Christmas is approaching, and with it comes one of the most lucrative trading periods for convenience retailers in the tobacco category. As consumers prepare to celebrate and indulge over the festive season, cigars and premium tobacco products present a significant sales opportunity that independents cannot afford to overlook.

The seasonal uplift is substantial. According to IRI data, sales of cigars increase 10 per cent in December compared to the previous month, while medium and large cigars grow sales by 20 per cent. This spike is driven by the gifting surge and consumers treating themselves during the festive period, making tobacco and accessories an increasingly gift-worthy category as prices continue to rise.

The festive tobacco landscape

The UK tobacco category is estimated at more than £22 billion each year, representing a significant portion of convenience retailers' overall sales. According to the 2025 Local Shop Report by the Association of Convenience Stores, 18.8 per cent of convenience retailers' category sales come from tobacco, e-cigarettes and vaping products. This makes the festive season – when tobacco sales traditionally spike – a crucial period for maximising returns.

"It's not a new trend but retailers certainly won't need me to remind them that cigar sales enjoy an upward trajectory over the Christmas period when many adult smokers like to enjoy one as part of their festive celebrations," explains Prianka Jhingan, Head of Marketing at Scandinavian Tobacco Group UK. "It's typically larger cigars that people will gravitate towards as a bit of a Christmas treat when they are in celebratory mood and typically have more time to enjoy it."

This connection between cigars and celebration has deep historical roots. Native American potlach ceremonies incorporated smoking tobacco to mark marriages, births, and other significant occasions. When cigars first reached Europe through Spain in the 16th century, they were incredibly rare and a conspicuous sign of wealth, making them the preserve of special occasions – a tradition that continues today.

Value and premium

Understanding current market dynamics is essential for retailers looking to optimise their festive offering. The tobacco market is experiencing continued pressures from the cost-of-living crisis, especially with predictions around tax rises forcing both cigarette and rolling tobacco smokers to re-examine their choices and seek products that offer value without compromising on quality.

"Products in the two lowest pricing tiers – economy and value – currently account for 72 per cent of all cigarette sales in the UK, so it's clear that the quest for value remains a relentless one," notes Andrew Malm, UK Market Manager at Imperial Brands [ITUK Report on Trade].

However, premium products retain a highly loyal customer base, particularly in rolling tobacco where nearly 37 per cent of products sold are premium. This bifurcation of the market means retailers must cater to both value-conscious consumers and those seeking premium products.

"The most prominent trend, that shows no sign of slowing, is a market that is splitting into two distinct ends," explains Malm. "One is a large and growing segment focused on value and economy brands driven by the cost-of-living pressures consumers are facing. The other is a smaller but highly resilient and loyal segment dedicated to premium products. For retailers, looking to support consumers and ultimately drive bottom lines, the key is to cater to both of these distinct consumer groups with trusted, high-quality offerings that meet their specific demands."

Cigars: a resilient performer

The cigar category has demonstrated remarkable resilience and growth. Latest data show the total cigar category to be worth just over £327 million in annual sales, representing year-on-year growth in value terms of 1.5 per cent [IRI]. Sales from the cigarillo segment currently account for over £155m of that total, while the three other segments combined – miniature, small and medium/large – account for £170m, with the remaining approximately £2m made up of handmade cigar sales.

"Cigarillos are undoubtedly the current success story in the cigar category and something that should appear in any convenience retailer's tobacco offering," says Jhingan. "The cigarillo segment may be the smallest in terms of the actual cigar size, but it is easily the largest of the four segments in terms of volume and not far off the other three combined in terms of value."

The cigarillo segment has seen particularly strong growth, with Scandinavian Tobacco Group's Signature Action brand sales almost doubling since last year, with adult smokers appreciating the great flavour and cheaper price point compared to other brands in the market.

“The cigarillos have a natural tobacco leaf wrapper and contain Virginia blend tobacco for a smooth tasting experience and a dual mentholated capsule in the filter for a cool and fresh peppermint flavour. In short, it’s a high-quality product at a comparatively low price,” Jhingan adds.

Stock the right range

For Christmas, retailers need to be strategic about their range selection. The key is not necessarily stocking a big range but rather stocking the right range.

"It's important to stock the right range of cigars rather a big range, so we usually advise retailers to consider stocking the top two or three brands in each of the four main cigar segments, as the top ten biggest sellers overall account for well over 90 per cent of total sales," advises Jhingan.

For the festive period specifically, medium and large cigars should be prioritised. "My advice at this time of year is always make sure you have brands like our Henri Wintermans Half Corona in stock as it is easily the UK's best-selling medium/large cigar and has a loyal following due to its quality blend and heritage," says Jhingan.

When it comes to pricing strategy, offering a range with different price points is crucial to meet differing consumer needs. “But in general, I would suggest they follow manufacturers’ guidance on pricing, as our recommendations afford value for the consumer, whilst giving exceptional margins for them, typically three times higher than those from cigarettes,” Jhingan adds.

Proactive engagement with customers is also increasingly important. More retailers are now engaging with customers to understand what they are looking to purchase, with this intelligence then driving decisions around how ranges are tailored on a store-by-store basis.

"Smart retailers are also being more proactive when it comes to checking stock levels to ensure the most popular products are always available," notes Malm. "This will help keep customers happy and ensure they have no need to go elsewhere."

Another point to note is that impulse purchases are very much on the rise. “These present fantastic incremental sales opportunities for retailers, meaning many are opting to stock a broader range of accessories to take advantage of this,” Malm adds.

Young adults and non-cigarette tobacco

One of the most surprising trends in recent years has been the rise in non-cigarette tobacco use among younger adults. Research published in Nicotine & Tobacco Research revealed that the number of adults in England using non-cigarette tobacco products – including cigars, pipes and shisha – increased from about 210,000 in early 2020 to a peak of nearly a million in mid-2022, falling back to 773,000 by September 2023.

Most notably, the most likely group to use these products is young people, with about 3.2 per cent of 18-year-olds smoking these products in September 2023, up from 0.19 per cent in 2013. By contrast, only 1.1 per cent of 65-year-olds were doing so.

This demographic shift presents both an opportunity and a responsibility for retailers. The rise has been attributed to various factors, including social media influence, a desire for differentiation, and an appreciation for tradition and premium experiences. One cigar shop owner in Mayfair reported that approximately 30 per cent of their customers are under the age of 30, particularly since Covid when delivery trade increased significantly.

Cigars as gifts

Cigars have become increasingly popular as Christmas gifts, representing sophistication, relaxation and shared happiness. The gifting aspect extends beyond just the cigars themselves to include accessories such as high-quality cigar cutters and lighters, which can enhance the overall presentation and experience.

The appeal of cigars as gifts lies in several factors. For experienced smokers, they represent a passion, making a premium cigar the perfect present. Cigars have long been associated with special occasions, evoking luxury and celebration. Christmas provides an opportunity for reflection and appreciation of the finer things in life, with many recipients keeping the custom of lighting up a cigar over the holidays.

Personalisation is another key advantage. Cigars are available in various options, allowing gift-givers to choose products that suit the recipient's preferences. Some brands also release special editions and premium releases during the festive season, creating unique and memorable gifts.

This gifting trend creates opportunities for retailers to upsell accessories alongside cigars. As plain packaging legislation exempts cigars, they can be displayed on the middle shelf of the gantry where they are visible and more likely to be purchased by adult smokers who can see them.

Accessories opportunity

The accessories category represents another significant festive opportunity, with impulse purchases very much on the rise presenting fantastic incremental sales opportunities for retailers.

The tobacco accessories market is valued at over £450m and growing at 14.6 per cent [IRI]. Sales in the convenience channel account for more than half of all tobacco accessories sales and are now valued at £251m, growing at 14.5 per cent year-on-year.

Imperial Brands' Rizla range continues to dominate the accessories category, with one in two papers sold in the UK being Rizla Green [EPOS]. The company recently added a new Classic King Size Combi variant to the Rizla range, including 32 unbleached king-size papers and tips, offering everything for the perfect, authentic rolling experience.

This launch was driven by value-savvy consumers increasingly migrating from king-size to combi cigarette paper formats for added value and convenience, alongside growing demand for unbleached papers as consumers seek a more natural look.

The £126m papers sector continues to perform well, with value sales up 8.1 per cent on last year [IRI]. Republic Technologies UK is making a major contribution to sustained category growth through ground-breaking NPD and strong trade support for both new and established products.

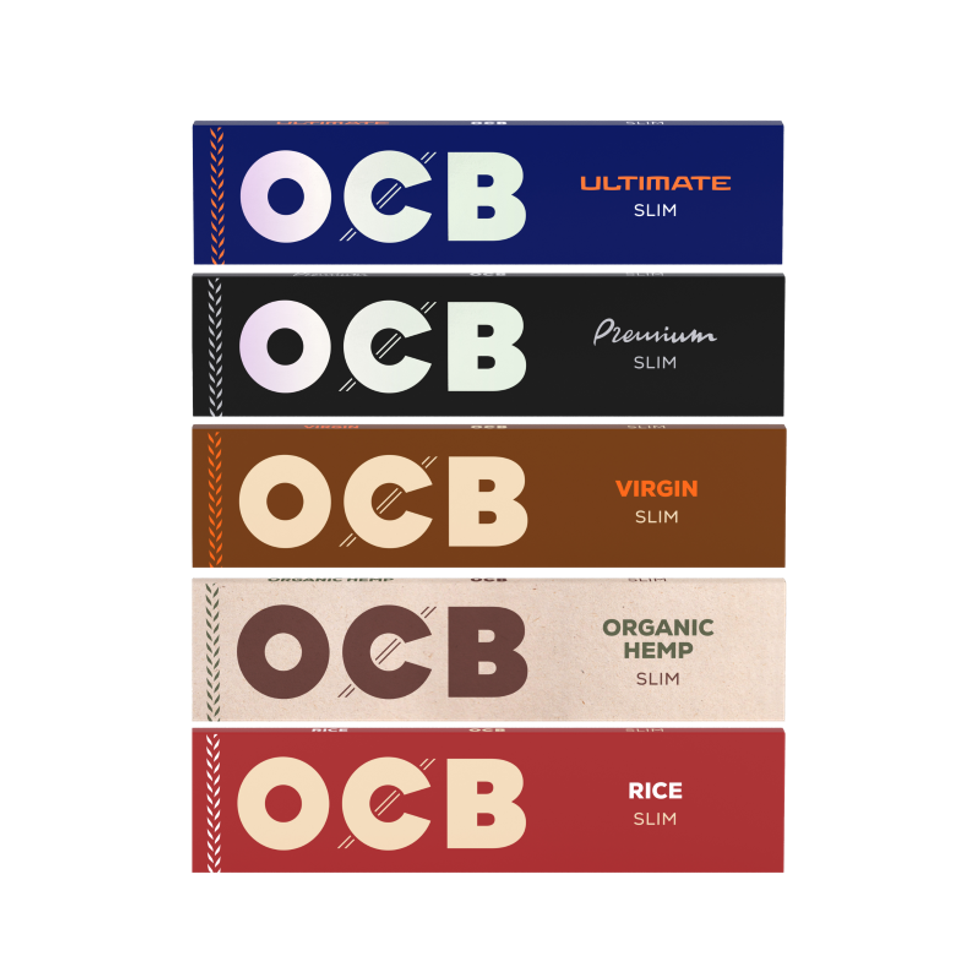

"Shoppers still want quality and value, which OCB delivers, but the plus point for the range is its environmental credentials, which offer a clear point of difference vs most other papers, and this is really resonating with roll your own purchasers," says Gavin Anderson, Sales & Marketing Director at Republic Technologies.

Organic and chlorine free, OCB Rice Papers are made from a blend of rice and organic hemp. The unbleached, ultra-thin papers deliver a premium rolling and slow-burning experience in a natural, brown paper. With 32 papers per pack, OCB Rice is available in both Slim (RRP: £1.10) and Slim & Tips (RRP: £1.73).

Republic Technologies is also underlining its environmental credentials in the £78m filters sector with the rollout of Just Paper plastic free Swan filter tips. In a category boosting first for tobacco accessories, innovative Just Paper Swan Filters provide consumers with an experience that is similar to traditional cellulose acetate filters, but with a much lower environmental impact.

The Swan Just Paper range features a “flip-a-tip” design which dispenses loose extra slim filters, without the use of plastic rods. Each box contains 120 filters, with 10 boxes per outer, with an RRP of £1.45 per consumer unit.

NPD

Several manufacturers have launched new products specifically targeting current market conditions. Imperial Brands introduced Paramount, a cigarette brand targeting smokers seeking high quality at exceptional value. Featuring premium, full-flavour Virginia sun-ripened tobacco, Paramount has become the fastest growing brand in FMC in FY25 [IMB].

In response to continued price inflation and cost-of-living pressures, the premium Golden Virginia Original hand-rolling tobacco now comes in a 40g pouch, as well as 30g and 50g, offering adult smokers more choice.

In the cigarillo segment, Scandinavian Tobacco Group launched Signature Action Mix cigarillos at the start of this year, which contain two capsules and combine the flavours of Berry and Mint. They come in ten-packs with an RRP of just £5.85, which is lower than competitor brands but still offering an attractive margin to retailers.

More recently, the company introduced a new 17-pack format, available to retailers since August, complementing the existing two ten-pack offerings. With an RRP of £9.89, including a price-marked version, the new 17-pack delivers value to consumers, positioning it as a competitively priced option in the market while offering an attractive margin for retailers.

Alternative nicotine

Independent research conducted by KAM on behalf of Philip Morris Limited (PML) highlights that 68 per cent of independent retailers believe that success will hinge on offering a varied product portfolio – one that includes a full range of e-cigarettes, heat-not-burn products, and oral nicotine pouches, rather than relying on a single category as they may have done previously with disposables.

"By adopting a multi-category product approach that meets different consumer tastes and preferences, and is supported by comprehensive information and education, there's an opportunity for retailers to switch single-use vape users to a different smoke-free option, preventing them from reverting back to cigarettes whilst also protecting their store's bottom line," explains Paul Dufourne, Director of Commercial Operations at PMI UK&I.

The heat-not-burn category has shown significant growth, with IQOS establishing itself as a leading alternative for those transitioning from cigarettes. Of the brand's 33.8 million users across the world, 2.4 million adult smokers have stopped burning tobacco entirely, heating it instead with IQOS. In a significant development, IQOS net revenues have surpassed those of Marlboro, the world's most valuable cigarette brand, in less than a decade since IQOS' launch.

In the UK, the percentage of convenience retailers now selling TEREA and HEETS tobacco sticks has risen by 42 per cent in a two-year period [Nielsen], while cigarette sales declined by 34 per cent during the same time.

“And now, with similar signs of rising popularity in the nicotine pouches category which saw volumes increase by 91 per cent in early 2024, the breadth of access to new smoke-free alternatives for adult nicotine users has never been as varied in the transition away from traditional cigarettes,” Dufourne adds.

Staying competitive

Independent retailers have distinct advantages over multiples when it comes to tobacco sales, particularly during the festive season. The key is leveraging flexibility, customer service and local knowledge.

"As always, it's very important for retailers to 'follow the money'," advises Malm. "Sales of value products continue to burgeon so there is a clear need to focus efforts there. However, it is worth remembering that premium products can carry higher margin than economy and value products and will always retain a loyal group of smokers, so we would advise against removing these products from any store completely."

The ability to maintain stock of both value and premium products, combined with knowledgeable staff who can guide customers towards appropriate products for their needs – whether for personal consumption or as gifts – gives independents a competitive edge.