“Something quick and easy to eat” continues to rule, claims a recent industry report, showing a decline in food-to-go in the month of January.

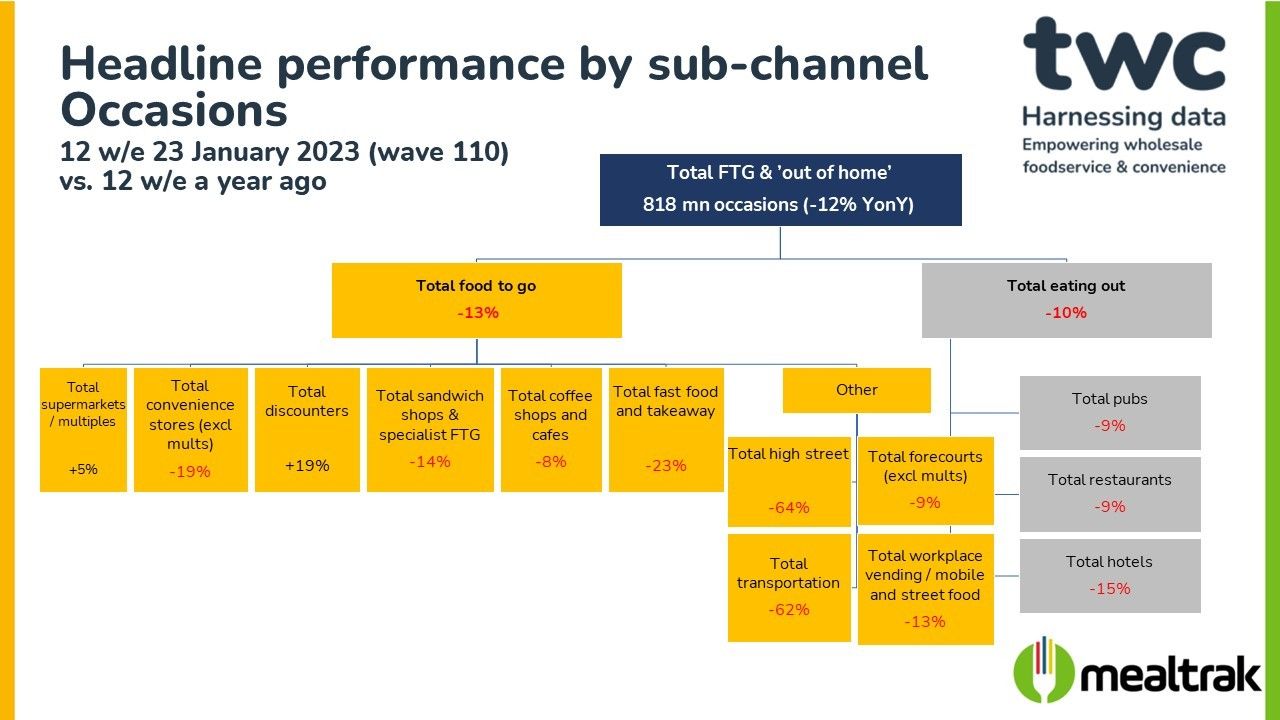

According to Wholesale experts TWC Group’s latest MealTrak results, total food-to-go occasions declined by -13 per cent in the latest 12 weeks, with forecourts and independent convenience stores showing the same trend.

The drop is mainly driven by sandwich shops (-14 per cent), coffee shops & cafes (-8 per cent), fast food & takeaway (-23 per cent), high street (-64 per cent), transportation (-62 per cent), workplace (-13 per cent), forecourts (-9 per cent) and independent convenience stores (-19 per cent).

A slight upward trend was seen in the multiples (+5 per cent) and the discounters (+19 per cent), with their more affordable food-to-go offer, remain the clear winners, although the growth rate in the mults has slowed this period.

A slight upward trend was seen in the multiples (+5 per cent) and the discounters (+19 per cent), with their more affordable food-to-go offer, remain the clear winners, although the growth rate in the mults has slowed this period.

Commenting on the results, Tom Fender, Development Director at TWC, said:

“January is typically a tough period for the eating out market, with the cost-of-living crisis adding to the woes of the sector this year. Occasions fell by -12% vs. January 2021, which is a continuation of the trend of falling occasions that we have been reporting over the last couple of months.”

“Even the multiple grocers with their competitively priced meal deals, have not been immune from the challenges. Whilst still in growth of +5%, this is quite a drop from the double-digit growth we’ve been reporting for some time. The discounters are now the only sub-channel in growth on a 12-week ending basis, and this is from a much lower base, with food-to-go representing a smaller part of the total store offer.”

“January is often a month of good intentions, both from a health and a savings perspective, so the decline in food to go could well be due to increased “brown bagging”, with more consumers bringing lunch in from home, or eating at home rather than going out at all. The biggest mission for food to go – and the fastest growing again this period – remains “something quick & easy to eat”, so this is a key need for operators and suppliers to tap in to.”

To use this website you must be aged 18 years or over. Please verify your age before entering the site.

To use this website you must be aged 18 years or over. Please verify your age before entering the site.