Highlights

- Rising inflation pushes 60 per cent of UK households into disposable income decline in July.

- Middle-income families face first fall in spending power since September 2023.

- Lower-income households now short £73 per month as cost of essentials soars.

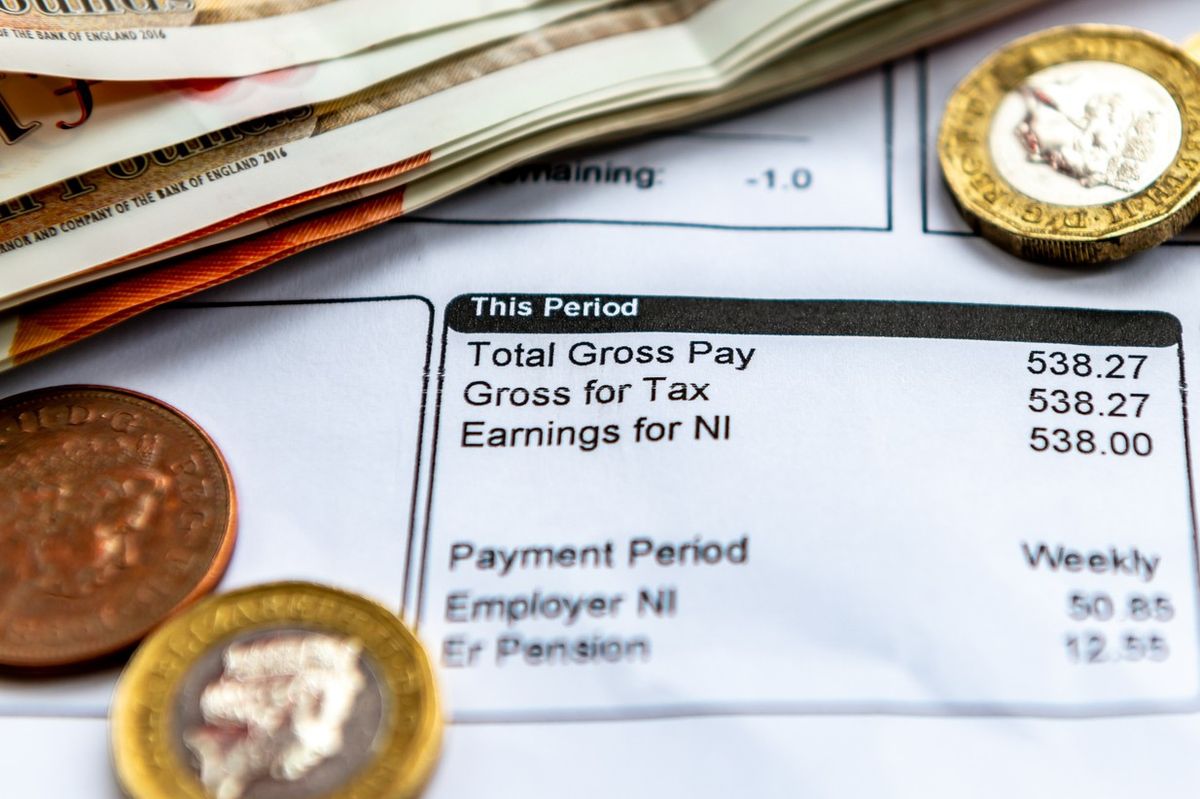

Disposable incomes fell for the majority of UK households last month, according to Asda’s August Income Tracker, raising concerns for grocery retailers reliant on resilient consumer spending.

The report, produced in partnership with the Centre for Economics and Business Research (Cebr), shows that 60 per cent of households experienced a decline in spending power in July. Inflation climbed to 3.8 per cent – the highest level this year – driven largely by food, drink and transport costs.

The cost of essentials rose by 5.1 per cent year-on-year, putting further pressure on household budgets.

The squeeze was most acute for lower-income households, who saw an 11.1 per cent decline in disposable income, leaving them £73 short each month after covering essential bills. Middle-income families, earning around £41,000 annually, also registered a 1.6 per cent fall in disposable income – their first drop in nearly two years.

While higher earners remain comparatively protected, the report highlights that the gap is narrowing as earnings growth slows and tax contributions increase.

Sam Miley, Head of Forecasting and Thought Leadership at Cebr, warned that elevated inflation will continue to weigh on purchasing power.

“Inflation accelerated to 3.8 per cent in July, the highest rate since January last year. The rise was driven primarily by sharp price increases in essentials, such as food and non-alcoholic beverages,” Miley said.

“This has been reflected in the Income Tracker, which showed only modest growth of 2.4 per cent in the year to July. While wages are expected to rise over the remainder of the year, persistently high inflation will put continued pressure on purchasing power, weighing on further gains in the Tracker.”

With inflation forecast to stay above the Bank of England’s 2 per cent target until well into 2026, retailers may need to prepare for increased trading down, stronger demand for value ranges, and shifting shopper behaviours in the months ahead.