The Big Night In, which was a phenomenon already worthy of notice in 2018, is now becoming – at least in terms of sales and revenue – something of a national institution.

Kenton Burchell, Group Trading Director at Bestway Wholesale, smartly sums it the BNI landscape as it is right now:

“Big Night In has been a key occasion for the Convenience channel in recent years,” he says. “During the pandemic, people spent more time at home, and socialising consisted of virtual meet ups with friends and colleagues. This change in consumer behaviour was a boon for retailers that resulted in a notable spike in categories such as alcohol, crisps, snacks, and sweets. Alcohol sales, fuelled by lockdown and the closure of on-trade establishments saw tremendous growth in 2021, with all segments in growth when compared to 2019.”

Debbie King, Sales & Marketing Director at Asian foods supplier Tiger Tiger, says “The Big Night In has traditionally long been associated with beer and snacks, but now that eating in is fast becoming the new eating out, there’s absolutely no reason why the BNI shouldn’t feature a sharing meal or two as well!”

“For consumers, every evening meal now has the potential to be a Big Night In, so there is a significant opportunity for retailers to maximise this occasion,”agrees Paul Baker, founder of bakers St Pierre Groupe.

It is a great and still evolving opportunity for the C-channel as BNI remains so deliciously local. Neighbourhood shops, by tailoring their offer to stay-at-home shoppers, can really capitalise on many categories of sales.

“The ‘Big Night In’ remains a key occasion for retailers. With 38 per cent of occasions happening at home, retailers should focus on their BNI offering by making sure items available and visible for this important shopper mission,” says Katie Walland, Gum Portfolio Director for Mars Wrigley. And the trend for confectionery at home as an evening treat is indeed noticeable.

Cheers!

We should start with alcohol, because the off-trade has seen such a sales boost over the last two years, also with the development of new trends such as RTDs and increased sales of premium spirits due to the cocktail craze.

Budweiser Brewing Group’s Director for Wholesale & Convenience, Sunny Mirpuri, says that 87 per cent of alcohol occasions now occur in the Off-Trade, “so stocking and merchandising effectively for occasions like the Big Night In will be key for retailers in 2022” – adding, “The Big Night In is no longer a crisps and dip affair. Mealtimes have grown in importance, and now account for 43 per cent of all drinking occasions in the home.”

Beer and cider has held up very well sales-wise in the channel. “Over the last year especially, consumers have really valued convenience and they have also focused on their drink experience at home which is something the Big Night In taps into,” says Calli O’Brien, Marketing Controller at Aston Manor Cider. “From trying new flavours of loved cider such as Crumpton Oaks Cherry & Berry, through to branching out from wine into perry with our ‘new look’ Chardolini, consumers welcome the chance to try something new at home.”

O’Brien, who supplies such drinks as Frosty Jack’s, one of the UK’s favourite ciders, has noticed the trend for alcohol-free and low-alcohol drinks. “We believe the increase in popularity of low/no alcohol options among teepartial and teetotal drinkers is a trend set to continue,”she says, adding that almost half (45 per cent) of drinkers are now looking at zero alcohol options.

Sandra Brunet, Marketing Director, Campari Group UK, has this advice: go big on sparkling serves. “The duty slash on sparkling wines announced in the last budget will have a significant impact on the category. For example, it gives retailers the power to position fizz at a more appealing consumer price point, helping to increase the popularity of Prosecco-based serves.”

Lauren Priestley, Diageo’s Head of Category Development Off Trade, also stresses that premiumisation (and sprits) are eminently stockable in the BNI growth context. “Typically, premium drinks are in growth, up 27.4 per cent in value vs YA1 in the off-trade,” she reveals.

“With this in mind, we recommend retailers stock super-premium and premium spirits to help consumers elevate the Big Night In, such as Tanqueray London Dry Gin, Tanqueray Flor de Sevilla and Cîroc flavours.”

“The Aperitivo moment is another occasion that perfectly complements the Big Night In,” adds Brunet. “A highly social occasion, the Aperitivo moment is a classic Italian experience. By stocking Aperol, wholesalers can help retailers to inspire shoppers with simple recipes and appealing options for the perfect Aperitivo moment as part of a Big Night In.”

Priestley says that Pimms is also perfect for starting a BNI: “Spritz serves lend themselves to early evening catch ups and summer occasions, making both the PIMM’S No.1 Cup and PIMM’S Sundowner perfectly placed to cater to these popular moments.”

The coming together of cocktails and BNI has boosted RTDs as well, as shoppers look simultaneously to craft their own drinks and to open convenient ready-mixed versions. Smirnoff Seltzer Orange & Grapefruit and Smirnoff Seltzer Raspberry & Rhubarb are fine examples of must-stocks for 2022. Meanwhile traditional shots such as Jägermeister can also join in the long drinks craze. Try 50ml Jägermeister and 25ml fresh lime, topped with ginger beer, says Head of Brand and Trade Marketing, Johnny Dennys, revealing that Jägermeister has posted positive growth across its entire range of PMPs including the 20cl at, 35cl at and 50cl – which saw 18.0 percent uplift.Jägermeister’s latest innovation, Cold Brew Coffee (ABV 33 per cent), works perfectly in a three-ingredient Espresso Martini, one of the Top 10 cocktails in the UK according to CGA data.

Beer remains king, of course, and Kevin Fawell, Off-Trade Sales Director at Molson Coors Beverage Company, and believes BNI is an opportunity for retailers to give their customers some culinary inspiration and drive incremental sales with meal deals, recipe ideas and guidance on drinks pairings – and he recommends meal-friendly brews such as Cobra, alongside Carling and Coors, now worth almost £320m in the UK. He adds that RTDs are also very well catered for: “Our Miami Cocktail Company range delivers on this, with a host of different options for consumers to choose from, including Margarita Spritz, Paloma Spritz, Mimosa Spritz, Sangria Spritz and Bellini Spritz. All are crafted with only premium organic ingredients.”

Wine also sits perfectly alongside BNI ;leisure gatherings and dining, and as the evenings begin again to lengthen, “we typically see an increase in demand for white wines including Sauvignon Blanc, Pinot Grigio and Chardonnay,” says Ben Blake, Head of Marketing at Treasury Wine Estates.“However,” he continues, “despite perceptions of red wine being a ‘winter wine’, sales of red varietals are strongest in the summer period vs the rest of the year.” He recommends Blossom Hill Gin Fizz for its refreshing qualities and also point to 19 Crimes in its 1.5L Bag-in-Box, which is attracting a new and appreciative clientele.

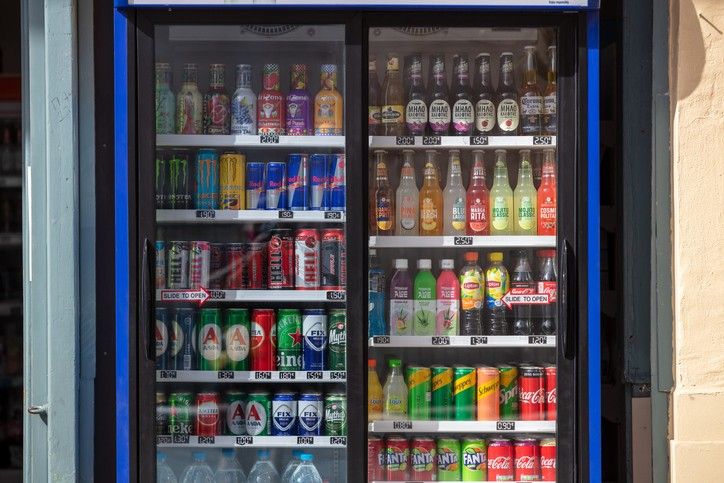

The softer side

Along with the taste for lower alcohol – and with children often present for family BNIs, soft drinks are also very much on the bill of fare. Amy Burgess, Senior Trade Communications Manager at Coca-Cola European Partners (CCEP), says that Soft drinks are often a big part of nights in, “adding a sense of sparkle for those choosing not to drink alcohol, or to be used as mixers. Our broad portfolio provides options to suit all needs and occasions. It includes Coca-Cola, which continues to drive growth in convenience, led by Coca-Coca zero sugar; Fanta, the number-one flavoured carbonates brand in GB; and Schweppes, worth £113.1m in retail.”

Drinks such as Appletiser are for adults as well as children at BNI occasions – in fact Burgess says that consumers’ efforts to recreate special with-food experiences at home have driven sales of adult soft drinks like Appletiser up by almost 24 per cent.

Bottled water, too, is a big part of the BNI experience, a premiumisation of regular tap water that lifts an occasion, adding taste and style as well as pure refreshment. Mike Buckland, Marketing Controller, Highland Spring Group, who says quite straight-forwardly that “Staying in is the new going out”, says that “Highland Spring’s plain sparkling water is another great product for big nights in. Sparkling water continues to increase in popularity, and should be part of any retailer’s offering. In the last 12 weeks alone, Highland Spring’s Sparkling Water sales have increased by 16 per cent, and we don’t anticipate this slowing as we continue into 2022. “

He adds that it is also key to stock products in different sizes to maximise sales for the occasion, so 500ml, 1L and the 1.5L are all good BNI options.

Highland Spring has successfully entered the flavoured water segment, and its sparling canned drinks are available Blackberry, Plum & Hibiscus, Pear & Elderflower and Rhubarb & Ginger flavours, “perfect on its own or as a mixer”.

Suntory Beverage & Food GB&I, meanwhile, have added to their Lucozade Alert Tropical Burst and Cherry Blast range, launched last September, with a new Original flavour. Alert was wildly popular, and the Channel Director for Wholesale,Matt Gouldsmith, says that it generated £1m in sales in under two months through wholesale and convenience stores. “Soft drink sales grew by 4.3 per cent last year,” he adds,“and flavours are a particularly strong area of growth for the category.”

Speaking of refreshment, chilled milk drinks such as YAZOO – which has the advantage for retailers of also being ambient and stable – also suit BNI perfectly. Dan Chesbrough, Business Unit Controller, Grocery at FrieslandCampina, says that, “Our one litre formats have been permanently available in our best-selling core flavours: Chocolate, Strawberry and Banana. It is a welcome addition to a big night in and tastes great straight from the fridge poured into a glass at home.”

Building a (big) thirst

Of course, BNI is nothing without the snacks that provoke the thirst in the first place! There has surely never before been such a fabulous range of tasty and innovative snacking solutions on offer, in a category that is almost tailor-made for the convenience sector.

“Consumers are also on the lookout for larger, value-for-money packs for the BNI occasion,” says Jon Wood, commercial director of Calbee UK.“Larger packs suit BNI perfectly, ideal for a cosy night alone, an evening for two or for entertaining family and friends. Our Seabrook £1 PMP sharing pack is available in Sea Salted, Cheese and Onion and Beefy flavours.”

Scott Snell, Vice President of Customer at pladis UK & Ireland, says that moments of togetherness have become a key part of the nation’s routine. “As a result, larger packs continue to drive significant volume growth – with sharing packs growing +17.8 per cent. Our Flipz brand is a must-stocks for retailers looking to drive ‘big night in’ sales.”

Matt Collins, Trading Director at KP Snacks, agrees that, “Consumer demand for sharing products is on the up and snacks are a hugely important part of a memorable sharing occasion,” and at £1.4bn, sharing is the largest segment in CSN, growing strongly at +7.3 per cent. “the CSN sharing segment has grown significantly and represents a huge opportunity for retailers.”

To that end, he recommends Tyrrells 150g Sharing bags, adding that the brand expanded last year with the introduction of a £1 PMP 60g range across three of the most popular flavours including Lightly Salted, Sea Salt & Cider Vinegar, and Mature Cheddar & Chive.

Popcorn is also a great option for BNI, and Butterkist, twice as large as its nearest branded competitor, enjoys a 37.3 per cent market share, and now available in Crunchy Orange Chocolate flavour toffee. Brand appeal also helps McCoy’s Muchoswith its swing towards spicy Mexican flavours and “full-on flavour guarantee”. And for healthier options, Gouldsmith mentions the protein-packed KP Nuts and the air-popped popchips (“popchips is rated as the number one ‘Better for You’ bagged snack brand in the sharing pack format“) as being well-worth precious shelf space.

Snell acknowledges the fact of tighter purse-strings for consumers this year, which will boost BNI “and snacks that represent good value – such as our range of Jacob’s Mini Cheddars PMPs.”

He adds that “We’ve recently expanded our popular line-up of Jacob’s Mini Cheddars £1 PMPs with the addition of Jacob’s Mini Cheddars Sticks Grilled Cheddar & Sizzling Steak flavour.”

Already worth £5.1m, Jacob’s Mini Cheddars Sticks remain a key sales driver for independent retailers and by launching this product in a tailored format for independent retailers, Snell says pladis is giving them even more of an opportunity to make the most of its popularity.

And talking of popularity, Tayto’s wildly successful marketing of the venerable pork scratching continues. Matt Smith, Marketing Director, is likewise full of praise for the snack PMP.

“As we emerge into the ‘new normal’, impulse pack sales are recovering but, as we continue to enjoy a snack in front of Netflix or enjoy having friends round again, £1 PMP Sharing Snacks, continue to grow faster than the market (+6.0% vs +5.0%),” he says. Tayto also own the Golden Wonder brand, which celebrates its 75th anniversary this year:

“Golden Wonder’s £1 PMP Snacks range is driving the category,” says Smith,“growing faster than the market at +12.1 per cent. We’ve seen this growth in Transform-A-Snack (+16.5 per cent), Saucers (+8.8 per cent) and the star performer, Fun Snacks (+151 per cent) – due to the launch of £1 Spicy Bikers.

The meal is the deal

As BNI evolves from snacks and ordering in a pizza to cooking at home more fully and often, ingredients and easy meals can be stocked for the occasion to a retailer’s advantage. Cooking at home can improve sales of baked goods for when shoppers make burgers and hot dogs. “The move towards premiumisation hasn’t slowed since restrictions have been lifted and premium brands, like St Pierre, give consumers an opportunity to ‘trade up’ and elevate everyday meals, such as gourmet burgers and hot dogs,” says Paul Baker.

Kepak Consumer Foods, makers of Rustlers say they are meeting shopper demand for hot, tasty and easy meal solutions that can be enjoyed as part of a Big Night In occasion. The brands versatile range creates dual siting and meal deal opportunities, boosting impulse purchase and basket spend. Monisha Singh, Shopper Marketing Manager at Kepak, says that “Rustlers are helping retailers to deliver Big Night In and Meal For Tonight profits with quality, time saving and easy to prepare solutions – credentials synonymous with Rustlers.”

Positioned in Meal for Tonight, with the opportunity to dual site in Food to Go, she explains that Rustlers acts as a beacon brand in the convenience chiller, selling more than two packs every second in the UK.

“Rustlers is increasingly being used as an essential part of a ‘Meal for Tonight’ meal deal,” she adds. “By creating a dedicated display, offering complementary snacks and drinks, and using POS to clearly signpost the occasion, retailers can drive basket size, spend and profits.”

Retailer Vinay Mistry of Nisa Local Moor Lane, Preston, endorses Singh’s words: “Rustlers have always sold really well and being such a well-known brand, it acts as a bit of a beacon in the chiller,” he says. “The range certainly delivers against expectations and it’s no wonder they’re one of my most popular chilled lines.”

Tiger Tiger’s Sales & Marketing Director, Debbie King, has also noticed the increasing opportunities for selling meal items to BNI consumers.“With 51per cent of consumers shopping more locally than they did before lockdown , there are some great opportunities for independents,” she says, adding that Tiger Tiger recently re-launched its Chinese range with new-look packaging. The range includes Light, Dark and Reduced Salt Soy Sauces, Oyster Sauce, Ramen and Rice Stick Noodles, Rice Vinegar, Luncheon Meat, Water Chestnuts and Bamboo Shoots.

And do not forget the miracle of ice cream for lifting the atmosphere at any BNI. to Jose Alves, Marketing Manager, Ice Cream at General Mills UK recommends the Häagen-Dazsmini cups, providing individual portion-sizes while also catering to the mindful consumption trend

“We’ve recently extended our DUO collection to introduce DUO mini cups,” he says.“The two new irresistible 4 x 95ml mini cups multipacks will offer a variety of flavours within each flavour camp.”

Meanwhile, the tub formats remain great for sharing and big night in occasions:“We launched our new Gelato Caramel Swirl in pint format and the new flavour is the quintessential guilt-free treat to share with amongst friends.”

Staying sweet

Sitting around with friends or in front of Netflix involves sharing not just snacks but sweets and ice cream, of course – delicious and great value treats and comforts that come into their element when money is tight. Again, larger sharing bags and boxes are all the rage and we do not predict that this will change any time soon. “We have seen a rise in sharing formats, perfect for get-together’s with friends and loved ones for the ‘Big Night In’ occasion,” says Victoria Gell, Fruity Confections Brand Director, Mars Wrigley.

The biggest NPD launch last year for Mondelēz International was Cadbury Dairy Milk Orange Giant Buttons sharing bag, and the Cadbury Caramilk tablet was the third biggest NPD launch, despite only launching in July.Susan Nash, Trade Communications Manager says that it is not all about chocolate: “The new Sour Patch Kids Watermelon bags will offer shoppers an affordable and delicious authentic candy treat with an RRP of £1.32 in 140g bags.” She adds that this year it will also be available in a PMP.

Very worthy of mention is Mondelēz International’s launch (at last!) of the French brand LU, in the UK. “Le Petit Chocolate, Le Petit Beurre, Le Petit Biscotte, and Le Petit Citron will offer customers a quintessential taste of France to enjoy at home with friends and family,” says Nash, and BNI just got a whole lot BN better.

Another premium Euro brand, Ritter Sport, which is making big friends with the c-channel. “Chocolate is one sweet pleasure that locked down Brits haven’t denied themselves in the pandemic, and we don’t see this changing,” says Katy Clark, Head of Marketing Ritter Sport UK & IRE.

“As the new-normal sets in in 2022, Ritter Sport’s bestselling 100g range format (Colourful Variety, Nut Selection and Cocoa Selection bars) offers chocolate fans a delicious treat to enjoy on your own or with others, however you spend your Big Night In.”

Katy Clark says the post Covid-19 concerns for the environment and the flexitarian-driven vegan boom are driving ever-increasing numbers to sustainable products, which commends Ritter Sport to shoppers. It only uses 100 per cent certified sustainably sourced cocoa and natural ingredientsandhas now been officially recognised as a CO2-neutral company by independent external testing body, TÜV Nord Cert GmbH. “’Doing the right things to create really good chocolate’ is at the heart of everything we do. This may not necessarily be the easiest or cheapest thing, but it’s always the right thing,” concludes Clark.

Victoria Gell stresses the sharing nature of sweets, saying that sharing formats “are key for the ‘Big Night In’ occasion, such as Skittles ‘Tear and Share’ Pouches, which are a firm consumer favourite.”

To maximise sales of these formats, Gell advises that retailers should stock latest product launches to intrigue consumers and encourage higher basket spend. Skittles Giants Crazy Sours are perfect for the ‘Big Night In’, she says, with the 141g and 170g pouches allowing for really fun snacking occasions: “Skittles Giants Crazy Sours tend to over-index with consumers on the shared screen time occasion, aligning fully with their ‘Big Night In’ celebrations with their family and loved ones.

Gell’s colleague, M&M’s and Maltesers Brand Director Leah Dyckes, reminds us that M&M’S Chocolate has long been associated with shared screen time and entertainment. Now the block version is available in Chocolate, Crispy, Hazelnut and Peanut flavours. “These blocks come alongside M&M’S bitesize offering, which works perfectly for the ‘Big Night In’ and offers consumers another way to engage with this favourite chocolate brand.”

Continuing the popularity for orange-infused product flavours, Dyckes recommends as Orange Maltesers Buttons to further drive category growth. “Orange flavour in chocolate continues to be a popular flavour, with the market seeing a +20 per cent growth,” she says.

Chews always go down well in front of the telly, and HARIBO is there with its varieties to cater for every preference. Claire James, HARIBO Trade Marketing Manager says, “When stocking up for the big night in, consumers buy with friends and family in mind.”

Well-loved skus are essential, but they can be mixed with new innovations. “Our top sellers are hugely popular, but our new products support big nights in too,” says James.“New product development is essential within confectionery, as retailers know that something exciting and different will help to leverage extra sales outside of the core confectionery lines.”

She explains that HARIBO’s most recent innovations, Sour Sparks and Twin Snakes, capitalise upon the huge appetite for sour sweets, and are now category top sellers [Marketplace Total Market Value sales MAT to 28.11.21], positioned as the fastest-selling new product lines within the market.

Again, larger sharing bags, in addition to being excellent value, last slightly longer!

Speaking of value, Gabriella Egleton, Senior Brand Manager at Kervan Gida UK Ltd, makers of Bebetos candy, believs that sugar confectionery continues to be welcomed as an affordable treat by consumers “who maybe haven’t been having the best experiences due to the pandemic and have limited options to experience their normal enjoyment of life in terms of socialising and going out.”

MD Stuart Johnston reports that Bebeto achieved 58per cent growth in 2021. “We now have a business that has grown 20-fold since the end of our first full year of trading, and one that now positively contributes to our group profitability,” he says. Stuart recommends stocking products that use sustainable palm oils and no nasty “NAFNAC” (no artificial colours and no artificial flavours).

“We are continuously developing innovative products to create excitement and provide enjoyment for our consumers,” says Egleton. “We have a robust NPD pipeline under our Bebeto brand, and throughout 2022 we will be adding additional share bag size products to our 150g gummy range, and our family sized value-added packs. “

In conclusion he importance of confectionery in BNI cannot be overstated (and see our upcoming Chocolates and Confectionery feature in the next issue).

Ferrero’s Customer Development Director Levi Boorer sums it up when he says that “Confectionery is one of the few categories where shoppers are willing to spend money on the products that they love, in order to cater for demand for treating.”

He would certainly know, and Ferrero’s brands are a treat to be brought out at the right BNI moment.

“We know shoppers often turn to the brands they know and love, and our portfolio of premium, established brands – Ferrero Rocher, Ferrero Collection, Raffaello, and Thorntons – offers their consumers high quality treats or gifts, which we know are in demand and suit the growth of the ‘big night in’ occasions too,” he says. we are consistently able to deliver premium products to consumers to support the growth of the category.

He believes that Premium Boxed Confectionery will continue to play an important role for retailers wanting to drive confectionery sales, so it’s important that the right pack formats are offered in-depot to suit retailer missions. “For example, Ferrero Rocher 300g and Thorntons Classic 262g are ideal offerings that make it easier for retailers to switch to these premium brands that will help drive bigger basket sales.”

Do have a good night in.

To use this website you must be aged 18 years or over. Please verify your age before entering the site.

To use this website you must be aged 18 years or over. Please verify your age before entering the site.