Unitas Wholesale members will now share more than £2 million in incremental revenue in return for their participation in the group’s central promotions, publications and events.

The More for More incentive, revealed by managing director John Kinney, at the Unitas Wholesale connect25 trade show in Liverpool, will help drive engagement, execution and compliance in supplier partnership activities.

It will reward members who can demonstrate a higher level of engagement in schemes including the URP promotions programme, the retailer support portal Plan for Profit, customer-facing promotional materials and the buying group’s flagship trade show and conference.

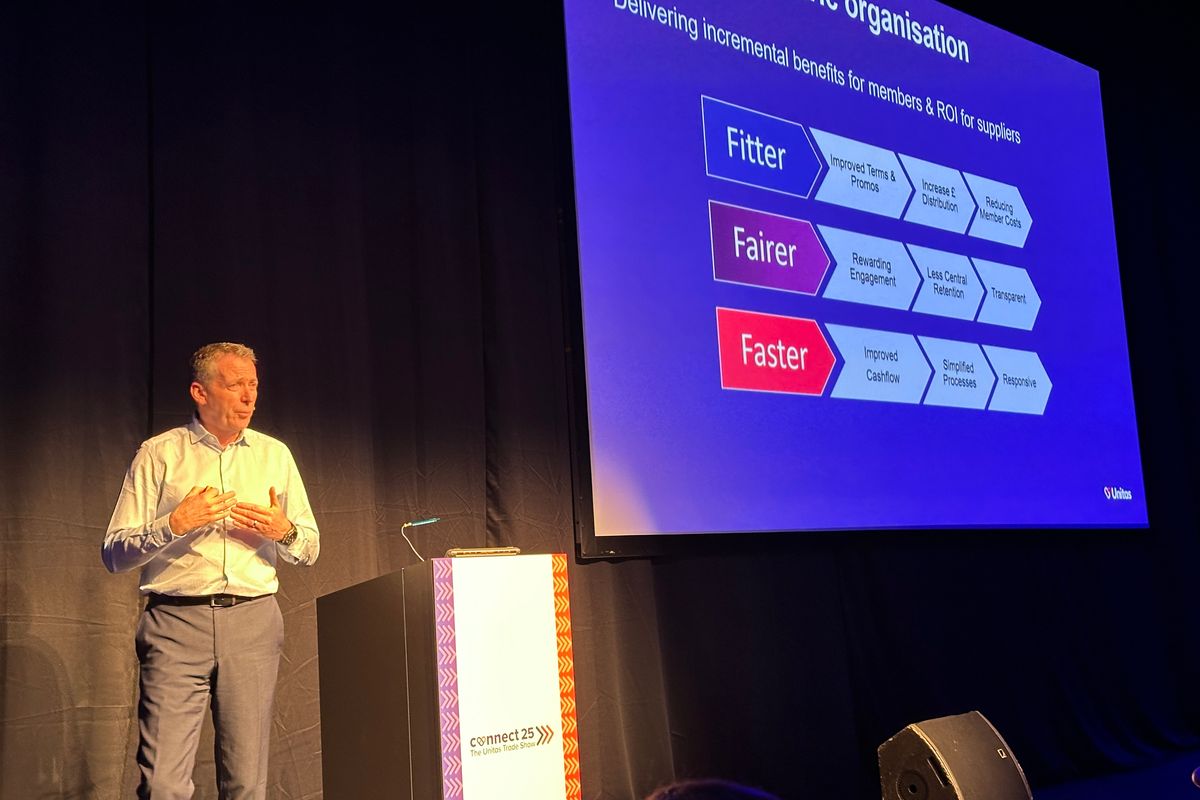

“Our mission is to be a fitter, fairer and faster organisation, delivering incremental revenue for our members, and return on investment for suppliers,” Kinney told the members at the trade show.

“We have made great progress on being fitter – increasing the revenue returned to members by 17 per cent in the last year, and 35 per cent over the last five years, and we have helped members reduce their overheads by £3m through our Unitas Procurement scheme.

“We are also faster - increasing members cash flow through more efficient financial systems, reducing the days taken to process payments.

“Now we need to be fairer – ensuring that those members who contribute most to the group get the most out of it. This is why we are putting aside more than £2m in additional rewards for those who actively engage, and incentivise others to do the same.”

More for More offers members the opportunity to more than recoup their annual membership fee from the additional revenue stream. This approach will help members navigate a challenging trading environment while demonstrating to suppliers that their investments generate strong returns, securing long-term investment in Unitas Wholesale.

Details of the criteria for accessing the income will be shared with members.

Unitas interim chair Dr Jason Wouhra OBE, CEO of Lioncroft Wholesale, welcomed the launch of More for More, saying, “Offering embers a greater financial incentive to actively participate in Unitas’ central schemes will appeal to wholesalers’ entrepreneurial instincts and will ensure those who put the most into the group will be rewarded proportionately.

“It will also incentivise members to drive compliance in joint ventures with our suppliers, which we know is the key to building mutually beneficial relationships. This new model will help to drive the right behaviours and will be vital to unlocking future investment and sustainable growth for members individually and for the group as a whole.”

Kinney added, “We believe our members should receive 100 per cent of supplier terms investment, as these funds are intended to support your business to grow their brands.

"This transparent approach strengthens supplier trust and will maximise their investment in promoting their brands, which in turn assures future investment.”

Unitas Wholesale members are its sole shareholders, with no external parties or directors profiting from the group, with no remit for the Central Office to build excessive profits.

Unlike other buying groups, Unitas Wholesale does not retain any of the supplier terms revenue it negotiates for members.