To understand how the tobacco, vape and nicotine category is performing at store level – and what’s likely to shape growth next – Asian Trader conducted an exclusive retailer feedback campaign as part of the feature on the category in the January 2025 edition, gathering responses from 91 retailers. The results underline a category in transition: while most retailers say sales are holding steady, growth is increasingly concentrated in vaping and newer alternatives, as shoppers adjust habits and spend amid regulation and pricing pressure.

Sales performance

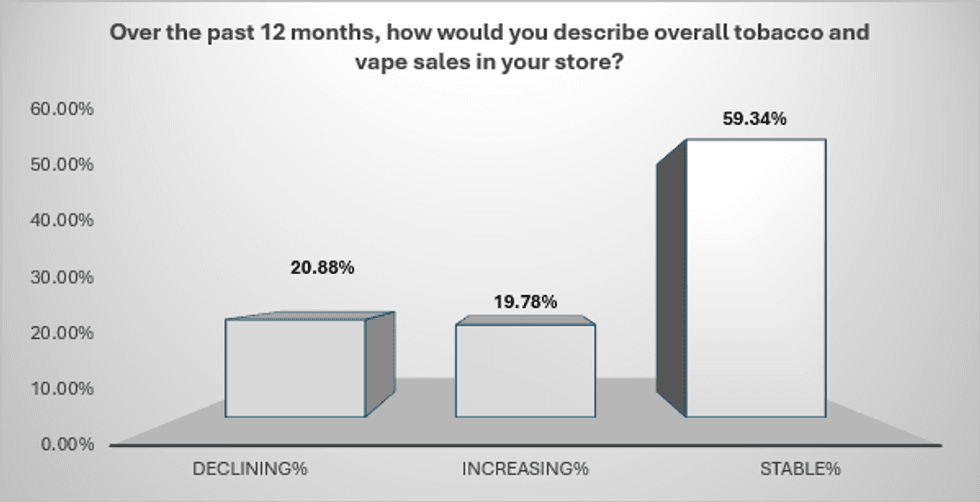

When asked how overall tobacco and vape sales had performed over the past 12 months, the majority of respondents (59.34%) said sales were stable, while 20.88% reported declining sales and 19.78% reported increasing sales.

Crucially, among retailers reporting stronger performance, the uplift is being driven by vaping rather than cigarettes. When asked which product was driving results the most, 76.47% pointed to vape, compared with 23.53% citing cigarettes. In practical terms, this reflects how vaping is now doing much of the heavy lifting for category growth – while cigarettes remain an essential traffic driver but are less likely to be the main growth engine.

Cigarettes still strong, vapes close behind

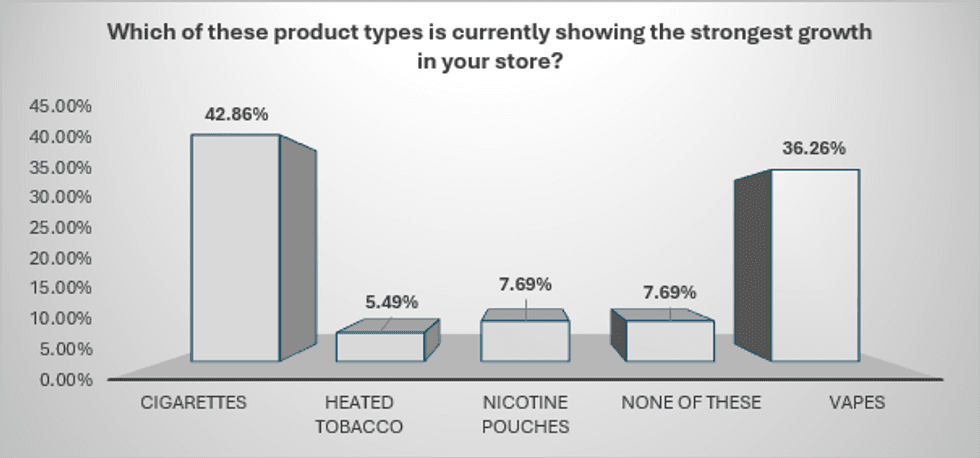

Retailers were also asked which product type is currently showing the strongest growth in-store. Interestingly, the most-selected option was cigarettes (42.86%), followed closely by vapes (36.26%). Far fewer cited nicotine pouches (7.69%) or heated tobacco (5.49%), and 7.69% chose none of these.

This tells two stories at once. First, despite long-term decline narratives, cigarettes still deliver real in-store momentum in many locations – likely influenced by price segmentation (value growth), shopper loyalty, and footfall resilience. Second, vapes remain a major growth pillar, suggesting that even as formats change, the consumer desire for smoke-free nicotine persists and continues to translate into strong sales.

Switching behaviour

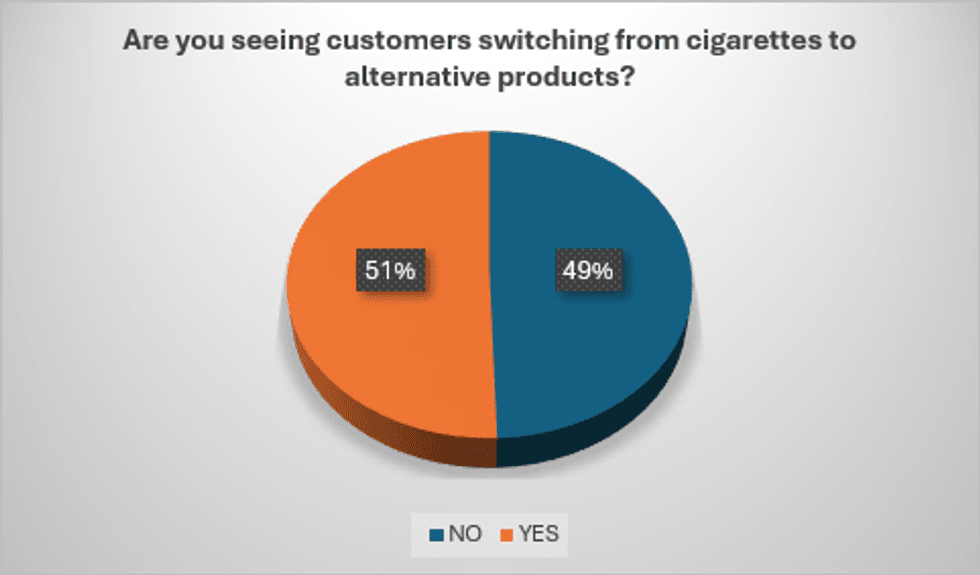

Retailers appear split on switching, showing the category is far from uniform across the UK. Asked whether they are seeing customers switch from cigarettes to alternatives, 50.55% said yes, while 49.45% said no.

However, among those seeing switching, the destination is very clear. 72.73% said customers are switching mainly to vapes, while 15.91% said the shift is primarily towards nicotine pouches. A smaller proportion reported switching to a mix (6.82%) or to heated tobacco (4.55%).

Regulatory impact

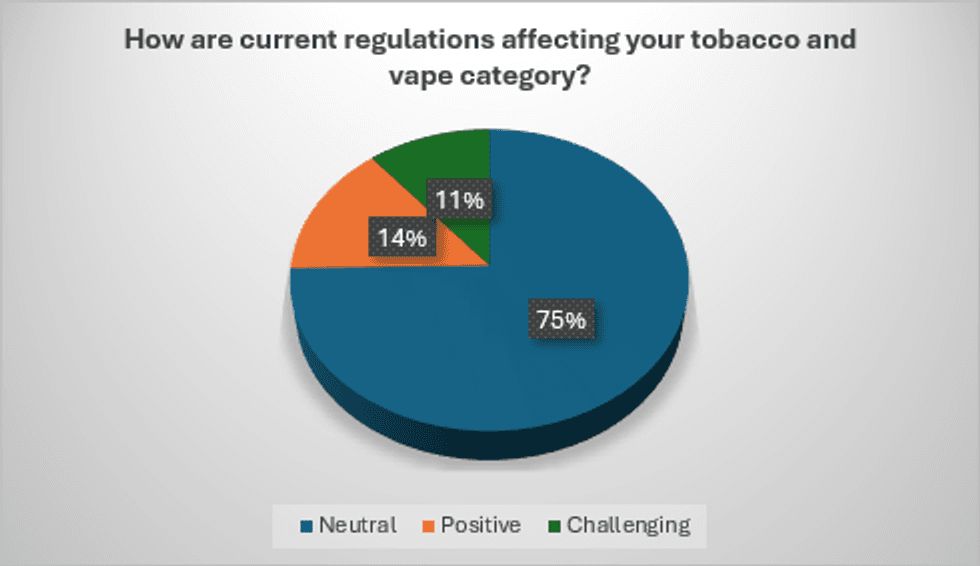

One of the most telling results comes from how retailers view regulations. Despite major changes in the market, including the disposable vape ban and increased scrutiny, most respondents (74.73%) said current regulations are having a neutral effect on their category. Meanwhile, 14.29% said regulations have had a positive impact, while 10.99% described the impact as challenging.

But when respondents were asked to pinpoint the main challenge, the answers sharpened. Pricing pressure dominates, selected by 57.14%, far outstripping product availability (14.29%), compliance (14.29%), and the view that “people are not buying the products” (14.29%).

This suggests that the practical challenge on the shop floor is less about understanding rules and more about consumer affordability. Whether in cigarettes, vaping or nicotine formats, shoppers are responding strongly to price – making value cues, clear pricing communication and smart ranging essential for protecting volume.

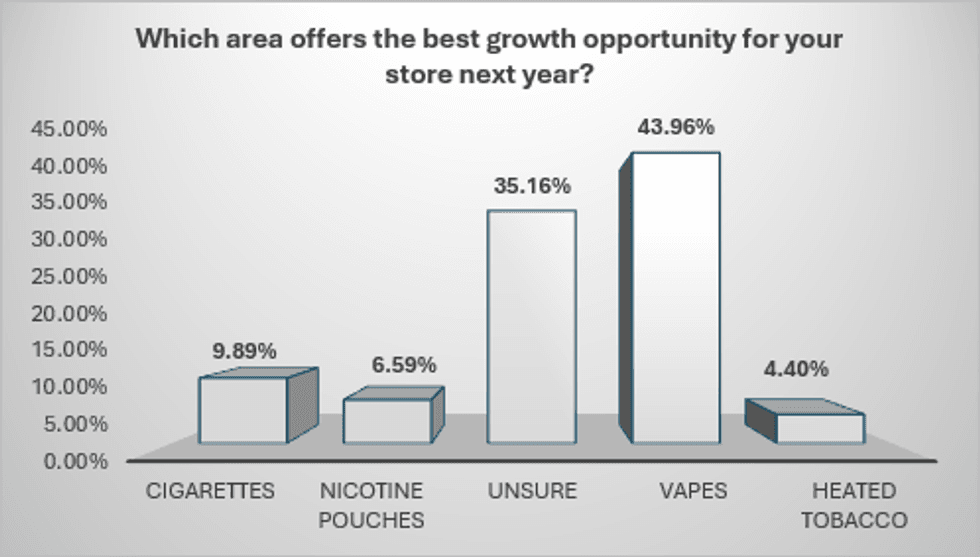

Where retailers see growth in 2026

Looking ahead, retailers were asked where they see the best growth opportunity next year. Vapes were the clear front runner, selected by 43.96%. Cigarettes were far behind at 9.89%, nicotine pouches at 6.59%, and heated tobacco at 4.40%.

Perhaps most significantly, 35.16% said they were unsure. That level of uncertainty is itself a headline, suggesting retailers know the category is shifting rapidly – but are not fully confident yet about which segment will deliver the most reliable returns as taxation changes and future restrictions remain on the horizon.

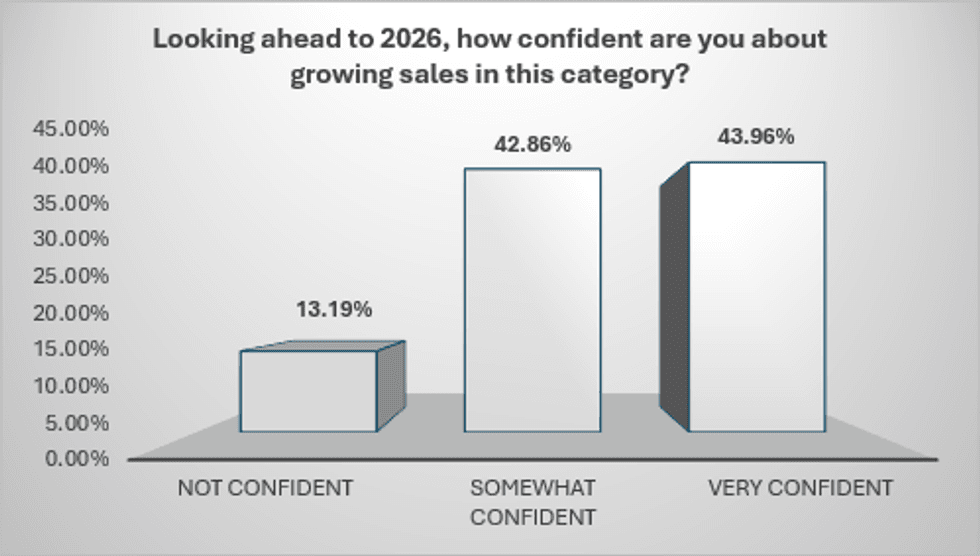

On confidence about growing category sales in 2026, sentiment is broadly upbeat: 43.96% are very confident and 42.86% are somewhat confident, while 13.19% are not confident. This indicates that most retailers believe there are still strong opportunities in nicotine – but that opportunity will likely depend on execution, compliance, and staying close to evolving consumer demand.

Supplier relationships

Among a smaller sample of 24 retailers, 45.83% said they have no preference on supplier type, while 33.33% prefer distributors, 16.67% prefer wholesalers, and just 4.17% prefer buying directly from manufacturers.

In terms of satisfaction, 58.33% rated their main supplier experience as very good, 37.50% as satisfactory, and 4.17% said it needs improvement – highlighting that while supplier support is generally working, there remains scope for stronger service, better availability and more proactive education support as the market evolves.