Life and snack sales are slowly returning to normal and John Wood, commercial director of Calbee UK, puts it succinctly: “As lockdown eases, consumers will start to spend more time out of the home with greater opportunities to purchase on the go. The snacking area will strengthen as a result. We also expect to see the return of the meal deal as consumers start going back to workplaces which will inevitably be great news for single pack formats.”

Donna Morgan of Brownlie’s Biggar in Lanarkshire, says, “We’ve found £1PMP bags and multipacks have increased in popularity this year. Understandably, sales of singles fell as a result of the pandemic, with food to go missions almost non-existent in our store. Even as we gradually come out of lockdown, shoppers continue to favour the bigger packs of snacks and drinks so we’ve taken a brave decision to list a reduced number of singles in store, which are entirely sales driven.”

That is not to say that the lockdown has been bad for the category – on the contrary. Jon Roberts, Brand Manager at Cofresh, says that snack sales are +29 per cent with Sweet & Savoury Mixes up an astonishing 45 per cent:“statistics which reflect the trend we’ve seen throughout lockdown where people have wanted to give themselves a special treat or just to gain some energy to get through the long days of working from home.”

Snack trends

Snacks have become the national, affordable treat over the past 18 months, and now the prospect of near-normality on the horizon “means there are once again some great opportunities out there for retailers to capitalise on the massive impulse snacking category”.

Value for money, whether in singles or multipacks, has also been uppermost in shoppers’’ minds, and that has meant the increasing profile of PMPs, as Jacqui Dales of Spar London Road, Boston, attests:

“Since the start of lockdown, our customers have been looking for good value for money when coming in store,” she says.“In the last year, we’ve moved a lot more into the £1PMP space. For a customer who wants a good value for money purchase, it’s a real no brainer that they pick a grab bag at this price point.”

Part of what has characterised the meteoric rise of snacks and crisps recently has been the innovation and diversity from the producer side, matched with adventurousness and plain curiosity from customers. As we have said before, this is a golden age for snacks.

Paul Hargreaves, CEO at artisan and fine food distributor Cotswold Fayre says: “The snacks category is incredibly exciting, offering something for everyone, with some really interesting emerging trends and unusual products.”

Perhaps most importantly, he believes that snacking is no longer all about potatoes. “Cotswold Fayre continues to see a move away from potato snacks, with chickpeas, plantain, corn, lentil chips, and even lotus seed-based products entering the category.”

Partly due to the pandemic, partly a pre-existing trend, this change incorporates a renewed consumer interest in healthier snacking, and the suppliers are busy catering to this growing demand.

Snacking and slimming

In fact, as Jon Wood points out, the “Better For You” sector actually slowed down a little under lockdown – yet only by a tiny 0.8 per cent [Kantar Data 12 & 52 week ending 21st February 2021], a fact he ascribes to the sale of larger sharing packs and the concentration on traditional TV snacks.

That is changing back to the previous rising curve of interest in healthy snacking, and Roberts says that “We expect the Better-For-You category to return to the high growth levels it enjoyed pre-pandemic as lockdown restrictions are lifted and consumers embrace attitudes to holistic health once again. At 75 per cent household penetration, there is still massive headway in this category to reach the 99 per cent penetration levels of the total market.”

What is on every producer’s mind is the upcoming legislation targetting all the fun stuff – sorry, the salts, sugars and fats – in our treats and snacks. But as with the sugar tax on drinks, the industry is already way ahead of the government in responding to consumer concerns and can only hope the rules are not needlessly heavy-handed.

Hargreaves understands that certain consumers may be shy about trying healthier snacks, but says “While some consumers may still require some convincing … we’re seeing plenty of ‘weird and wonderful’ product combinations, which taste great and capture shoppers’ imaginations. Many of these new snacks are also non-vatable, which makes a big difference when it comes to retail price.”

Products such as graze are finding a mainstream place very quickly, and Hargreaves recommends brands such as Hanover Pretzels, Blanco Nino tortillas and Olly’s.

A Unilever spokesperson added that, they have seen many shoppers turning to unhealthier crisp and nut snacks as they sought ways to help lift their mood under lockdown (“a huge 69 per cent of shoppers said they used snacking as a way to help them get through the day”, but that it is changing.

“In recent months we’ve seen a shift in attitudes with consumers moving away from indulgence as they started to refocus on their health, which presents a real opportunity for the healthy snacking category. Whilst the intention is clearly there, with the results of our recent annual health survey of over 2,500 people showing that 53 per cent of shoppers are trying to snack more healthily, we know their biggest barrier is being tempted by unhealthy choices.”

It’s time to think about stocking more healthy options – crisps and bars. Unilever’s graze, again, is a case in point: “With graze, shoppers can enjoy a variety of delicious, portion controlled sweet and savoury snacks, without having to make a compromise between health and taste, as we deliver on both.”

PMPs in the bag

Bagged snacks – and especially price-marked-pack skus – remain a vital driver of growth within convenience and demand shows no sign of slowing, says Matt Collins, Trading Director at KP Snacks. He points out that since the beginning of the pandemic savoury snacking occasions increased and were up 47 per cent at the height of lockdown, “with CSN continuing to perform ahead of other impulse snacking categories such as biscuits and chocolate.”

“C-Stores have grown in importance with more people shopping locally,” he says,with 67 per cent more people choosing convenience for “main shop” and 27 per cent of people are expected to visit convenience stores more often post lockdown.

So bags of snacks can be shifter faster than ever. “In the last year, we have seen a significant increase in multipacks and sharing format sales, with familiar, trusted and well-known brands doing exceptionally well. Strong familiar brands are driving individual segment growth and our diverse portfolio is currently growing at +5.5 per cent whilst meeting a range of different need states,” he says.

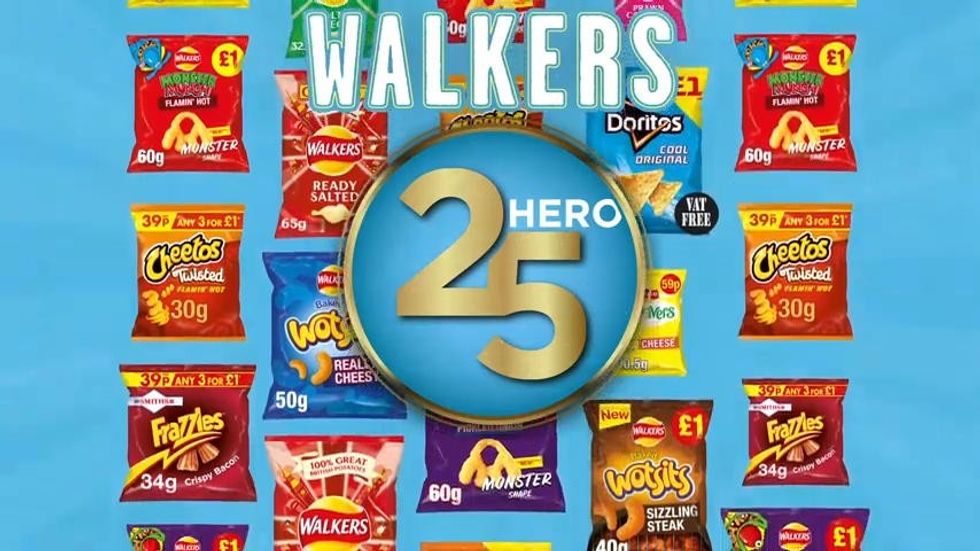

Of course, single serves suffered but the strategy that Walkers developed to overcome it was in their “Hero 25” ranging analysis and advice, which planogrammed out the most efficient facings depending on the size of store and customer base and foregrounded PMPs, especially £1 bags. It’s a system that is set well to continue, according to many storeowners.

“We’re constantly evolving our range of products in order to adapt to shopper demands, and we felt like we were really missing a trick by not stocking enough £1PMP,” said Jacqui Dales. “We never realised just how many strong SKUs were included as part of Walkers Hero 25, so since May this year we’ve substituted a number of £1PMP into the bay in place of a few lines of singles.”

The sales results have been great. Asian Trader Award-winner Imtiyaz Mamode of Premier Wych Lane, Gosport reveals, “We’ve seen a massive change in our customers’ behaviour over the last 18 months, who are opting for bigger bags as they spend time catching up with friends outside or enjoying at home with family members. What hasn’t changed for us is the popularity of PMP products, which always perform strongly. Customers seek PMPs because they trust in the brand and the value they’re receiving as a result, so whether it’s a regular £1PMP or the Walkers and Doritos £2PMP products, PMPs are always a big win for us.”

Matt Smith, Marketing Director for Tayto Group, concurs, and says that£1 PMP Snacks are growing three times faster than the market and now account for nearly 40 per cent of sales. “Family favourites such as our Golden Wonder Ringos and Transform-A-Snack brands performing well in this format – as they deliver Golden Wonder’s legendary ‘punch per crunch’, great consumer value, as well as strong margins for retailers. Capturing the booming sharing snacks market means retailers need to be stocking a strong range of £1 PMP snacks - which are growing at 20 per cent.”

So the category appears to predict continuing sales of sharing packs while at the same time expecting singles sales to increase through a combination of expert ranging and PMP deployment – alongside a growing expansion of the market through healthy innovations.

Flavour rules

The No.1 CSN category driver is taste, affirms Collins: “We are in the business of making great tasting snacks that serve a number of customer & shopper occasions, across all snacking segments (crisps, snacks, nuts, popcorn), delivered in all formats (singles, multipacks, sharing) and up and down the value spectrum.

The Sharing segment is strong and growing. Worth over £1.3bn, the largest within CSN, it is currently experiencing growth of +7.9 per cent. KP Snacks have a range of products that covers all of consumer’s ‘Together Time’ needs.

Looking ahead, we are likely to see a dialling up of long-term trends including a focus on healthy snacking, ‘together time’ as people spend more time at home, and a heightened importance in the role of PMPs in convenience as shoppers' budgets are squeezed.