KP Snacks has recently become sponsor of The Hundred tournament, which means we are meeting up at Lords cricket ground even though it’s not a match day. The sporty association chimes with the prevailing legislative weather – which is gently blowing Big Brother vibes onshore as the government tries to tackle the slowly unfolding health problems of an overweight and ageing population.

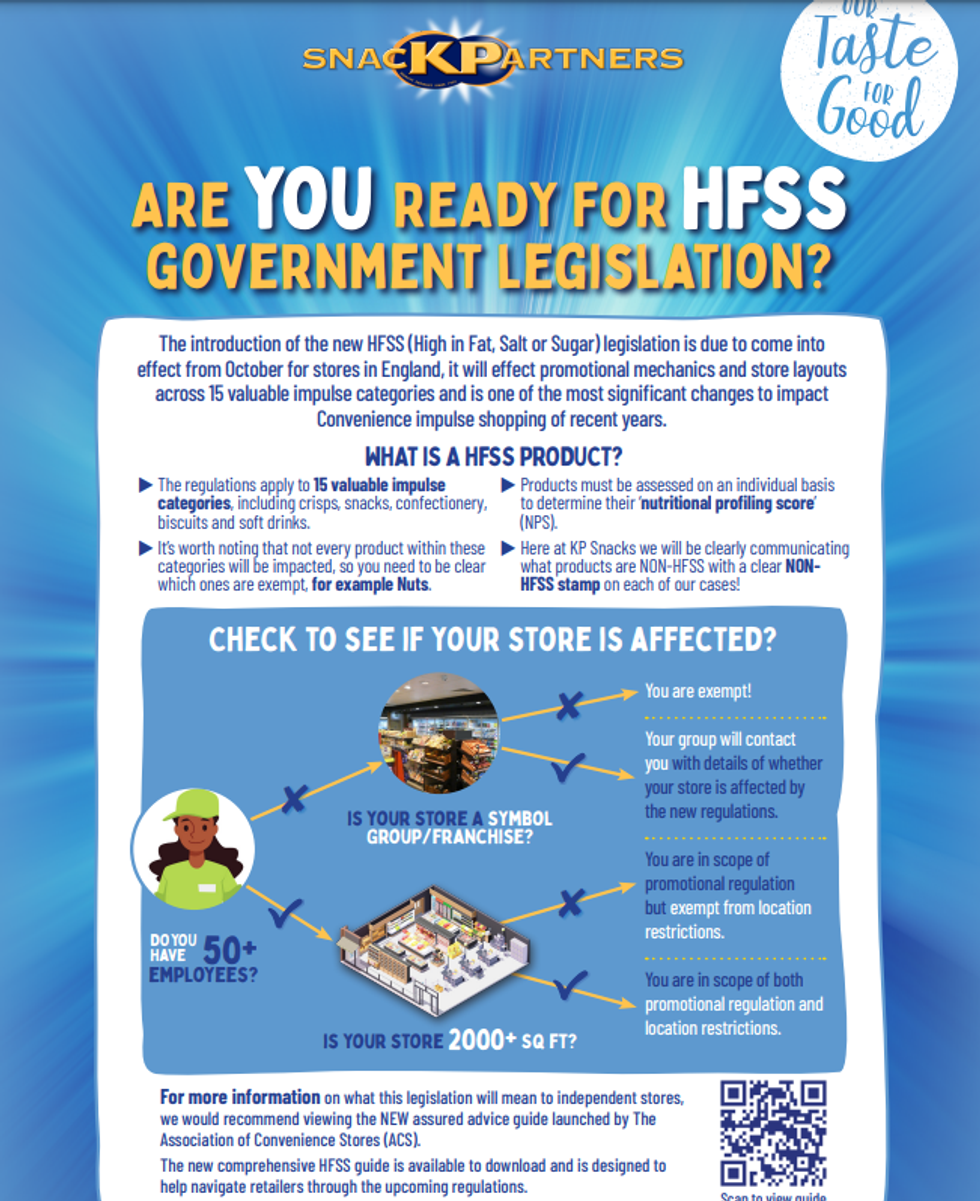

The latest rules are the HFSS – high fat, salt and sugar – restrictions due to come in soon ... or not, as the case may be (it is complicated). I am hoping that Matt can enlighten me as to exactly what HFSS means for the crisps, snacks and nuts (CSN) sector in general, and for KP Snacks in particular.

Post-pandemic

Is the sector in good health, so to speak, and will it be knocked back when HFSS comes in, I ask. And as a related question, when is HFSS coming in? What exactly is coming in? Only 15 per cent of retailers say that they think they understand the new legislation.

"I think snacks – crisps, snacks nuts, popcorn – remains a highly scalable, priority category in excess of £3.5 billion,” Matt says. “There’s a strong CAGR [compound annual growth rate] currently at just over six per cent, and high household penetration at about 84 per cent.

“So it's a good healthy category,” he continues. “At the moment, we are seeing a sort of balance between value and volume, with value driving the growth through it. Some inflation is coming through, but we are still behind the average grocery inflation, which is tracking at about eight per cent. The category inflation here is probably closer to about six and a half per cent, or six per cent at unit price, and about 11 per cent on a per kilo price.”

Snacks did well under lockdown as sharing and home-treating rose, and snacks are doing well again as on-the-go sales pick up. Is it fair to say it is a win-win situation?

Matt laughs (he is in a justifiably good mood): “The difference is that we've seen that mix change. Whilst COVID restrictions might seem a distant memory, the reality is we were still in some of them last year. We're still seeing a rebound of the singles, eat-now and on-the-go product, which clearly has a higher pence per kilo and a lower unit price than a sharing bag.”

He confirms that food-to-go is bouncing back strongly despite COVID legacies such as work-from-home.

“If you rewind to 2019 it was more nine-to-five office culture,” Matt explains. “You can see that has changed, and people now have more hybrid working. But within that, we're still seeing the occasion going into the high street rather than eating at home, and there’s a resumption of the meal deal. Singles are bouncing back, particularly with everyone travelling again, and we're back to 2019 levels, if not higher.”

The Convenience channel benefitted from the lockdown, although footfall is slowly returning to normal. Is Convenience doing well from KP Snacks’ vantage-point?

“It depends on how you differentiate the Convenience channel,” Matt answers. “We say it’s any store 3000 square feet or below that is able to trade for eight hours or more on a Sunday. So, you have the bigger, more national mults such as Tesco Express, JS Local, the Co-op, and then you have the symbols within that, so the likes of SPAR, Nisa, Premier – and then the true independents. So circa 50,000 shops, and at the moment we're seeing that channel grow plus 12 per cent in value. “

Keeping up with inflation, then!

“Convenience is still very strong because whilst there might be a change in some shopping habits, in terms of the top-up shop, any offset has been caught back up by city centres reopening, busy working districts in office areas reopening – so that food-to-go is really driving that growth within convenience.”

When HFSS attacks

I am interested to know what products are selling. Consumers have been hearing about HFSS for ages and surveys claim they are shopping more with health in mind. Is Matt seeing demand for products that are self-consciously aimed at being more healthy?

"In short, yes,” he says, “although I don't think it's fair to say consumers are aware of the term HFSS, or what that legislation is. But clearly, they're more aware of what the DHSC [Department of Health and Social Care] is trying to achieve.

"The big thing we see is packs under 100 calories, and the task is how to get those better baskets, not just bigger baskets. There is a shift, but you still have some of the bestsellers, mainstream brands, still doing very well,

I note that popchips seems to fit the HFSS description for a good snack, and sales are indeed through the roof.

"Yes, popchips is the beacon for healthier snacking and really delivers on flavour, a good range and variety of products," says Matt. “We've seen phenomenal growth, in excess of 19 per cent, but it's also because for the first time, last year, we started to really put some meaningful investment behind the brand in terms of above-the-line advertising.”

What exactly is HFSS going to mean when it comes in – in October this year? In October 2023? Bit by bit? What and when? Where? How? You know, it seems very, it seems opaque.

"I think opaque is a very fair word,” he replies, “but it's been changing. We were looking at starting in January this year; then it moved to October; then within the October legislation, that's already changed and the multibuy restrictions have been lifted – paused with a view to putting it back in October 2023.

It really is a confusing mess of bureaucratic dilly-dallying, isn’t it?

“The advertising legislation could even be pushed out to January 2024, so there's still some question marks,” Matt agrees. “And the big piece of legislation now concerns the location restrictions, effectively, in any store. The way we try and simplify it if we're talking to retailers or to partners, to specialty shops online, multiple grocery and independent convenience across the board, firstly, it's ‘Do you have 50 employees or more?’ And if not, you're exempt from the legislation.”

So, the convenience sector is basically unaffected by it?

"Well, that's a bigger question, because the 50 or more employees, when you're part of a franchise or symbol group – does that count as 50 or the total number in the group?”

Headache! In fact, news came through just as we were talking that the contracts for stores in symbol groups exempted them from being included in the chain’s overall employee count. Or at least for Londis and Budgens – it depends on the wording of original agreements. Arguments will no doubt continue to flare up over various parts of the new legislation.

"You've seen already the different court battles and hearings going ahead,” says Matt. "Kellogg's have recently had one with their cereals and about the addition of milk. And therefore, the NPM [nutritional profile model], which it is based upon creates the score.”

It’s complicated.

“That’s the challenge around HFSS. It's understanding where the products sit and everything else. The ACS [Association for Convenience Stores] is doing a really good job in terms of sharing their knowledge and guidance.”

Matt says that the promotional elements of the HFSS restrictions have at least been paused due to the cost-of-living crisis – with HFSS potentially adding to inflation.

“Next, you come to the placement restrictions, which are based on the size of the store – 2000 square feet. If you're below 2000 square feet, you're exempt. If you're above 2000 square feet, you're in scope.”

Won’t a ceiling – or rather a floorspace – of 2000 square feet include much of the convenience channel?

“Yes, and it's interesting, really. I think what would have been helpful is if the limit had been 3000 square feet, which is the typical [cut-off] measurement for a convenience store, as classified. But it's 2000 square feet. And so that is where we are today in terms of the restrictions that are coming in from the beginning of October.”

Do you see any unintended consequences evolving yet? Like shops dividing themselves into two shops.

“I'm sure there will always be some entrepreneurial and creative ways of measuring the floor space,” he laughs. “All of a sudden, the storage cupboard might have gotten a little bit bigger, or there might be a seating area or something else.”

It’s funny but it is also serious – more rules and no real effective enforcement, leading to chaos and further destruction of government credibility …

"Ultimately, how will it be policed?” Matt wonders. “How will compliance be checked, and controls imposed? Is it coming down to the Trading Standards? Given the scope of interpretation of the legislation and the number of stores involved, if this is all the resources that are being put into it, then I think that's going to be quite hard one to review.”

Product pillars

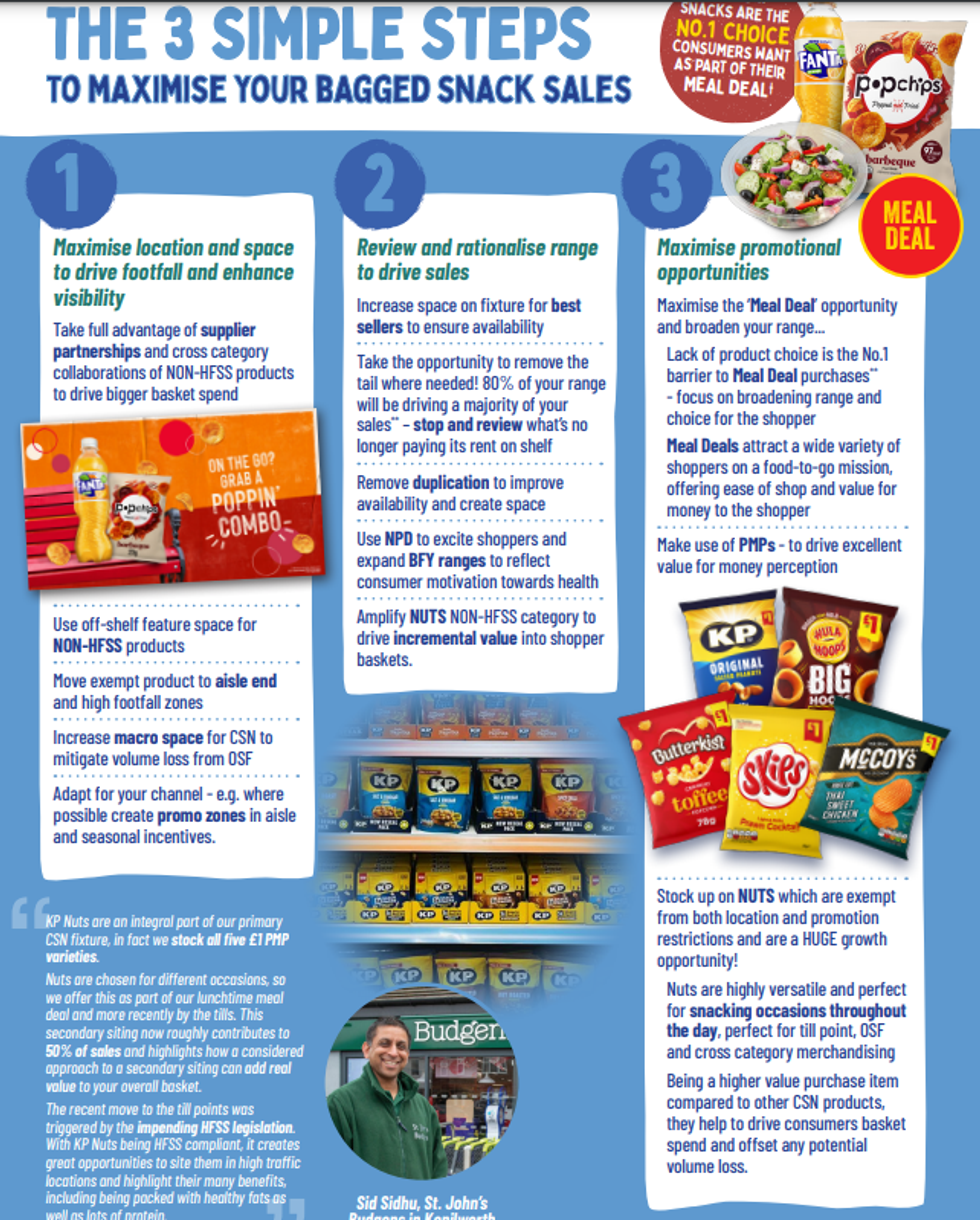

I ask what steps what KP Snacks has done to prepare itself for all this – have they thought about it brand by brand, and reformulated, remarketed? What's been the KP strategy to remain successful in the face of all these regulatory headwinds?

“That's an excellent question,” says Matt eagerly. “The first thing for us was we were already working on it – as part of Taste For Good, which is our environmental sustainability, and responsibility programme, and effectively our CSR [Corporate Social Responsibility] programme.

“We've been working on our products for a long time and when the legislation came out in (I think) December 2020, we then started all of the planning, but we'd already been working on it in the background.”

Matt says it is all about “embracing the opportunity” and understanding the legislation, and that KP Snacks breaks it down into different pillars.

“First, it's about our product offer: how do we reformulate? popchips is a great example, or Penn State, to make sure that they can be beacon brands and effectively compliant with the legislation

“Then we have nuts, which as a natural source of protein and fibre are exempt from the restrictions and are exempt from the legislation. How do we then innovate in that category and make the nuts category even bigger? That was really important to us.

“Then on some of our other products, being really clear about which ones we weren't going to look to reformulate because they had a different role to play: something like McCoy’s Flame-grilled Steak would be a good example.”

The full-fat treats will survive then – and thank goodness, say some of us. Well, one of us at least.

“Next,” says Matt, is how do we work with trade press like yourselves, how do we work with retailers to share our expertise, our guidance – because we've got a duty of care. And within that duty of care, how do we help people understand the legislation, be compliant with the legislation and help the category still thrive and prosper?”

One thing KP Snacks have done across all their products is stamping the outers really clearly so retailers can see which are HFSS or non-HFSS: “Any product that is non-HFSS has a stamp on it that will help with merchandising and replenishment,” Matt concludes.

Consequences, consequences …

What does Matt think the practical implications of HFSS are going to be? One discount supermarket, that shall remain nameless, had lined up bottles of beer, vodka and rum, right at pram eye-level around the till. Exposing children to the colourful labels of booze brands is an exemplary “unintended consequence” of the new legislation.

"Who knows,” sighs Matt, “but if you look at Easter or Christmas big seasonal events, which typically would have been front-of-store – chocolate for example – they're not going to be able to display chocolate, while they can still display booze, so those kinds of things …" We both shake our heads.

“I think it's 15 categories in total that are impacted,” he goes on, “some which are the impulse ones, some which are more advanced [regarding the new regs] than others. The soft drinks category, I think is in a very good place and they've done good work in terms of replacing sugar, going back pre the soft drinks levy. I think that category is in good health is positioned well regarding HFSS.”

Who is going to suffer most from HFSS, then?

“With CSN, if you look at what a lot of manufacturers are doing, there's lots of reformulation going on,” Matt answers. “They’re asking themselves, have we changed recipes, changed salt? But then I look at some of the other categories like chocolate and biscuits, and I think that's going to probably have a more difficult time reformulating products, taking out the sugar. That’s speaking about the impulse category, I think different segments are going to have different success.

What are the biggest challenges for producing indulgent but non-HFSS products? Do consumers appreciate all this virtuousness?

“You have to be clear in your portfolio about what role each brand and product is going to play,” says Matt. “It can't lead to a compromise on taste or quality. Simply put, we're in the business of producing great tasty snacks, whether they're HFSS compliant or not.

“We can demonstrate that with the success of popchips where, if you put up the product side by side – the original recipe and the non-HFSS recipe – I would defy you to taste the difference. Sometimes you need to keep going back to the drawing board, but our technical team have done a superb job.”

Selling HFSS

How do you promote and merchandise non-HFSS goods in a treats category and an impulse channel?

“You've already seen some retailers stating that, despite the legislation being paused or delayed for 12 months, they're still going to go ahead with it and taking multi-buys out of their offering," Matt answers. “Other retailers have decided not to. Everyone has their own strategic choice and their reasons and their rationale for doing it. We will work with each according to their promotional plan, their promotional priorities, and strategy.”

I am genuinely interested in whether customers will choose these products after the novelty has worn off.

"How do you drive it forward, you mean?” asks Matt. “I think on non-HFSS products, particularly if it's with innovation, temporary price reductions are more effective, because that way you you're reducing the barriers to purchase and enabling people, and you can grow penetration and trial by having price reductions.

“If that's done in a multi-buy that risk of purchase is greater. If customers don’t yet know if they're going to like the product, why would they buy two or three of them? They buy on a trial price, then if they like it, it's how do we move it up and try to encourage them volume behind it with a multi-buy, or a link deal.”

So, enter the market at a lower or more attractive price point – a welcome anti-inflationary strategy as well as a healthy one. What else?

"We've run some trials in partnership with CCEP, where we're looking at partnering non-HFSS brands together. A good one we've recently just finished is with popchips, and Fanta. The results have been superb in terms of uplift, penetration awareness, just by putting products together.”

Does Matt imagine that non-HFSS can be a positive thing in commercial terms? Can it provide an opportunity to increase basket spend and grow the bottom line?

"I see the legislation as something that we have to embrace,” Matt says simply. “I see an opportunity, not mitigation. Whether that's about growing the size of prize and size of basket is one thing. Is about creating healthier baskets on occasions? Absolutely. Will you necessarily grow a product? Maybe, maybe not.”

With a recession hurtling towards us, does the fact that multi-buys are penalised mean fewer sales?

“The promotional restrictions are in place, but they have been paused, so you can still offer multi-buys for the next 15-18 months,” he says. “I think consumers will always be savvy and you'll see people trading into where they know they're going to get value and still get quality, with brands they trust.”

The fact remains that the sector has suffered four major legislative hammer-blows over the past few years. First of all, the sugar tax. Then Natasha's law and subsidiary things around that. Then calorie labelling, and now HFSS. DRS still to come. The regulatory environment for people who are trying to produce food and get items into the shops is getting harder and harder, with more hoops to jump through. Does Matt expect more rules on the way?

“It's a good question,” says Matt. “We don't have a crystal ball, and we never know the government’s policy and priorities ...

“I think there's going to probably be change around packaging legislation, or if not legislation, around taxation on packaging, and how you make that more recyclable. But from a product perspective, I think we have to get through HFSS now, in this first phase, then the second phase is in terms of promotions, and the third phase in terms of advertising. I think that will still need to be pinned down. It's definitely going to be evolving policies over the coming years.”

Much to be fearful of, or is it great opportunities ahead?

“We're here to help people navigate change. Optimism and positivity, momentum and ambition are high!” he laughs.