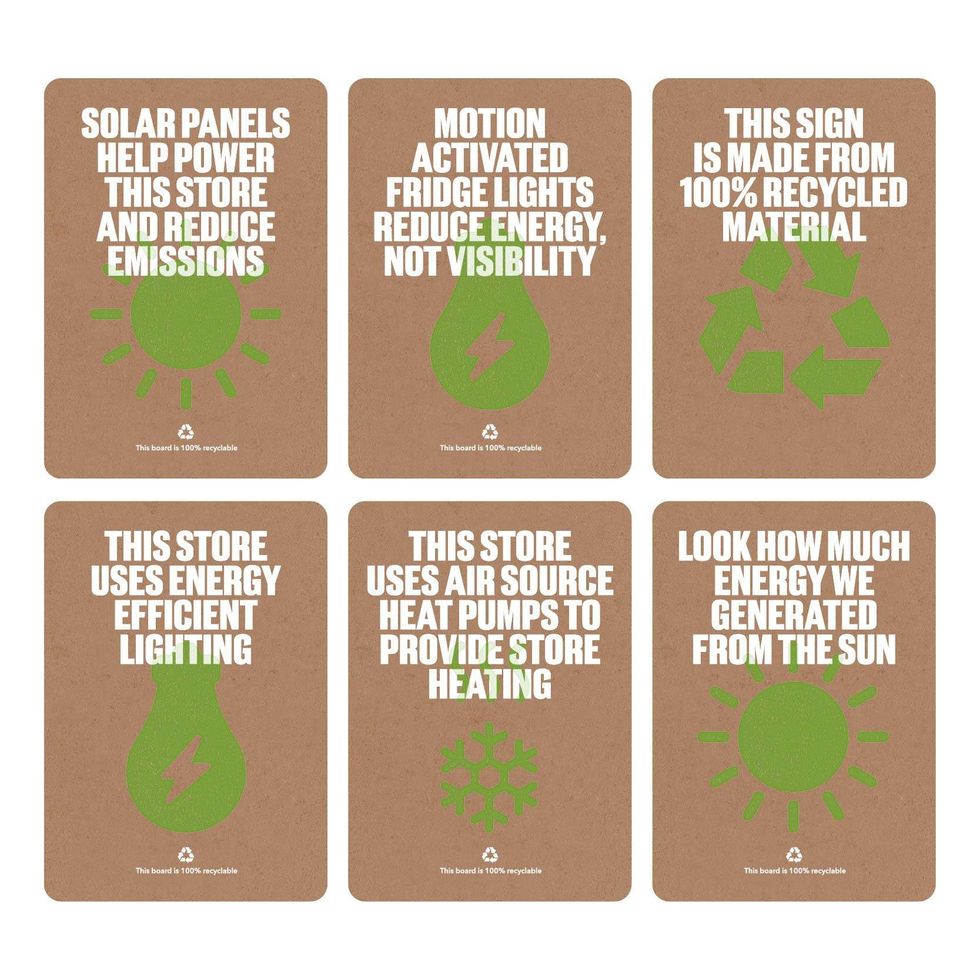

This store is a living exhibit of sustainable retailing, featuring everything from solar panels and motion-activated fridge lights to in-store digital screens displaying real-time energy consumption.

These innovations reflect Co-op’s public commitment to reach net zero across all operations by 2035 and across the entire business by 2040. The store also serves as a testing ground to trial and refine environmental technologies with the intent to scale successful initiatives across all locations.

In one Northern Ireland example, a wholesaler-led programme to install solar systems across fifty SPAR and EUROSPAR stores has reduced head-office electricity usage by thirteen per cent, proving that small formats can deliver meaningful savings.

On the other hand, Central Co-op took sustainability to another level. It has prevented more than 8,800 tonnes of food waste over the past three years after rolling out an AI-powered system across its store estate.

The UK’s largest independent retail co-operative said the move has helped save nearly 21 million meals, divert more than 32 million food items from landfill, and avoid around 23,700 tonnes of CO₂ emissions.

Even small steps, when done visibly, matter.

Take a leaf out of retailer Christine Hope’s rulebook on how she runs her brainchild, Hopes of Longtown, in a Hereford village.

She took up retailing to give a sustainable lifestyle to the village. Today, on its shelves, alongside mainstream brands, sit organic options and hyper-local products, from ice cream made just ten miles away to artisan treats produced locally.

The shop is focused on promoting local products, and by local, as Christine stresses, she means products made “within 30 miles of the shop”. The store also has refill stations for cleaning products such as liquid detergent and beauty products such as shampoo and body wash.

A simple “We recycle here” sign, an on-door chiller note about energy savings, or a poster explaining that refill bottles cost less than new ones all contribute to building shopper confidence.

The Deposit Return Scheme (DRS) debate adds further urgency. Delayed until 2027, the system will require retailers selling drinks in disposable containers to provide return facilities or accept returns manually.

However, preparation will take time as store layouts, staff training, and cash-flow systems will all need adjustment. Retailers who start planning now will be ready when implementation arrives.

Additionally, plastic packaging for fresh produce, such as apples, onions and potatoes, could be banned as part of a broader set of waste-reduction measures expected to be announced in the coming weeks.

Experts believe that forcing shops to sell loose fruits and vegetables would improve not just recycling rates but would also reduce food waste.

The measure is advocated by Waste and Resources Action Programme (WRAP), a UK environmental NGO aligned with the Labour Party.

According to the NGO’s estimates, removing packaging from these 21 types of produce could prevent 100,000 tonnes of food waste and 13,000 tonnes of plastic film waste each year, representing a significant environmental benefit.

Government advisers on the circular economy task force, a group of scientists, engineers, business leaders and charity bosses, are discussing including the packaging ban in proposals to be published for consultation later in the autumn.

If approved it would be the biggest change to the rules governing retail plastic use since the introduction of the plastic bag levy in 2015.

The talks are timely indeed since recent reports show that single-use plastic bag sales in the country have increased for the first time since the 5p levy was introduced in 2015. Ocado was singled out as the largest contributor.

According to the Department for Environment, Food and Rural Affairs (Defra), shoppers bought 437 million single-use plastic bags in 2024, up seven per cent from 407 million the previous year.

The increase marks the end of a decade-long decline that followed the introduction of the plastic bag charge, which doubled to 10p in 2021.

A shared future

The sustainability transformation of British convenience retail is being driven simultaneously from three directions – the consumer who demands clarity and choice, the supplier who innovates under regulatory pressure, and the retailer who must make it work at ground level.

In this triangle, collaboration is everything. Brands can only succeed if stores display, explain and champion their sustainable products.

However, cost of living crisis and inflation concern often puts this issue at the backseat, putting a screeching brake on the momentum.

Consumers want a greater commitment from retailers in cutting food waste, refilling stations, sustainable packaging, and partnering with social purpose organisations – though price sensitivity still plays a crucial role, states recent research by Vypr.

Consumers, particularly Gen Z women, are keen to use refill stations, provided they offer a cost-saving of 6-10 per cent compared to packaged goods.

The study indicates that older shoppers are less likely to use refill stations unless prices are reduced by 15 per cent or more, which Vypr said shows the importance of price in driving consumers to adopt sustainable shopping habits.

Two-thirds of UK consumers say they expect to pay more for sustainably packaged products, and that figure rises to 86 per cent among Gen Z and Millennials. However, Vypr’s research suggests that while shoppers express willingness to pay more, price sensitivity still plays a crucial role.

Something similar emerged in the latest data from Worldpanel by Numerator published earlier this month.

It noted that shoppers are weighing sustainability concerns, though they remain cautious about paying more for greener products. Half of British consumers now say environmental issues pose a critical threat to humanity, yet only nine per cent are willing to pay extra for sustainable items.

More than half would, however, accept plainer packaging or bring their own containers if it meant products were better for the environment, suggesting a potential for refill stations.

Clearly, customers want retailers to embrace sustainability but only if it makes their lives easier, not harder and pricier.

The call to action is clear – making reuse simple, accessible, and rewarding will define those who lead the next chapter of convenience retail in the UK. Those who answer it will secure loyalty, control costs, and help build a truly sustainable future of the UK.