Almost two-thirds of adults in England are overweight and one in three children is now leaving primary school obese. The government calls obesity one of Britain’s biggest long-term public health problems. One of its moves to tackle obesity is to restrict the promotion of foods and drinks high in fats, salt and sugar (HFSS) by October 2022.

Most retailers have supported and welcomed the government's move and believe that it's an opportunity to promote healthier and fresh products. But at present independent symbol stores are concerned about the massive lack of information by the government. They are asking the government to treat small stores fairly and give a clear picture of how it is going to police this.

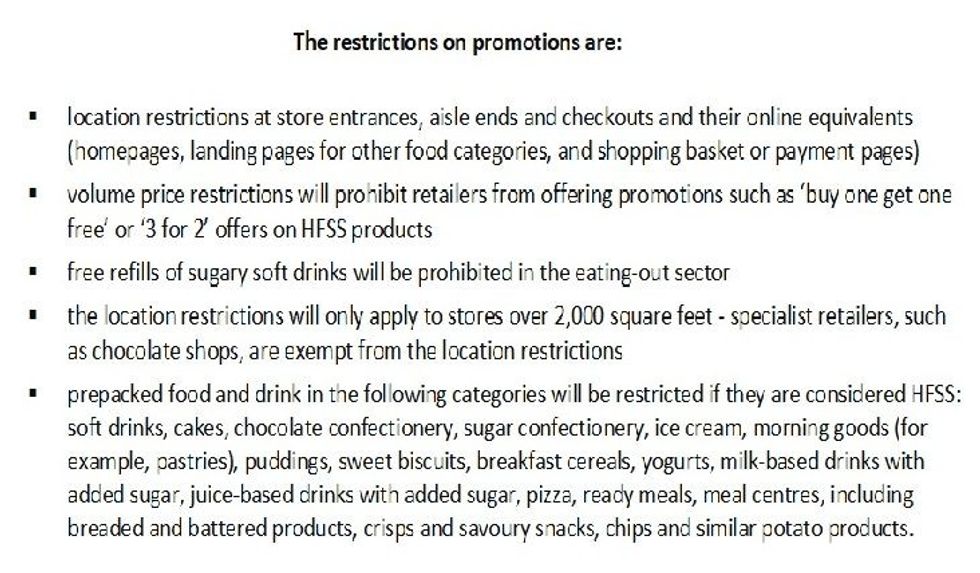

In November 2020, Britain proposed a ban on online advertising of unhealthy foods as part of its efforts to tackle obesity and improve public health. In its plan, store promotions on such products cannot be advertised, and unhealthy promotions will not be allowed at checkouts, shop entrances, or at the ends of aisles from October 2022.

The government has exempted convenience stores which are either under 2,000 square feet in size or run by a business with fewer than 50 full-time equivalent employees. But franchise or symbol group stores deemed to be part of the larger brand-owner business – such as Spar, Nisa and Costcutter – are not exempted.

Earlier, the government had planned to enforce the restrictions on promotions of HFSS foods and drinks by April 2022 but later it extended to October 2022 to allow more time for retailers to make the necessary changes to store layouts.

Nonetheless, trade bodies representing convenience stores have expressed concern about the government’s intention to include smaller symbol group stores in the proposed restrictions.

“The proposal to include symbol groups within the requirements of the policy is both unfair and inconsistent with current government policy toward retailers,” commented Stuart Reddish, national president of the Federation of Independent Retailers (NFRN) in a press release.

“By including independent retailers who have decided that they can best serve their local communities as part of a symbol group, while excluding those who trade under their own name, the government is creating a false division between symbol and non-symbol retailers, to the disadvantage of those retailers who have chosen to join a symbol group.

“A ridiculous situation will occur where two stores in similar locations, with similar levels of staffing and of similar size and product ranges, are treated differently solely on the basis of the sign above the door.”

The Association of Convenience Stores (ACS) said in a statement that the measures will put an estimated £26 million cost burden on around 2,000 independent symbol group retailers. In its submission, ACS has urged the government to rethink the size exemptions and instead use the widely accepted 3,000 square foot definition of a convenience store.

According to the Lumina Intelligence UK Convenience Market Report 2021, 19 per cent of convenience store purchases are picked up in areas that will face restrictions under new HFSS legislation. As over four in ten shoppers (44%) purchase on promotion, the categories like Bakery, Crisps & Snacks, Soft Drinks and Confectionery, which are the most commonly purchased on promotions, are set to be impacted by the regulation.

| Location | % who pick up product from location |

| Display on the end of an aisle | 7.9% |

| Display at the front of the store | 5.8% |

| Display at the till | 5.7% |

Credit: Lumina Intelligence UK Convenience Market Report 2021

Amish Shingadia, Londis Caterways and Post Office said, "It is a positive move for our country's health. We will grow other categories such as fresh, protein, and sugar-free goods."

"It is a good idea but the government needs to go further and not lay all the responsibility of this at the feet of us retailers,” said Pete Patel of Costcutter Brockley. “I strongly believe the growth in fast food delivery services has a much bigger impact on this issue than high sugar products at till point in a retail store,"

In one of its consultations on child obesity, the government said, “Tackling obesity requires us to look at all factors that influence our food choices. Every day we are presented with constant encouragement and opportunity to eat the least healthy foods. We face numerous decisions about the food we and our children eat created by the advertisements our children see on TV and on-line; the range of foods sold in our local shops or delivered straight to our doors; and the food that is promoted in-store and on-line. All of this is intended to influence the choices we make about the food we buy our children.”

However, some retailers believe that banning the promotion will not help in tackling the obesity issue as this move is not addressing the actual source of the problem.

Sunita Aggarwal of Spar Wigston and Hackenthorpe, said, "The government needs to look at the source of the problem and it needs to start from suppliers/manufacturers. Pack quantity and price as well as promotions set by suppliers determine a large percentage of our sales. More promotions need to be set on healthier products for us to promote this out to the consumer."

Bobby Singh, Holmfield Lane Superstore and Post Office, personally believes in having healthier options, as it is better for the health of the nation going way forward. He thinks, "if the products are being produced, and then being allowed onto store's shelf, it contradicts both the matters to me. They make the product, they allow the product, and then you can't promote the product. I cannot see how it makes sense.

"There are lots of healthier options out there now than going back ten years – protein products, low-fat products, low sugar, etc. If the government has recognised something is not good for people then why is it being produced? Either it's at the front of your shop or the back of the shop, we are still selling. I can't understand this. It's a big contradiction."

On an average, for retailers, HSFF products contribute between seven to 25 per cent of their overall sales. The implementation of the restrictions might affect their business in the early days.

HFSS products contribute 10 per cent of overall sales in Patel's store. He said, "We will lose some impulse sales as whatever we replace at the front tills, product wise, it will not have the same impact as the current lines do,” he says. “Though this is a good opportunity for the healthier product, producers need to do more promotion activity so that can go on the gondola ends and at the checkouts."

Aggarwal said that 25 per cent of her sales are from HFSS products. Although "sales are hugely based on price and availability but the implementation of restriction on the promotion would "increased costs in a number of ways: refit and restructuring the layout of the store."

Asian Trader also tried to understand the scenario in Scotland. Anand Cheema, Spar Falkirk said, "In Scotland, legislation around health is devolved to Holyrood. The Scottish government has put its plans on restricting in-store promotions of HFSS foods on hold because of the pandemic. The postponed ‘Restricting Food Promotions Bill’ would also likely have placed restrictions on where products could be positioned within a store.

"Indeed, the advertising bill, applies to the whole of the UK! HFSS advertising restrictions on TV and online to meet the objective of reducing children’s exposure to HFSS advertising. You can now see how retailers are getting confused! It will be interesting to see how this is aired and regulated."

He added, "Having consulted my father [Dr Pete Cheema OBE, the CEO of Scottish Grocers Federation], he advises me that at present there is no firm timeframe for bringing in a draft Bill in Scotland. The Scottish Government is continuing to look at evidence relating to the impact of the pandemic on the use of promotional mechanics, customer behaviour etc."

"I would suggest that most retailers in Scotland are waiting inherently on the Scottish Government before taking any action instore," he said.

Bharti Chavda of Westminster Grocery does not belong to a symbol group; she is an unaffiliated independent retailer. But it is interesting to know how the government's decision impacts small store's business and revenue.

"We have a primary school nearby and we already have noticed that the sugar products was reduced gradually over last 5 years when Jamie's sugar tax came in. Therefore, it already has impacted our business, I would say 10 to 15 per cent."

"Not sure how much more this new HFSS will affect us. We just have to keep trying other avenues for footfall we are no longer just a retailer, we now have to provide a service such as a parcel service, money transfers, Post office facilities etc."

The measures by the government aim to support people in achieving and maintaining a healthy weight and improve the nation’s overall health. The policy focuses on the products that are significant contributors to sugar and calorie intakes in children and that are heavily promoted. Only those products that are HFSS will be restricted, so there is scope for businesses to promote healthier products within these categories. It would be interesting to see how retailers plan their store’s layout so that they get similar benefits and profits as they get from HFSS products.

But the new regulations will be both a challenge and a huge risk for independent retailers.