Although not the premier category in c-stores, traditionally speaking, it would be fair to say that Chilled and Frozen has steadily grown in importance over the decades, as the channel has grown more sophisticated. Where in the past there might have been a stand-up fridge for cans and perhaps a small chest freezer crammed with lollies and ice creams, now chillers are measured in metres (often double digit) and can occupy entire walls; and freezers stand proudly, constituting their own aisles, often stacked with gourmet meal solutions as well as veg and fish staples.

There was a period, influenced by changing consumer purchase patterns (following good Covid lockdown performance), and exacerbated by subsequent supply-chain problems, that depressed sales of frozen and chilled. But that seems now to be in the past.

Rupert Ashby, chief executive of the British Frozen Food Federation, says the volume of frozen food sales has returned to growth in the first quarter of 2023, according to Kantar data. The 12-week figures show that volume sales of frozen food grew by 2,572,000 tonnes, compared to the same period last year. The value of the retail frozen food sales also continued to increase in the same period, up +9.5 per cent (£273,061,000), largely driven by inflation across the entire food supply chain.

Bestway’s Director of Trading, Kenton Burchell, confirms that there is growth in in-home frozen meal occasions by +12 per cent in 2021 vs 2019. “There is a growing popularity of premium frozen category, with consumers looking for high quality frozen foods,” he says, adding that “Consumers are looking for meal deals with 22 per cent of frozen shoppers more likely to purchase frozen food as part of the evening meal.”

In fact, the Frozen and Chilled category is the secret weapon of the c-store, according to cooler hardware experts Husky:

“Because independent stores are often open late at night, early in the morning and on holidays, many people rely on them for emergency purchases of things like ice, milk, eggs when regular stores are closed,” said a spokesperson. “Ensuring that you have a good range of impulse treats to tempt your customer who pops in for that emergency purchase is crucial. The Husky PRO range of chillers are suitable for both dairy products and cold drinks which enables cross merchandising as well as meal deal opportunities for customers who are on their way home but don’t want the hassle of queuing at large Supermarkets!”

Ashby explains that frozen food offers consumers excellent value without compromising on quality, and one of the main reasons why frozen food is often significantly cheaper than the fresh or chilled alternatives is due to the amount of waste generated in the unfrozen supply chain when goods are damaged or spoil before they are sold. With the ongoing inflationary pressures, he stresses that as consumers now look for more affordable ways to stock their kitchen, “frozen has become the choice for households looking to maintain premium taste and ensure that they are getting the most nutrients in each of their meals.”

Chill out

Chilled is cool all year round, but it comes into its own in the summer months, when the coolness and freshness that the chiller can serve up is truly appreciated:

“As we step into summer, lighter eating with a fresh accompaniment becomes a staple for consumers, yet research highlights that most households stick to a very limited repertoire of the same recipes week in week out,” says Nick White, Head of Marketing at Florette UK, as it spearheads a £40m summer promotion that will reach 8.6m shoppers. “Our new campaign will show consumers that Florette can transform their routine, turning the mundane into something tastier and more vibrant, making a dish UnFloretteable.”

With over a third of consumers (39 per cent) planning to eat out less frequently, outdoor dining occasions such as BBQs are set to become a very big opportunity this summer, thanks to the rising trend of eating and entertaining more at home.

Already selling 31 million packs annually, Florette is poised to help retailers provide shoppers with a versatile and tasty accompaniment for a suite of meals and cuisines occasions.

Martin Purdy, Florette’s Commercial and Marketing Director, says that the sponsorship will be complemented by a brand-new TV advertising campaign throughout June to August, across ‘on demand’ service platforms including ITV X, Sky and All 4.

Heloise Le Norcy-Trott, Group Marketing Director for Lactalis UK & Ireland, points out that the chilled section is economically healthy as well as good for you.

“Chilled and frozen are growing in sales – a trend that was developing during the pandemic and has now accelerated alongside the cost-of-living crisis,” she says. As a result, independent retailers are dedicating more space to these ranges and fixtures.”

Indeed, Burchell adds that chilled food production has been one of the UK’s fastest growing innovations and advanced food sectors with each year putting 15,000+ different foods on shelves:

“According to the Chilled Food Association (CFA) in 2022 consumers spent almost £10.5bn on chilled ready-made meals. With a gradual return of workers to their offices there has been an increase of 12.7 per cent of ‘out of home’ sandwiches, rolls, baps, and baguettes," he reveals.

“Recent reports confirm that inflation is sending shoppers to the freezer cabinets in search of value and quality, continuing an enormous increase in consumption of frozen products as eating out and to an extent fresh produce suffers,” says Le Norcy-Trott. “Convenience has benefitted from frozen and chilled sales, especially with work-from-home ex-commuters shopping more locally than ever before.”

Branded Cheese currently accounts for 42 per cent of total cheese value sales with a total of £1.2b per year. Meanwhile, Private Label, which accounts for 58 per cent, took £1.5b in values sales in 2022.

Sales are improving again, but she says that in line with the wider food and drink industry, cheese was impacted by rising costs and inflationary rates in 2022, making it a challenging year for the category: “This, combined with consumers tightening their belts, resulted in a sluggish market, especially when compared with the two ‘lockdown years’ which saw sales of a variety of flavours and formats soar.”

One trend benefitting the Seriously Cheddar, Galloway and Leerdammer brands is quick-and-easy-to-use formats. “This is being partly driven by consumers working in offices again, having more ‘out-of-home’ lunches and having less spare time overall,” says Le Norcy-Trott.

For the best chiller sales she adds that it is important retailers stock best-selling and well-promoted brands in their core range, whilst choosing products according to the different ways of eating cheese. “For example, stocking President Brie for snacking, Seriously Spreadable for spreading and snacking, Seriously Cheddar for everyday consumption, Galbani Mozzarella and Galbani Parmiggiano (block, grated and sliced) for recipe usage, Président Camembert for speciality cheeses, while Leerdammer cheese slices and block, are great additions to salads, and sandwiches.”

Cold desserts and breakfast pots are also best-sellers that are massive chiller turnover items.

"Make Pots of Profit" is Müller Yogurt & Desserts’ new program created specifically for convenience stores to offer help and advice to improve the effectiveness of their Chilled Yogurts and Potted Desserts (CYPD) category. CYPD is currently worth £2.9 billion and is the third-largest sector in chilled. However, according to Penny Williams, Senior Category Manager at Müller Yogurt & Desserts, there are currently an estimated massive 938 million buying occasions for CYPD in the convenience channel that are not being met due to retailers not having the right range and the right focus on CYPD in their stores. The new category advice toolkit from Müller Yogurt & Desserts is designed to help retailers maximise the category opportunity, please shoppers, and get their fair share of sales.

It is based on category data and shopper insight and focuses on a three-step plan to help retailers get the basics right and drive their category sales. Step one is to stock the best products across key segments, ensuring that all shopper missions are covered by consistently having the right range of top performing brands. Step two is to meet consumer needs for different occasions at the right time. Finally, step three is to merchandise the category in the right way to make it easy and exciting to shop, inspiring shoppers and encourage additional sales by keeping pricing realistic and competitive.

“Chilled Yogurts and Potted Desserts is often a forgotten category by convenience retailers,” testified Justin Whittaker of MJ’s Premier, Royton. “I’d recommend other retailers give Make Pots of Profit a try, it’s easy to do and you’ve got nothing to lose. The steps and planogram make perfect sense and made a massive difference to the ease of shopping the fixture. What really opened my eyes was to see how things have moved on in the category, and spending half an hour doing this and putting in the recommended products reaps the rewards.”

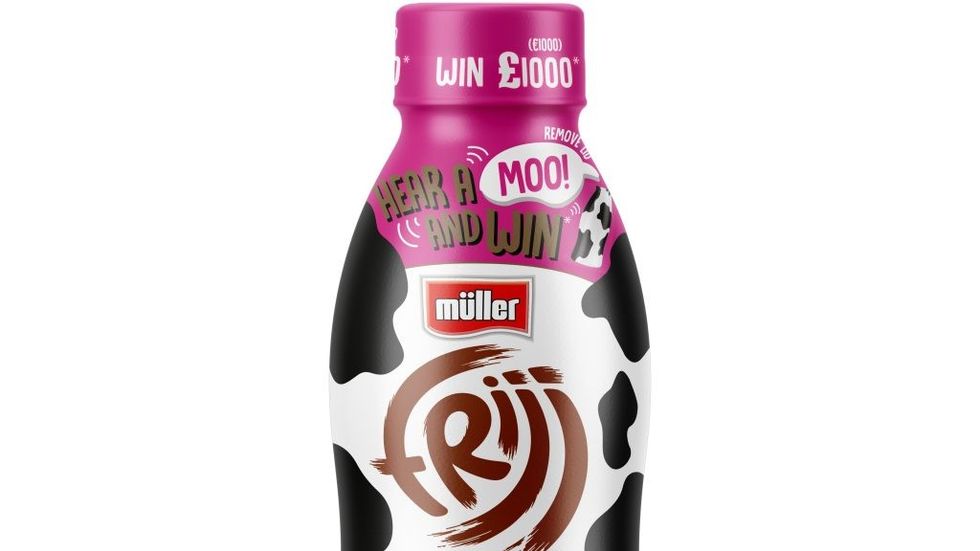

As part of the trial retailers were also invited to stock Müller FRijj, which is the UK’s No.2 flavoured milk drink brand in the UK (worth £23.8m) and growing fast in convenience +49 per cent (MAT). Available in a range of flavours including Chocolate, Banana, Fudge Brownie, Strawberry and Cookie Dough, the addition of Müller FRijj to retailers’ drinks chiller enabled them to offer their shoppers an increased choice of popular milk drinks and create additional sales for their stores.

Anthony Frankland, Senior National Account Manager, Müller Yogurt & Desserts, says that the Chilled Yogurts and Potted Desserts category is bigger in value terms than Cereals, Bread, Pet supplies, and Morning Goods. He says: “We know chilled space is precious, but retailers should give the right amount of space to CYPD that its value return dictates, and getting the basics right is vital.

And once the facings are decided, be sure to have the best presentation for them. Husky reminds us that in addition to food, summer requires ice cold beverages, ready to go. Dairy safe chillers such as the Husky upright single and double door PRO range enable cross merchandising of food and dairy with cold drinks to benefit from incremental sales.

In the Frozone

“Frozen food has been grabbing headlines recently after the BBC reported that sales of frozen food are outperforming fresh and chilled foods as consumers feel the pinch of the rising cost of living.” remarked the BFFF’s Ashby with optimism.

“With many consumers buying more frozen products and some trying it for the first time, the benefits of frozen food have been put in the spotlight and I am confident that we are seeing the start of a ‘frozen food boom’”.

He stresses that the past few years have not been without challenges, as conditions placed enormous pressures on the entire frozen supply chain. But now, emerging from the post-lockdown period, the frozen food market is showing modest growth YoY of £7.25bn, at a time when total grocery volumes fell by four per cent.

Bestway’s Burchell agrees that it appears consumers are swapping fresh for frozen – perhaps due to the rising prices in groceries, adding that meat-free options have been one of the main drivers in the frozen aisle, generating a 16.8 per cent growth rate since 2019, contributing to a £237.4 million (19.8 per cent) growth in savoury foods.

Joss Bamber, Head of Convenience at Birds Eye, revealed the significant benefits of the frozen food category for retailers over the past year. He says that research conducted by KAM media found 62 per cent of convenience retailers consider frozen food key to their sales mix: 43 per cent have seen demand for frozen food increase, with more shoppers looking for frozen products as part of their weekly shop. Retailers also favour quality, with 67 per cent stating the importance of stocking well-known quality frozen brands to tap into consumer demand. The research also doesn’t shy away from some of the challenges currently faced by independent retailers. While the frozen aisle is key to satisfying consumer needs and driving retailer sales, due to increasing energy prices and the cost to keep freezers running, many retailers are finding it a difficult category to justify supporting. In fact, 45 per cent of retailers cited energy bills as the biggest barrier to success in the frozen category.

“Frozen food continues to be an essential part of everyday life and demonstrates an opportunity for retailers as we know that historically the frozen food shopper puts more in their basket than the average convenience store shopper and spends more with that,” said Bamber. “However, we fully recognise that rising energy bills are having an impact on retailers and their ability to make the most of their sales.”

Making best use of your equipment, and buying the best and most economical, can help defray the costs of keeping cold. “Freezers should be kept clean and frost free, and products should be stacked so that the packaging can be read clearly with each SKU having the appropriate space and visibility,” is the advice from freezer specialists, Husky.

“If you visit a range of different retailers, the difference in the way they display their frozen produce is often stark. Some with faceless cabinet with frosted up doors and broken product at the bottom, to welcoming open freezers that are well branded and can attract new customers to the frozen aisle to browse and ultimately try the products.”

As summer approaches, it is very much worthwhile looking at one of the stars of the cold cabinet: ice cream.

Husky, continuing its practical advice, recommends that you maximise ice cream sales by making your ice cream freezer unmissable – placing it alongside other impulse products such as crisps and confectionery. Be sure to offer a good range of impulse ice creams and consider promoting your ice cream range on social media on warmer days to drive shoppers to your store.

The UK ice cream tops value sales of £3.4 billion with wrapped handheld ice cream being the most prominent segment in the market sitting at £1.8 billion, says Michelle Frost, General Manager at Mars Chocolate Drinks and Treats (MCD&T).

Within convenience and convenience multiples, ice cream sales are currently worth £790.8m, with handheld multipacks also proving to be the segment here with sales worth £379m.

“It is evident that wrapped handhelds and multipacks are key driving growth to the ice cream category within convenience. It is important therefore for retailers to offer a variety of products in various formats to cater to different occasions and consumer preferences,” says the aptly-named Frost. “For at-home consumption, tubs and multipacks are increasingly becoming more popular for those Big Night in occasions with friends and family.”

According to Jose Alves, head of Häagen-Dazs UK, it’s been a turbulent few years but as the cost of living continues to rise, he says we should expect more consumers to seek everyday luxury in affordable and accessible formats: “Häagen-Dazs is perfectly placed to help deliver this routine indulgence and make life a little better for shoppers and retailers alike.”

Häagen-Dazs is working to drive reputation as a year-round growth driver by focusing on flavour, variety, and format needs of consumers, as well as looking to help de-seasonalise the category. For example, the Häagen-Dazs x Pierre Hermé Macaron range, available in pint and mini cup formats, is “a love story of ice cream and macaron with Parisian flair. The two classic flavours; Strawberry & Raspberry and Double Chocolate Ganache, both bring an iconic and pure French 'amour' taste experience that can be enjoyed at home. The high-profile partnership is set to be Häagen-Dazs’ biggest NPD launch ever.”

He adds that this suits another trend, which is daytime snacking, presenting a clear opportunity for ice cream to unlock through current format activation and innovation:

“Changing lifestyles and behaviours has resulted in a shift from formal dessert occasions to sweet treats across the whole day,” says Alves.

Frost at MCD&T says that they are seeing a rise in popularity of “nostalgic” brands. “This year we have launched Hubba Bubba Ice Lolly, the first time ever that the popular gum brand has been developed into a frozen treat. The Hubba Brand has enjoyed a recent resurge in popularity and appeals to a wide spectrum of consumers.

“Following on from the successful launch of both Skittles Stix and Starburst Ice Lolly in 2022, introducing Hubba Bubba to our range of branded ice lollies is an exciting move for 2023 where we hope to add a pop of fun and excitement to the freezer aisle!”

In addition to Hubba Bubba Ice Lolly, MCD&T has also launched an addition to its ice cream sharing tub range, Milky Way Ice Cream Tub, a first for the popular confectionery brand and also be the first HSFF-compliant offering from the Mars ice cream range.

She says that Mars branded ice creams are outperforming the market with a growth of 36.2 per cent YOY, and that Milky Way is the fourth brand to join the Mars range of ice cream tubs, following on from Mars, Snickers and Maltesers.

Over at Magnum-maker, Unilever, Head of Ice-Cream Jennifer Dyne believes that innovation has been a primary driver of growth in the category: “To help retailers tap into this opportunity, we have continued to ramp things up on the innovation front and achieved nine out of 10 top NPDs in Summer 2022 with the likes of Ben & Jerry’s Sundaes, Magnum Remix and Magnum Vegan Mini’s.”

Dyne also attests that ice cream occasions have evolved from being just a refreshing treat in the summer. There are now many different occasions available for ice cream – from evening desserts and family get togethers to solo indulgent treats and snacking moments on the sofa.

Launched in January 2023, Magnum Double Sunlover is made up of coconut ice cream, paired with a tangy mango and passionfruit ice cream swirl and sauce layer, encased in delicious white cracking chocolate combined with crispy coconut pieces. Magnum Double Starchaser features a double swirled popcorn flavour ice cream and caramel. Both editions are available in multiple formats: sticks, minis, and tubs.

Ben & Jerry’s also introduced two brand new flavours to their Sundaes ice cream range with a never-before-seen whipped chocolate ice cream topping: Dulce De-lish – a salted caramel ice cream with chunks of caramel bar and caramel swirls topped with chocolate whipped ice cream, caramel swirls, and chocolatey chunks; and Choco-lotta Cheesecake: chocolate cheesecake ice cream with chocolatey chunks and chocolatey cookie swirls topped with chocolate whipped ice cream, chocolatey swirls, and chocolatey chunks.

The lighter ice cream range sees the return of a fan favourite, Chocolate Cookie Dough, and also a new flavour, Vanilla Brownie.

In the lolly realm, Wall’s Twister Fruit Zingerrr is the newest addition to the “Responsibly Made for Kids" range, now being HFSS-compliant but with “no compromise on the great taste the brands are renowned for”. In fact, Wall’s entire kids’ portfolio is now HFSS- compliant, including Twister, Mini Milk and Calippo.

Twister Zingerrr was Walls’s response to a growing demand for new flavours. Google searches for lemon and apple ice cream had shot up by 55 per cent and 49 per cent respectively and sour flavours, such as lemon, were already a (long-term) big trend within confectionery. Made with real fruit juice, no artificial flavours, or colours, and containing just 65kcal per serving, Dyne says that Twister’s zingy innovation is unique to the kids' segment, with a combination of tangy apple, sour lemon, and sweet blueberry.

Also this year, Magnum has expanded its portfolio with the Vegan Raspberry Swirl. Containing a velvety raspberry ice cream with swirls of tangy raspberry sauce, dipped in signature cracking Magnum Vegan chocolate, Magnum Vegan Raspberry Swirl offers 100% plant-based indulgence.

It all makes summer worth the wait.

Stay cool

Summing up, Penny Williams at Müller sees as a huge opportunity for retailers to get it right when it comes to chilled: “We know that core and consistency is absolutely key and, to win, retailers need to deliver on customer choice, conversion, loyalty, and value. By following the advice we’ve provided through our new "Make Pots of Profit" initiative, retailers can be confident they are stocking the right range to meet shoppers’ different missions and meal occasions, and this could help increase their sales.”

The BFFF’s Ashby concludes that, “The frozen category continues to attract new customers helped by innovative product development. That development is particularly seen in premium luxury products, in meat-free, and Halal which all continue to drive growth and cater for varied dietary requirements.

“Innovation is at the heart of the frozen food market, with exciting new products regularly hitting supermarket freezer shelves. I am always impressed with the products which are being brought to the market by our members, so I would encourage all consumers to make friends with their freezer and visit the frozen aisle during their next shop,” concluded BFFF’s Ashby.

Burchell agrees and stresses the importance of Independents “being aware of their best sellers and to communicate and promote to their customers what they are looking for.”

Husky’s expert advice is to allocate your refrigeration space depending on the fastest-selling lines and your customer profile. If demand changes from soft drinks and water at lunchtime to wine, beer and cider in the evening, restock as required. Keep your contents of your fridge and freezer front facing for maximum impact. The Husky PRO range provides full-length LED lighting to ensure that the stock contents are well lit from top to bottom and easily visible for those customers on the go.

“Did you know,” they add, “that by switching your 1mtr Open Fronted Dairy Deck to a Husky 1mtr Double Door Display Dairy Chiller you would save over £3,000 per annum of energy costs (based on an electricity rate of 45p per kwh).” Cool!