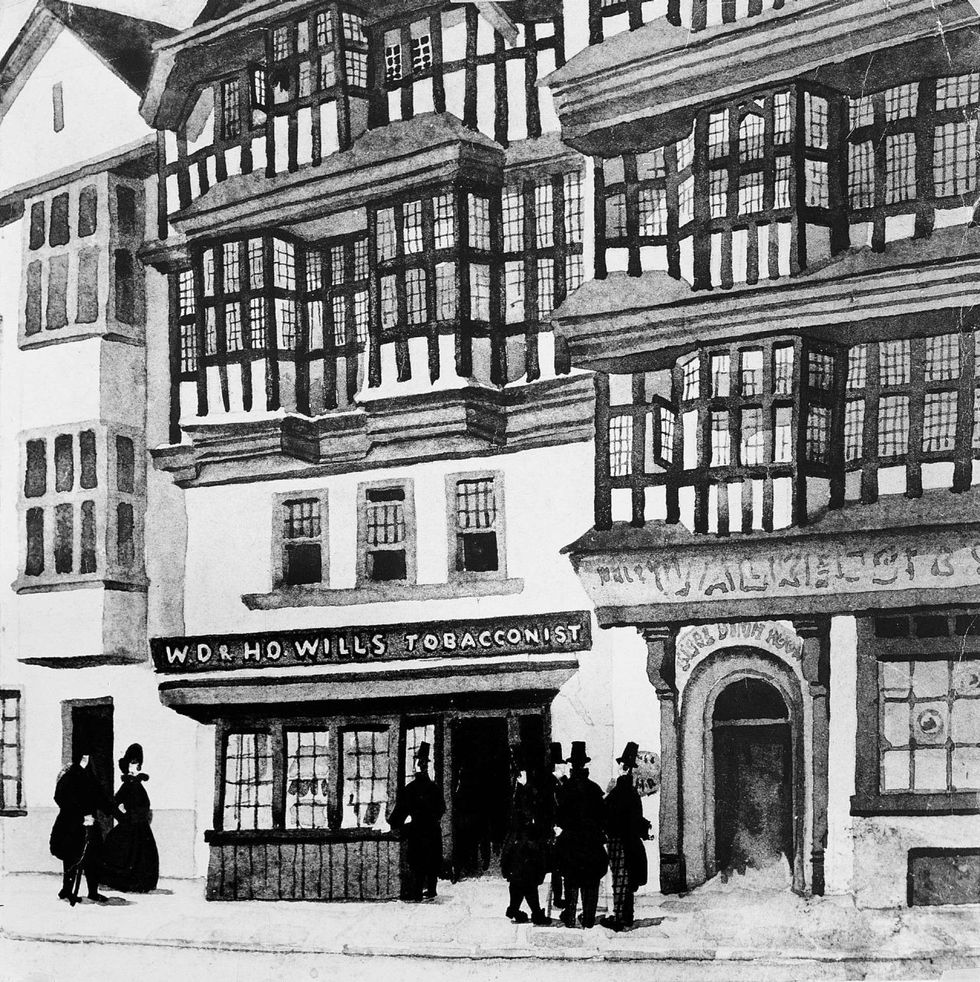

It strikes me on entering the bright, sun-filled offices of Imperial Brands – not the main one, which is in Bristol, but the sleek new building in Hammersmith from where the company’s international businesses is administered – that Patrick Ganguly is a good match for the firm, which was created from a medley of tobacconists way back in 1901, near the Bristol quayside.

One’s first impression is how Patrick’s charming appearance is further embodied by his voice – an accent combining crisp, cultured Bay of Bengal consonants with a light vinaigrette of Ozzie Strine that occasionally slips through, pencilling in both his origins and experience.

He was born in Kolkata and educated there at a Christian school before the traditional transit to St Xavier’s College, although academic life, he says, was not in his plans.

“Dad used to work for Pfizer, and he got transferred somewhere but basically said, No, I don't want to go, I don't want to leave the family. So Mum and Dad ended up buying a franchise. That was quite ahead of their time, because it was all Indian tiffin back then, rice and so on – and they introduced the concept of sandwiches, cakes, occasions, in partnership with another company, and we did fairly well there.”

It sounds like a solid middle-class upbringing in what is arguably India’s most “English” city, and like Bristol, a major port on a big river ….

“Coming back to my story,” says Patrick, “I saw an ad which asked, Do you want to come and study in Australia? Now, I had zero intention to study, but Australia seemed like a really cool place because the cricket was there. So, off I went in 1995 and I now call Australia home. I've lived in Australia for almost 32 years.”

He began his professional life at Vodafone, before moving to W.D. & H.O. Wills, then Imperial, which had entered the Australian market in 1999.

So, it is maybe appropriate that after a career of working and travelling in many countries and territories – not only Australia and New Zealand, but also places like Japan, Taiwan, Cambodia, Laos, Vietnam, Hong Kong and Korea – that Patrick fetches up in the old and traditional port of Bristol, as if returning home from a long voyage, to take the helm of Imperial Brands UK as Managing Director (or to put it more precisely, MD & Cluster General Manager United Kingdom, Ireland and the Channel Islands).

We are here to talk about the tobacco and vape industry, Imperial’s place in it and plans for the future; and the context is the looming Tobacco and Vapes Bill, not to mention what was, a month ago, the imminent disposable vapes ban, now in place.

If you read Asian Trader you will know we are tireless campaigners for the rights of tobacco consumers, producers and above all retailers, within a sensible and well-enforced legal framework – a nice idea that the UK Government should probably give a try one day.

The obvious place to begin our discussion, bearing in mind that Patrick formerly had responsibility for the ANZ region, is New Zealand. That was where Jacinda Adern, its recently departed Prime Minister, had attempted to impose a law that was so short-sighted and impractical that it contributed to the downfall of her administration.

We speak of course of her radical and illiberal proposal to impose a generational smoking ban, that would invent a new sort of age-related apartheid – if you were born after a particular date, you would be forbidden ever to purchase tobacco products, although an older sibling, for example, would suffer no such restriction. Indonesia had the idea first, but it was wisely struck down by that country’s Supreme Court as inimical to basic human rights.

So naturally, we are going to introduce it in the UK instead. I ask Patrick how the industry can deal with what we could call “ideological” legislation, the sort that barrels ahead with a political cause regardless of consequences. The kind of legislation that disregards the wellbeing of the population, for example – like the vapes ban.

He points out that in the small print of the Government’s own impact assessment of the disposables ban, it admits a third of users would go back to smoking. Great.

The problem seems to be that the Government needs the tax revenue, but wants to ban the practice at the same time, which leads directly to a mismatch of legislation, enforcement and ambition.

“If you think of ideological legislation, the generational ban probably falls into that area,” Patrick agrees.

“Yes, it's great to bring legislation into play that has a generation ban and ultimately means a different future. The big question would be, how would you actually implement it at store level?

“If you look at Europe, for example, they have a simple age ban.

“We must remember that this 'Generational Ban' only applies to retail sales in UK shops. It will not apply in the duty free environment, it will not apply in other countries where consumers may make tobacco purchases and bring these purchases back to the UK... and, of course, no rules apply to the black market where illegal sellers will certainly not be seeking age verification."

In other words, another great route for illicit product and sales.

“And if we feed fuel into this fire, it will continue to grow,” he adds. “You have an age limit of 21 in a number of European countries. And let's not forget, the first country that planned a generational ban did step back from it.”

So disposable

But before the generational ban, which is in the Tobacco and Vapes Bill scheduled to come into force on January 1, 2027, there is the more immediate prospect of restrictions on vapes, which took effect this month, and which might well give the country foresight of the social and legal consequences lurking in the later legislation.

I ask Patrick what he thinks about the disposables ban, but also whether the new laws are well thought through, and can be upheld by the authorities with the resources currently allocated to enforcement agencies – and of course what the implications are for the burgeoning illicit trade.

“Well, the Government has put forward legislation that bans disposable vapes and has given a fair amount of time for that to come into play. From our point of view, we have been working with retailers to educate them on what that actually means on the ground,” he says.

“What does that transition look like? How much stock do you have of disposable vapes? How to transition into the new vapes and continue to educate and service the consumer? One of the big feedbacks that we get from the retail community is that's all good,” says Patrick, although I can feel a “but” coming.

He continues: “There are certain components in proposed regulation that we support, for example retailer licensing, which is quite important. We support restricting flavours to proper adult flavours, rather than names such as candy floss and gummy bears, because we make our products for adult consumers. But back to your point, responsible regulations must be backed with solid enforcement. Because ultimately, if we don't save our stores, who will?

"Regulation is only as strong as its enforcement,” says Patrick. “Good regulations need to have strong, enforced backing to them, which protects the retailers, rewards them for doing the right things. And punishes people that are not doing those things.”

He has put his finger on the problem without needing (as I usually do) to bang the table. It’s a question of enforcement, and also one of compliance on the part of consumers. I ask Patrick how it was in Australia, which early on saw some of the severest, even punitive, anti-tobacco legislation in the world (leave the bar to smoke, but you may not take your drink with you; no smoking on the beach, or pretty much anywhere, outside as well as inside). What has all that draconian legislation done for compliance with the law?

“I come from Australia,” he stresses. “If you see the situation there, you will see that it's out of control.

“The Government claims, for example, that smoking incidence is reducing, but nicotine consumption has remained absolutely steady in Australia over the last five to 10 years, because people are moving to vapes and vaping. And vaping, except for pharmacy, is illegal.”

Ban smoking and people will begin to vape; ban vaping and turn law-abiding citizens into crims.

“But that's where the consumer evolution is,” replies Patrick, “which gives rise to this illicit market, and I see a lot of that being played out in the UK. And it's a bit like a movie. Once there is a plot that comes into play, you have good actors and bad actors; and there are good retailers that are focusing on doing the right thing, but we must understand that the retailers are also trying to support their livelihood, and if a retailer is in the same area as a bad actor, then who's getting rewarded and who's getting punished?”

A thriving illicit market is an existential threat to many convenience retailers, who rely on nicotine products not just for a big proportion of their revenue, but also to drive footfall for other categories in-store. But it is not just retailers who lose out to the black market.

“Ultimately, who's suffering?” Patrick asks. “The Government is [also] suffering because we have proven, in many ways, shapes and forms, that the Government is not making the necessary revenues that it once used to, from tobacco. I strongly feel that the Government needs to enforce these regulations so that we don't lose control.”

If it sells, tax it

If you pass a law you have a responsibility to uphold it, or only “bad actors” will benefit. I mention incentives, which seem to lie at the root of almost all human behaviour. Presently, punishments for illicit vapes and tobacco are very lenient and the enforcement is very sparse, such that the risk bears no relation to the reward illicit activity brings. With something like one Trading Standards officer per 100,000 of the population, it’s not even close, with illicit and forged vapes and cigs being sold out the back of every different kind of shop and vehicle.

Primarily, illicit tobacco and vape products thrive because they are cheap. We have seen decades of taxes imposed on the trivial pleasure of smoking, to the point where – after years of an ongoing cost-of-living crisis – illegality trumps obedience to the law.

“Consumer choice and affordability are quite linked together, and that's the strand of where this thing starts,” Patrick agrees.

“If you continue to tax something to a point where it becomes unaffordable, either you choose to quit it, or you choose to find substitutes and alternatives. That's where illicit vaping products started coming into Australia, obviously, at a small level initially, but then – because it's quite lucrative even at the lower prices – massively.

“It's very simple, because taxation on tobacco, for example, is almost 76 to 78 per cent, so if you supply the product at a very cheap price, because you've legally not paid tax on it, it remains very profitable. But it's not profitable for the Government. It's not profitable for the manufacturer, and it's not profitable for the good actors, for the retailers.”

There are other consequences for the retailers in addition to the loss of revenues, however – more serious and possibly physical consequences, because unenforceable laws affecting vapes and tobacco compel the retailer to become the enforcer.

When you look at these policies and try and put them into play, the Government is now transferring that ownership onto the retailer, onto the manufacturer. That’s not the retailer's job. The retailer is not a pseudo policeman. The retailer is there to serve the customers in their community.

“We are there to support the retailers, but the retailer today is a under physical threat, with attacks in-store, with the amount of stock that they carry. Is this a community and an environment that is sustainable in the longer term if this continues to happen without any intervention?

“What tends to happen is there are threats to the retailers – to their own lives and livelihood – but ultimately you end up in criminal warfare, gang wars,” adds Patrick. “We’ve seen plenty of that. You asked me the question about, where is that in terms of UK, and is it different? So the weather in Australia is certainly different to the UK. But when it comes to this trend, it's actually quite similar.”

I ask Patrick how the industry can respond to what looks like an impending legislative fiasco. In a sense, companies like Imperial Brands should be the Government's partner in regulating the market, upholding standards, taking care and making sure the distribution is tight – Track and Trace, other forms of cooperation. Ultimately, by keeping illicit actors out of the market, the producers increase revenue for the Government.

“They should have you as allies, but what actually is the relationship?” I ask.

“In terms of in terms of trying to work with the Government and giving them information on what's working and what's not working, we have a very good team that is trying to engage at every possible step of the way,” he says.

“We work with associations to try and bring that to life. Is the Government listening? And is that making an impact? I think there are facets of Government that may be taking it into consideration, but as a sum total, no, the Government is not there yet.”

Smugglers’ Cove

The other aspect of tobacco and vaping legislation is, of course, the relentless increases in tobacco tax over the decades, which hasn't hit vapes yet, but could well do so (“for health reasons”) in the next few years. There's so much tax on cigarettes now that people are increasingly patronising the illegal market.

We know from the Laffer Curve that tax revenue drops off quickly beyond a certain level. But at this point, it’s a Laffer Cliff, a tipping point, where Government revenue from taxing cigarettes and tobacco is suddenly vanishing.

Having taxed tobacco so highly, back-tracking far enough to discourage illegal sales is almost impossible. Duties would have to drop so low that cigarettes would cost £5 or £6 a packet, because that's what illegal product is selling for.

“The first item is actually to recognize and realize,” says Patrick. “We need to recognize that it has become a cliff rather than a curve, it has gone too far. Then in terms of actions to take, again, we have sent quite a few documents and we've had quite a few discussions on this, but it could be a static policy, rather than rolling back. Are we pricing tobacco so much that it's going out of the market? Should we hold excise at a level, and then focus on stronger reinforcements of those products that are coming in without any excise whatsoever? 38 per cent of the market today is non-duty paid.”

True, and some people think it’s already much higher, especially when one reads frequently in the national press about the rash of cash-only “barbershops” springing up, which are suspected of laundering illicit funds.

How can you turn back this tide?

“I think there is enough information for the Government to act,” Patrick says. “It really comes down to, will the Government act? The industry continues to provide evidence on where it's happening and how it's happening, and I look at it as two areas. One is what I call ‘into market’, and then ‘in-market’, right now.

“We have to stem it at both places. How is [illicit product] coming into market? Where is our border security? What are we doing? And how do we bring that together? And then, how do we enforce it within the market? Because if we cut the supply off at our borders and then continue to enforce that in the retail, that's how it's going to work.”

“We employ a full-time anti-illicit trade manager who's working with the trade and industry,” Patrick says. “He deals a lot with enforcement agencies, helping them in authenticating products and passing on information around illegal selling.

Apparently the post-COVID inflation had a huge impact on consumer behaviour. “The UK excise model RPI plus two per cent. When our inflation was nine per cent and 11 per cent the tax prices were crazy.”

Again, it’s a case of Government policy helping to grow the black market and foster international criminal gangs.

“In summary,” says Patrick, “it's an evolving journey. We need to continue to work with the Government, wherever the Government chooses to listen to the information that we continue to provide, and in the meantime our role fundamentally remains to serve our consumers, and we do that through the network of retailers that we have in this country.”

Voyaging onward

With so much ill-thought-through and under-consulted legislation rumbling and flashing on the horizon, the ship of the nicotine sector still appears to be well-braced – “a third above the beams, Cap’n, and prettily trimmed fore and aft”. Yet there is nervousness about the onrushing storm of new laws, and a feeling that it’s time to man the yards and pull in the foresails before the angry waves swell and break against the hull.

If so, what sort of tack will Imperial Brands be taking? Putting out or pulling in the sheets? I ask the skipper. Steady as she goes, is the answer.

“First of all, Imperial has been in the UK for the last 124 years,” Patrick explains. “We opened our doors in 1901, and we talk about evolution. Imperial has been through a constant and consistent evolution, even though the industry has changed.

He draws an analogy, not with sailing but the music industry – how we used to listen to vinyl discs and now it’s all Spotify – but still music: evolution, see?

“The way we listen to music is different, and that's exactly what we've been doing with tobacco,” he says. “Sure, consumers still want certain combustibles, and we will serve that demand, but we are moving into different, next generation products.”

It’s especially in next gen where the hopes of the convenience channel reside. Retailers know that’s where they have the edge over the multiples because people don't just pick something off a shelf. They're coming for advice and education, and the retailer will talk to them about changing from tobacco to vapes or something else, so that there is a crucial relationship only this channel has established.

“You've got 40,000 independent retailers in the UK,” Patrick begins, “and they sell our products across the multi category. They turn up, they open their doors every day to serve their community and their customers, and we turn up supporting them, through our reps, through our product offerings, through furnitures, if and when required. But ultimately, we see our relationship with them not as something we need to do today. That's always been there, and it will always continue to be there – because one of the biggest ways independent retailers add value to our business is that they are able to engage with our core consumer.

“The retailers tell us what's working and what's not – and we need to be able to listen to them and act on that.”

And what’s working certainly seems to be Imperial Brands’ fabulously successful – even category-defining – blu pod system. The company, though, has so far steered clear of other next gen innovations (at least in the UK market) such as heated tobacco devices and of course this year’s big trend, nicotine pouches.

“We've recently done research on nicotine pouches, or OND, ‘oral nicotine delivery’, and we do see a trend in there. But currently it’s completely the Wild West. There are no regulations. There's many different people trying to sell it, and some of our competitors are into it. I think what we need to look at is when is the right timing for us, with what proposition and at what margins,” Patrick explains.

“That's the strategy I'm trying to bring into the heart of Imperial Brands in the UK – where it's not just about running after something but being very clear about what we stand for. Because I believe, unless we are clear for what we stand for, we will fall forever.”

I remark that it seems Imperial has a good anchor in heritage, just as other brands (Jaguar, cough, cough) are trying to get rid of theirs. Indeed, it seems there's a big space for someone to go in and say, Actually, we've been here a long time. We're evolving. We have these products. We're sticking with them.

“It's a tested and proven strategy. I think it's really important to recognise that we've been doing this for 124 years. Of course, we didn't get it right all the time, but I think we got it more times right than wrong. That's why we're still here, and heritage is quite important to me. It's a part of my culture. It's part of my upbringing.

“Respect, heritage and humility is what makes us who we are”

And the new legislation?

“I know it sounds quite boring,” Patrick concludes,” but reasonable regulation that can be backed by enforcement and can be physically implemented is what is required, and I choose to remain optimistic!”