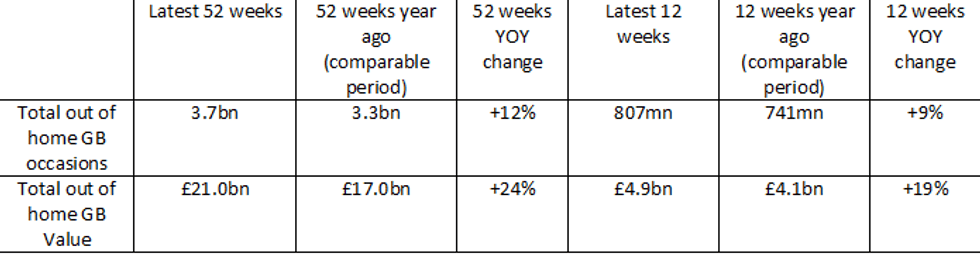

The latest MealTrak results show the number of out-of-home eating occasions were 12 per cent higher than the comparable period in 2021 on a 52 week/MAT basis

In the latest 12-week period, the number of out-of-home eating occasions was 9 per cent higher than in 2021 with 807 million OOH eating occasions in the 12 w/e 11 July 2022. The ‘eating out’ channel (pubs, restaurants, hotels) was in strong growth, +42 per cent vs previous year, but growth rate has slowed significantly since last month, when 12 w/e growth was +97per cent. Growth in "eating out" is driven by restaurants (+58 per cent) and pubs (+32 per cent).

The figures suggested that sandwich shops (-5 per cent), coffee shops/cafes (-9 per cent), fast food & takeaway (-12 per cent) and high street (-36 per cent) are all in decline, although forecourts are rebounding well – with a 17 per cent increase in occasions in the previous 12 weeks YOY. Most importantly, Convenience stores have seen a stronger performance in the last 12 weeks, at +18 per cent.

“The market has slowed as the impact of economic shocks bites, with growth dipping under two per cent over the last four weeks, but the wider recovery remains solid, with both occasions and value making strong gains over 12 and 52-weekly periods across both FTG and Eating Out," commented Tom Fender, Development Director at TWC.

“Encouragingly, for the moment at least, value growth remains ahead of occasions, indicating that spends are holding up and consumers are continuing to seek rewarding experiences rather than trying down on prices and functionality [Value sales are up 24 per cent on a 52-week/MAT basis and +19 per cent on a 12-week ending basis versus 2021.]

"That said, in FTG we are seeing the strongest growth in the Multiple and Convenience sectors, whilst Coffee shops and GTG Specialists are flat and Takeaways have fallen back.

“Eating Out continues to recover well across both restaurants (especially) and pubs. Consumer Missions are also beginning to show some movement in response to current inflationary and economic pressures, with a higher proportion of consumers looking for FTG products which are ‘Not too expensive’ or ‘Quick & easy’. Allied with a corresponding fall in demand for Hot FTG (weather-related), Treats and Cravings, missions which grew significantly during Covid.

“At Category level, we are seeing strong growth in the traditional ‘Meal Deal’ product groups (Sandwiches, crisps & snacks, soft drinks) and Hot Drinks, alongside above average growth in treaties sectors such as Confectionery and Cakes and pastries. Categories underperforming are led by FTG Hot meals, Soups and Cereals.

“Interestingly (and unusually) growth is currently being driven by older consumers now retiring to the market, especially 45 - 64s, where growth is much stronger than for the younger age groups across both FTG and Eating Out (Millennials and Gen Z are generally the trailblazers). Over 65s have yet to return to FTG whilst Eating Out, which had been recovering well in this age group, has dropped away over the latest 12-weeks, perhaps because this age group is more vulnerable to the impact of rising costs.

“Similarly, over the last 12-months growth in all channels has been driven more by women than men, but this has reversed over the last 12-weeks, with women too perhaps changing their behaviour more rapidly in response to current economic pressures”.