The tobacco, vape and nicotine category remains one of the biggest footfall and profit drivers in UK convenience retail – but it is also one of the most volatile. Store owners are navigating a fast-changing landscape shaped by policy shifts, rising enforcement activity, pressure from the illicit trade, evolving consumer behaviours, and the growing likelihood of new restrictions and frameworks.

| To understand how the tobacco, vape and nicotine category is performing at store level – and what’s likely to shape growth next – we conducted an exclusive retailer feedback campaign for this feature, gathering responses from 91 retailers. See results here. |

While cigarette volumes are declining and regulations are tightening, nicotine demand remains resilient and in some parts of the market it is accelerating. While tobacco still dominates in value terms, the shopper mission is fragmenting. Consumers are responding to cost-of-living pressures by trading down in cigarettes and rolling tobacco. Meanwhile, modern nicotine products – particularly nicotine pouches and newer refillable or hybrid vape formats – are expanding rapidly and presenting both opportunities and risks for independent retailers.

Retailers are operating under heightened uncertainty stemming from the Tobacco and Vapes Bill. There are questions over future flavour restrictions, nicotine strength limits, and what a potential licensing regime could mean for availability, costs and compliance. Even when policy is not yet in force, speculation can influence consumer sentiment and purchasing behaviour – and that can affect what sells, what doesn’t, and what ends up as dead stock behind the counter.

In this context, the fundamentals matter more than ever. Availability of core lines. Correct compliance processes. Staff confidence. Smart merchandising. An informed understanding of what is driving change. And crucially, strong supplier partnerships that help independent retailers keep up with market shifts while protecting sales and profitability.

Yet for all the change, the reality in-store remains stubbornly consistent: nicotine still drives traffic, and nicotine shoppers still spend. Even if tobacco revenue declines in the long term, it remains true that smokers’ basket spend is above average. That means nicotine categories remain strategically vital – not just because they deliver direct sales, but because they influence the overall health of the convenience business.

Evolving, not vanishing

Nicotine’s role in convenience is transforming, but it is not shrinking into irrelevance. That point is emphasised by Phil Hudson, Associate Director at the Global Institute for Novel Nicotine (GINN), who argues that the category is moving into a new era where the mix of products matters as much as the category’s size.

“From where I sit, nicotine remains one of the most important categories in convenience. It still drives footfall, it still supports basket spend, and it still matters to the bottom line. What is clearly changing is the mix,” he says.

Hudson notes that cigarette volumes are declining, but nicotine demand is not going away. “Cigarette volumes continue to decline, but nicotine itself isn’t going anywhere quickly. Instead, novel nicotine (including nicotine pouches) is starting to play a much bigger role as adult consumers look for different ways to use nicotine.”

For retailers, the key takeaway is that nicotine customers are not disappearing – they are diversifying. Some are switching formats, some are dual-using, and many are shifting their consumption based on time, place and social setting. That makes range planning and fixture execution more complex, but also creates fresh growth pockets.

Hudson adds: “Retailers I speak to across the UK are telling a similar story. Nicotine pouch sales are growing quickly, often from a low base but with strong repeat purchase. They take up very little space, are straightforward to manage, and in many stores they’re already becoming a reliable contributor behind the counter.”

The format’s operational benefits – minimal space, limited breakage risk, and high repeat purchase – are particularly attractive for independents seeking to protect profitability while managing increasingly restricted tobacco fixtures.

Huge value, price-led

Despite well-publicised declines in cigarette smoking rates, traditional tobacco remains a cornerstone category for convenience. The UK tobacco category is estimated at more than £22 billion each year [Statista], and within that, the cigarette market continues to represent the largest share of sales, accounting for 70 per cent.

The story of tobacco in 2026 is not simply decline. It is value retention despite price inflation, combined with strong consumer loyalty – and increasingly polarised purchasing behaviour across price tiers.

Andrew Malm, UK Market Manager for Imperial Brands, says affordability remains the single biggest factor shaping the category.

“Price remains key as economic pressures continue to bite, meaning many customers are shopping around to find products which give them an enjoyable smoking experience without hitting them too hard in their pocket.”

Imperial’s perspective reflects what many retailers report day-to-day: consumers are more conscious of price than at any point in recent memory. That pressure is forcing smokers to reconsider their purchases – either by trading down within cigarettes and roll-your-own (RYO), by switching brands more frequently, or by exploring alternatives such as vaping, heated tobacco and pouches.

Malm says: “Continued pressures on the cost of living are forcing both cigarette and rolling tobacco smokers to re-examine their choices and seek products that offer value without compromising on quality.”

In cigarettes, this trend is clear in the growing dominance of the lower price tiers. “Products in the two lowest pricing tiers - economy and value - currently account for 72 per cent of all cigarette sales in the UK [ITUK Report on Trade, July 2025], so it’s clear that the quest for value remains a relentless one.”

Imperial adds further evidence of that value shift within the cigarette market: “Sales of value products continue to burgeon, with the value sector now representing nearly 37 per cent of the UK cigarette market, so there is a clear need to focus efforts there.”

Premium matters – especially in RYO

At the same time, the market remains nuanced. Even as value grows, premium segments continue to carry consumer loyalty and can deliver higher margins – a key point for retailers trying to balance volume and profitability.

Malm notes: “It is worth remembering that premium products can carry higher margin than economy and value products and will always retain a loyal group of smokers. This is especially the case in roll your own (RYO) where the premium price sector holds the largest share of the market at 37 per cent.”

That makes RYO an important battleground. It remains a high-loyalty segment, and for many smokers it is perceived as better value than factory-made cigarettes despite ongoing pack-size restrictions and pricing pressures.

“With this in mind, we’d recommend that retailers stock a range of leading premium RYO brands, including Golden Virginia,” Malm suggests.

Independents that get the mix right – value in cigarettes, premium strength in RYO, availability on core sellers – are better placed to protect footfall while maximising return.

Illicit trade factors

Any discussion of tobacco in convenience now must also consider the illicit market. Retailers are increasingly concerned about illegal tobacco and illegal vapes undercutting legitimate sales, while enforcement activity intensifies and regulation continues to evolve.

Phillip Glyn, Commercial Director at Vape Supplier Ltd (VSL), a vaping distributor and wholesaler, highlights the scale of illegal tobacco consumption: “Circa 35 per cent of total consumption in the UK is from illegal tobacco products, further showcasing the consumer shift to ‘cheaper’ packs and their desire to look to for alternatives to the increasing RRPs they notice in retail stores on tobacco brands.”

This claim underscores an uncomfortable truth: even where retailers execute tobacco well, a large proportion of nicotine demand can leak out of legitimate retail through illicit channels. That impacts not only category sales but also broader basket spend and store loyalty.

Glyn adds: “Legislation is continuously evolving and the ban on 10’s RMC and smaller RYO packs forced consumers to purchase more expensive products, which was the catalyst for Reduced Risk Products to grow in the UK Market.”

This interaction between legislation and consumer behaviour is critical. Where regulation increases the price barrier for legal tobacco, consumers may respond by either trading down legally, switching category, or turning to illicit product.

Post-disposables, ‘big puff’ growth

Vaping has undergone its most significant shift in years following the disposable vape ban. The category that once grew rapidly on the back of low-cost, easy-to-use single-use products is now being reshaped by innovation in compliant devices – particularly hybrid “10+2” formats, pod systems and higher-capacity replaceable formats.

The transformation has not been smooth, but it has created new opportunities for those retailers who adapt quickly.

Glyn says: “Despite the disposable ban, vaping continues to grow in revenue in the UK and more consumers have now opted to transition to ‘big puff’ devices as this is a more value for money option, especially when they repurchase the replacement pods.”

The shift towards pods has implications for ranging and execution. “Pod sales are now greater than kits sales in the UK, which further supports this and highlights how ‘savvy’ a vaping consumer is.”

Jacqueline Hoctor, IVG Commercial Director, confirms that the quick adoption of reusable, prefilled pod systems such as their IVG PRO 12 has created a “more sustainable and value-driven category” for retailers and consumers.

That behaviour – retaining the battery and replacing pods – supports repeat purchases and potentially better margins over time, but also requires retailers to manage SKU complexity: consumers may need the right pods for the right device, and availability becomes more important to avoid lost repeat sales.

Glyn adds: “All brands have launched compliant variations of their previously successful 2ml device, which have all continued to perform well despite the growth of ‘big puff’ – as some consumers wish to continue with their previous vaping habits and brand preferences.”

According to Glyn, consumer behaviour has rapidly consolidated around “big puff” formats: “With the introduction of the disposable ban more consumers have transition to the Big Puff Category, and now 57 per cent of total category sales are in Big Puff.”

He adds: “57 per cent of sales in the Big Puff category are now in pods.”

At the same time, smaller, compliant devices still play a role: “The 2ml category continues to decline overall and now represents 26 per cent of total UK vaping sales, with only 30 per cent of that being pods.”

This suggests that a significant portion of the market continues to purchase 2ml formats in a disposable-like way — a behaviour that could shift again with upcoming taxation.

Vaping Products Duty: prepare now

One of the biggest looming challenges for the vape market is the Vaping Products Duty (VPD), which introduces a new cost shock that will likely change purchasing patterns again.

Glyn states: “In October 2026 there will be an introduction of Vaping Tax in the UK, increasing the retail price to consumers on all vaping products. We expect an increase in volume in the months leading to the legislation as consumers and retailers stockpile in readiness for the six months ‘sell through’ period to April 2027.”

That expectation is echoed by Steve McGeough, General Manager at RV Karma, makers of übbs pouches, who anticipates a front-loaded year for vaping: “In 2026, we can expect a strong first half of the year for vaping as consumers stock up before the Vaping Products Duty is implemented in October, significantly increasing prices.”

Hoctor also anticipates steady sales until April, a surge from April to August as retailers and consumers stockpile ahead of VPD coming into force, then a slowdown from October as prices begin to rise.

“As 2026 progresses, value and quality will become more important to consumers. Later in the year, shoppers will seek trusted brands with competitive pricing, becoming more selective as they adapt to new price positioning,” she notes.

McGeough is explicit about the duty’s impact, with a new flat rate of £2.20 per 10ml of e-liquid applying to all vaping products. “This will significantly increase the cost of vaping for consumers and may encourage them to seek alternatives that fall outside of this rate, such as nicotine pouches.”

He adds: “By further increasing the relative value of nicotine pouches and rising consumer awareness of the category, we expect another year of significant growth in our trade.”

So, vaping remains important, but volatility is not going away. Those who plan for likely stockpiling patterns, communicate value clearly, and build capability in alternative nicotine formats will be more resilient.

Flavours remain critical

Even in a heavily regulated market, flavour continues to drive purchase decisions. Imperial’s Malm says: “Fruit-flavoured vapes remain by far the most popular, being the preferred choice for 64 per cent of vape users according to recent figures from June, followed by menthol, mint and mint combo flavours [VapeHub, June 2025].”

This preference has shaped how suppliers are developing post-disposable ranges.

Imperial has responded by expanding blu pod flavours: “We have seen a significant expansion to our range of blu pod flavours, developed to appeal to those transitioning from disposables. Customers can now buy and try a total of 16 flavours of blu pods.”

The company is also supporting the trial mission through kits: “blu box kit and blu bar kits, which include a rechargeable vaping device and 1 x blu pod. Each kit is compatible with the full range of blu pod flavours too, giving customers a much broader choice.”

Malm highlights the introduction of blu box kit, launched last summer to complement their blu bar kit and blu pod line-up: “The blu box kit is a compact and discrete device aimed specially at the quarter of former disposable vape customers who prefer a box format vape device.”

It offers “1,000 puffs of intense flavour per prefilled, replaceable pod” and includes “a security lock to protect the device when it is not in use” and “visible liquid level detection.”

Refillable value

Javier Soria De Vicente, Senior International Sales Manager at The Klinsmann Partnership, owners of Bar Juice 5000 and SNÜ nicotine pouches, argues that while disposables historically drove strong impulse margins, their removal has “accelerated the shift toward refillable vapes and pouches”, while also introducing new friction for retailers including “staff training, recycling and return logistics creating added expenses”.

Against that backdrop, De Vicente believes the value proposition of e-liquids is becoming central to conversion and repeat purchases. With shoppers still under cost-of-living pressure and “looking for longer lasting forms of nicotine”, the company says refillable vaping “offers far better value per use”.

For retailers, the key commercial argument is simple and easily signposted: “Bar Juice delivers the same great flavours as disposables, but one 10ml bottle replaces around five single-use vapes, making disposables, on average, five times more expensive.”

De Vicente adds that highlighting the economic case with messaging such as “cheaper long term” and Bar Juice’s “Never Count Your Puffs Again” can help convert “price-conscious customers” into repeat e-liquid buyers.

Flavour choice is also positioned as a major driver of loyalty and basket spend. De Vicente points to “extensive flavour portfolios like Bar Juice’s 50+ range” as a lever to build repeat footfall, advising retailers to use “flavour blocking, stocking bestsellers and guiding customers who are ready to switch”, supported by “point-of-sale kits, educational materials, and retailer-focused promotional plans backed by an on the road business development team.”

At the hardware end of the market, Pyne Pod is promoting its Click 50K format as a post-disposable solution for consumers seeking “punchy flavours, affordability and ease of use”.

It claims the device is “ingeniously designed to house both the UK-compliant pod and a separate 10ml bottle of e-liquid”, delivering extended satisfaction without losing the convenience consumers expect. Pyne Pod also stresses the “simple, intuitive” user experience – “Click, Swap, Go” – where the 10ml bottle “pops directly into the pod” and the filled pod “magnetically clicks securely onto the device”, making it “perfect for swapping flavours on the fly”.

From a retailer perspective, Pyne Pod argues that simplicity can lift rate of sale by encouraging “the sale of multiple pods per customer”, boosting average transaction value and repeat purchasing.

Rocketing nic pouch sales

If there is one part of the nicotine market generating widespread excitement in 2026, it is nicotine pouches. Multiple contributors describe the segment as accelerating – driven by consumer demand for discreet, smoke-free, vape-free nicotine use, and boosted by the shift away from disposables.

Scandinavian Tobacco Group UK (STG) sees pouches as a key post-disposable growth story. Prianka Jhingan, Head of Marketing at STG UK, says: “Following the disposable vape ban last summer, both tobacco smokers and vapers are now entering the nicotine pouch category in growing numbers, with sales increasing accordingly.”

STG’s data positions the segment as large and rapidly expanding: “Our latest data shows total UK nicotine pouch sales to be worth just under £188 million and growing by 63 per cent YOY in volume terms.”

It highlights the pace of growth in 2025: “In the first nine months of 2025 alone, the category grew by over £50m in sales and this shows no sign of slowing.”

And critically for convenience, Jhingan says: “Although more sales currently take place in the grocery channel, they continue to grow fastest in the convenience channel. In fact, our latest data show pouch volume sales have grown by 79 per cent in the last twelve months in convenience stores, with our own XQS selling particularly well in this channel [IRI Marketplace, w/e 28-09-25].”

XQS is already the sixth biggest pouch brand in the UK, despite only being launched just over 18 months ago.

Jhingan highlights their best-sellers – “Tropical and Black Cherry flavours, which were two of the earlier flavours to launch, while other particularly popular ones to call out at the moment would be Arctic Freeze and Strawberry Kiwi.”

Their latest additions to the XQS portfolio are Cola Lime and Fizzy Peach which are available to retailers now through the Vape Supplier website.

Imperial has meanwhile launched ZONE, a new brand of high-quality nicotine pouches, in the UK.

Malm says the goal is to help retailers “capitalise on the escalating consumer interest for nicotine pouches, while appealing to nicotine users who are looking for an alternative nicotine experience, which has the convenience and ability to be used anywhere.”

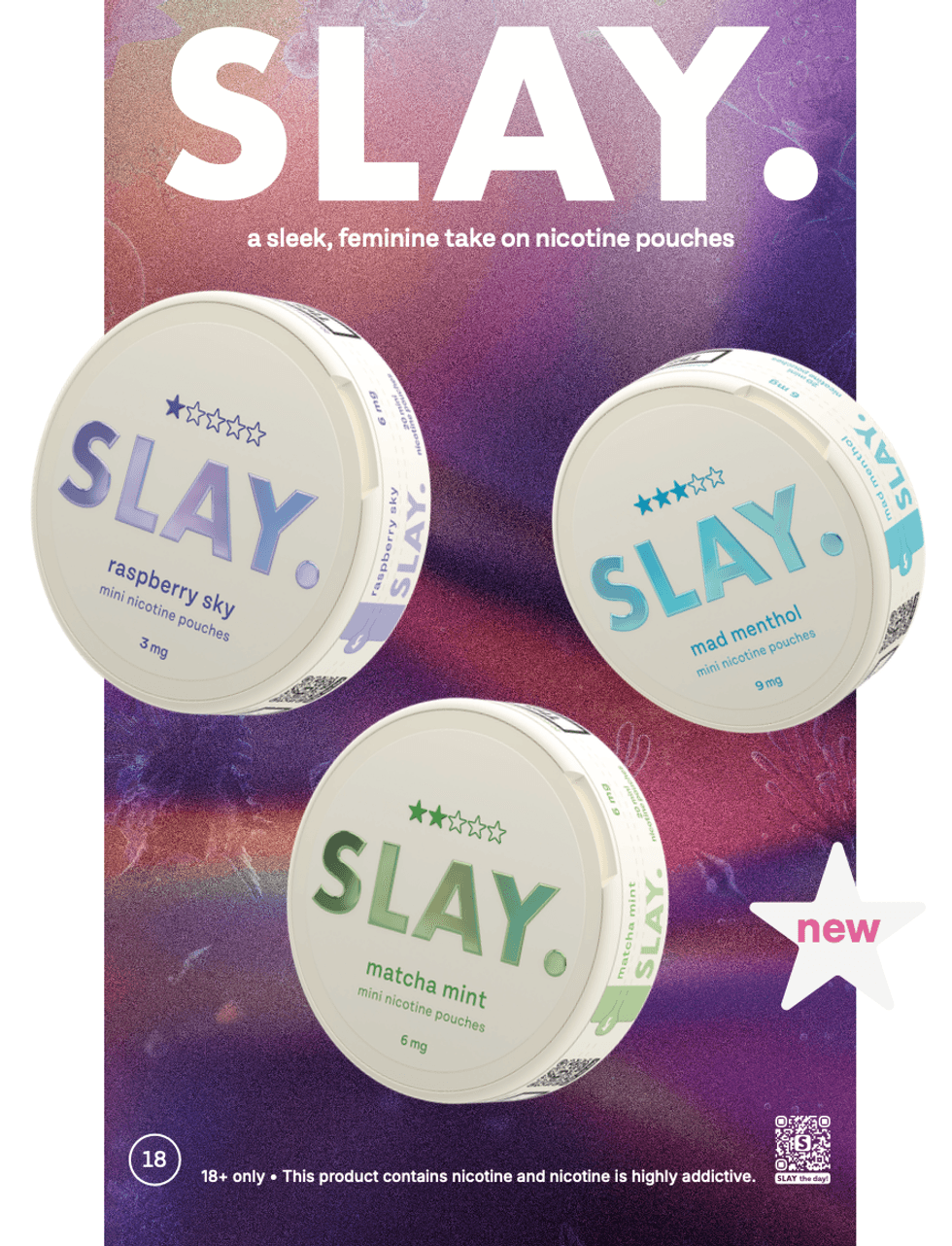

Tamas Rigo, marketing lead at Slay, a new nicotine pouch brand from Continental Tobacco Group, says they are seeing increasing weekday pouch usage.

“Tobacco and vape users want discreet solutions while at work or travelling, and even while socialising with friends and family. Some retailers tell us that while customers may vape socially at weekends, pouches are increasingly part of their weekday routine,” he notes.

He adds: “Slay is a sleek, female-led premium nicotine pouch brand. It helps retailers engage an under-served group of adult nicotine users… Slay has a discreet mini-pouch format and a modern design. The flavour range is easy to navigate, with each variant … featuring its own distinctive hue.”

De Vicente notes that “nicotine pouch use surged 93 per cent last year, reshaping the market”, with young adult consumers increasingly gravitating towards pouches for their ease and convenience.

He adds that SNÜ’s strategy reflects this behaviour shift: “Pouches are the future of nicotine; SNÜ are leading the industry in a cleaner, more responsible direction whilst removing the barrier of device dependence.” With consumers looking for products that work “in workplaces” and in social situations where vaping may be less practical, De Vicente suggests pouches offer retailers a strong repeat-purchase category with a relatively simple operational footprint.

Shifting strength segmentation

McGeough adds detail on how the segment is maturing, with shoppers becoming more discerning: “We have seen an explosion of new nicotine pouch brands, providing consumers with more choice than ever. As a result of this, nicotine pouch customers are becoming more discerning about the quality of the products they buy.”

He also notes a decline in “extreme strength” (35mg+) pouches: “Medium-high strength products have taken their place (11-20mg). We are seeing strong growth in the low strength category (4-6mg) as curious smokers and vapers are looking for a smooth entry to the category.”

This is important for retailers trying to plan ranges around possible future regulation, including any nicotine cap.

While tobacco innovation is heavily constrained, pouches are seeing a wave of flavour and strength innovation. McGeough says: “The past year showed us that as the nicotine pouch market matures, consumers are looking for new exciting flavours.”

He claims NPD is already a major contributor: “Innovation is such an important factor that new releases represented 25 per cent of nicotine pouch sales.”

From a store perspective, that suggests pouch growth will increasingly rely on retailers giving NPD a chance – while balancing range discipline to avoid dead stock.

McGeough also positions übbs as high-control manufacturing: “From the start our pouches have been made to pharmaceutical standards, in our own custom-built factory. Every pouch we make goes through more than 1300 quality checkpoints.”

He also highlights price: “Our standard sell out price of £2.30+VAT means übbs remains extremely competitive on price, with high margins even when not on offer.”

De Vicente points to SNÜ’s bolder, “Gen Z approach to marketing” as a key reason why awareness and trial are rising, highlighting that the brand “targets high-profile online personalities, leading to influencer-led purchasing and a greater overall awareness around conscious consumerism.”

That broader visibility can translate directly into store demand – particularly when supported by major event activity such as SNÜ’s recent sponsorship of the Usyk vs Dubois fight in June, which De Vicente says helped position SNÜ “at the forefront of high-profile sporting events, attracting significant consumer attention that subsequently benefits retailers.”

PML’s smokefree momentum

As the traditional cigarette market continues to decline, Philip Morris Limited (PML) says demand for smoke-free alternatives is rising among adult nicotine users who would otherwise keep smoking or using nicotine products.

Paul Dufourne, Director of Commercial Operations at PML, says adult nicotine users are increasingly seeking variety and flexibility rather than a single “replacement” format.

“We are proud to be an organisation that offers three premium smoke-free options – with two global leaders in their respective categories – to support adult smokers, who don’t want to quit nicotine, make that switch from cigarettes,” he says.

PML positions its strategy as part of a wider global shift: “Almost half of our global revenue at Philip Morris now comes from smoke-free products,” Dufourne says, adding that the company’s products are “sold in 100 markets and are estimated to be used by over 41 million adults worldwide”. He describes IQOS as “the world’s number 1 heat-not-burn device”, while ZYN “stands as the world’s No.1 nicotine pouch brand”.

“The direction is clear: this isn’t just about one product fading; it’s about multiple alternative categories rising,” he says.

One of the clearest current trends, Dufourne argues, is dual or poly-use, where adult nicotine users mix different formats depending on need state. “Some might use heated tobacco or a vape when they’re at home, then switch to nicotine pouches when they’re on the go. That mix-and-match behaviour is shaping demand in stores,” he says, arguing that retailers can benefit by stocking across categories rather than relying on one segment.

“Stocking multiple categories allows retailers to meet customers at the different nicotine moments and maximise sales, rather than forcing them into one box.”

He adds that independent research conducted by KAM on behalf of PML suggests this approach will be increasingly important, with findings showing that 68 per cent of independent retailers believe that success will hinge on offering a varied product portfolio – one that includes a full range of e-cigarettes, heat-not-burn products, and oral nicotine pouches.

For retailers facing changing legislation and the risk of adult consumers reverting to cigarettes, Dufourne says a multi-category smoke-free offer “is critical” and must be backed by “comprehensive information and education of the benefits of switching from cigarettes to better alternatives.”

Cigars steady, cigarillos surge

While cigarettes, RYO, vaping and pouches dominate most discussions, cigars – particularly cigarillos – remain relevant and may offer some retailers profitable growth.

“Our latest data shows the UK Cigar market to be worth just under £328m in annual sales which shows value growth of 1.4 per cent versus the same time last year,” STG’s Jhingan notes.

By far the largest segment within cigars is cigarillos, with sales accounting for £156m of that total, followed by the miniature segment (£93.6m), the small segment (£52.4m) and the medium/large segment (£23.5m), with the rest (£2.2m) being made up of handmade cigar sales [IRI MarketPlace, w/e 28-09-2025].

Jhingan adds: “There’s no doubt it’s cigarillos which are the current success story within cigars … sales are now worth £156m and they account for more than half of all cigars sold in volume terms.”

STG’s Signature Action cigarillo brand has benefited: “In fact, its sales have gone up by almost 40 per cent since the same time last year, with adult smokers appreciating the great flavour and cheaper price point, compared to other brands in the market.”

Compliance challenges

Across all nicotine formats, compliance is no longer a background issue. It is central to the category’s future. Retailers must manage age verification rigorously, ensure only legal and compliant products are stocked, and keep up with evolving rules.

Imperial’s Malm stresses education as a compliance tool: “Being well versed and knowledgeable about the products you can offer is vital and we are committed to supporting retailers in this through our Ignite app – where they can keep up to date on regulatory changes as well as new and popular products.”

The app also supports training: “Retailers can also ensure their staff stay informed with pointers to relevant staff training opportunities and access exclusive offers or incentives to drive sales.”

übbs’ McGeough highlights the importance of robust controls and welcomes tighter rules: “Compliance, responsible marketing and product strength are key to our strategy, so we welcome tighter regulations, as we know we can meet and even exceed them.”

Hudson puts it bluntly: “As with any age-restricted category, responsible retailing is essential and will play a key role instore. That means clear age verification at the till, confident staff who are comfortable refusing sales when needed, and only stocking legal, fully compliant products, including nicotine pouches at or below the strengths of 20mg, all of which play a key role in protecting the category as it grows.

“Getting these basics right protects both retailers and the wider industry as well as maintain a solid future and access for adult consumers.”

The agility advantage

Price competition with supermarkets is always difficult. But in nicotine categories, independents can win in other ways – speed, localisation, relationship, and range agility.

Imperial’s Malm says: “Independent stores are also better-placed to respond more rapidly to changes in consumer preferences and behaviours.”

He adds that proactive customer engagement can sharpen ranging decisions: “We are seeing that more and more retailers are now engaging proactively with customers to understand what they are looking to purchase – this intelligence then drives decisions around how ranges are tailored on a store-by-store basis.”

STG’s Jhingan agrees on the basics: “By ensuring they remain fully stocked with the best-selling brands and, if possible, making sure they try and match the multiples on price.”

But she also emphasises the wider value: “Nicotine remains an important category for independent retailers to get right, not only for the revenue it brings into their till, but as a driver of footfall and repeat business from regular customers and all the associated basket spend which goes with that.”

McGeough frames agility as a direct competitive edge: “In the nicotine pouch category, the advantage of independents is agility, autonomy and range. New SKUs come to market at a much higher rate than multiples review their ranges.”

He adds: “This allows independents to be ahead of multiples when it comes to the latest flavours, strengths and brands.”

Rigo, of Slay, concurs, terming flexibility as the ‘superpower’ of independents. “They can refresh ranges quickly, spotlight local favourites and use prime front-of-fixture positioning, advantages that larger chains often miss,” he says.

New nicotine categories are still forming habits. That means the retailer who becomes a local destination – with availability, variety and confidence – can win long-term loyalty.

Merchandising: visibility, clarity and impulse

Nicotine is fundamentally a counter category, but the right merchandising can still improve rate of sale, customer satisfaction and basket attachment.

Imperial’s Malm recommends using accessory adjacencies to capture impulse: “While rolling tobacco must be stored behind the gantry, we’d recommend stocking complementary products, such as papers and tips, near to each other to make life easier for both customers and staff – which can help to stimulate impulse purchases.”

He also highlights a broader impulse trend: “A final point to note is that impulse purchases are very much on the rise – these present fantastic incremental sales opportunities for retailers, meaning many are opting to stock a broader range of accessories to take advantage of this.”

In vaping, the fixture itself has become a selling tool. Malm says: “As the vape category continues to develop and change, it is important that retailers ensure their vape display, in whatever form, looks organised and appealing to customers.”

Malm adds a key point for many independent stores: less can sell more. “We know retailers like to stock an extensive range of products, but it’s important that they are carefully displayed to promote a minimalist look, as it can simplify the shopping process for customers and make it easier for them to decide what they want to purchase.”

Hoctor notes that brand recognition is critical, especially in times of regulatory change and economic pressure.

“Shoppers gravitate towards familiar and trustworthy brands. We provide tiered ranges across value, mid-market, and premium devices to cater to different customer segments. The Reload Mini serves value customers, PRO 12 targets mid-market, and XL35 is aimed at premium shoppers,” she explains: adding: “Tiered puff counts, device efficiency and quality flavour experience help retailers offer clear value at every price point, promoting loyalty and repeat purchases.”

Pouches need visibility, navigation

Pouches are small, discreet and easy to hide – which is exactly why stores need to focus on visibility and ease of navigation.

Jhingan says: “We know something which is key to driving purchase of nicotine pouches is visibility and how you display them in-store.”

She recommends multiple placement: “We believe that to really maximise sales of XQS it is best suited in multiple locations due to it being a newer product in the category that some consumers may still not be aware of.”

Rigo also emphasises visibility: “Think of nicotine pouches as a fast-moving category; visibility and range navigation are critical. Organise ranges by strength and flavour for easy navigation and explore dual placement near tobacco and at the front of store.”

McGeough adds: “Where possible, aim to have next-generation nicotine products as visible as possible to adult customers, whether that's through a menu or product display. Avoid hiding your range at lower portion of the gantry.”

In a counter category, staff confidence is part of merchandising. “The range of choice can sometimes be overwhelming for those making the switch from cigarettes. Simplifying the range with a curated selection of leading brands and best-selling flavours increases the chance of a successful switch … and reduces the risk of dead stock.”

De Vicente says in-store execution remains essential: “To maximise pouch sale visual display is key; pouches are discreet but they’re marketing doesn’t have to be. Eye level is ‘buy level’ and flavour blocking, creating a simple strength ladder and positioning them at the till not behind the counter will see greater uplift.”

He adds that retailers seeing the strongest results are those who “treat pouches like a flavour-led impulse category – instead of a tobacco product”, and hints that “SNÜ are bound to be adding fresh flavours to their already stacked line up very soon”, which could provide another impulse spike as consumers chase “the latest trends in the category.”

Accessories: lighters still drive impulse

While nicotine discussion often focuses on tobacco, vape and pouches, accessories remain valuable incremental earners. Clipper UK highlights the role of impulse in lighter sales.

“Market studies show that Clipper still has the strongest brand awareness within the UK lighter market, with a significant lead in spontaneous awareness,” Mishu Sidhoo, Head of Sales & Marketing at Clipper UK, says.

Clipper positions itself as a sustainability-led alternative to disposable lighters: “As a responsible lighter brand, we take the issue of the environmental impact of disposable lighters very seriously. Clipper has been at the forefront of developing truly reusable, ecological lighters since 1972.”

Sidhoo says: “From the beginning, we have promoted the consumption of reusable lighters to prevent plastic waste. Our commitment to the planet and the unique design of our products has made us an iconic brand around the world.”

For retailers, display is key: “Clipper displays such as carousels, four-tier stands and shape displays are a proven success-model to retailers across the UK … and increase sell-out rotation by 50 per cent.”

Sidhoo adds that independents are crucial, given the impulse mission: “Independent retailers have always been vital to Clipper, contributing to 50 per cent of our total sales. Research into consumer purchase habits shows over 60 per cent of lighter sales are decided on the moment of purchase.

“We have always considered lighters to be an unplanned shopping item, which is why our products need to be available conveniently to the consumer, our independent retailers offer that for us.”

Nicotine mix must change

The nicotine category is getting more complex, more regulated and more competitive. Yet it remains one of the strongest commercial opportunities for convenience – as long as retailers evolve alongside their shoppers.

Nicotine itself is changing shape. Tobacco still carries the biggest value, but its shopper is increasingly price-led and vulnerable to illicit leakage. Vaping remains crucial, yet now sits under a new set of dynamics shaped by post-disposable behaviour and an impending duty shock. Meanwhile, nicotine pouches are moving rapidly into the mainstream, creating a high-margin, high-repeat category with strong operational benefits – provided retailers focus on visibility, navigation and compliance.

Hudson sums up the opportunity: “As more adult consumers move away from smoking, and some step back from vaping, novel nicotine is increasingly filling that space. For independent retailers, it’s a chance to keep those customers coming through the door, while future-proofing the category as long as compliance remains front and centre”.

In 2026, the winners will be those who treat nicotine not as a legacy category – but as a dynamic engine of footfall, basket spend and store loyalty, where execution and agility separate the best operators from the rest.