As the autumn chill sets in and winter approaches, convenience store retailers across the UK are presented with a significant commercial opportunity that continues to expand year on year. The over-the-counter (OTC) winter remedies market represents not merely a seasonal sales boost, but an increasingly important element of the convenience retail proposition as consumer shopping habits evolve and healthcare accessibility becomes more challenging.

Most adults suffer between two and four colds annually, creating consistent demand throughout the colder months. However, this year's opportunity is amplified by broader healthcare trends that are fundamentally reshaping where consumers seek their first line of medical support.

With GP waiting times remaining a major concern – nearly one in five patients waited more than a week for an appointment in the first eight months of the year, and over five per cent waited longer than a month – and pharmacies facing their own accessibility challenges, with NHS data showing 72 closures in England by August (around two a week), convenience stores are increasingly emerging as a crucial touchpoint for consumers seeking quick relief from winter ailments.

A market poised for growth

The UK OTC market is expected to reach a value of £3.6 billion by the end of 2025, driven by continued self-care interest, NHS pressures, and consumer willingness to invest in trusted brands [Statista]. Cold and flu remedies remain one of the top three drivers of OTC sales.

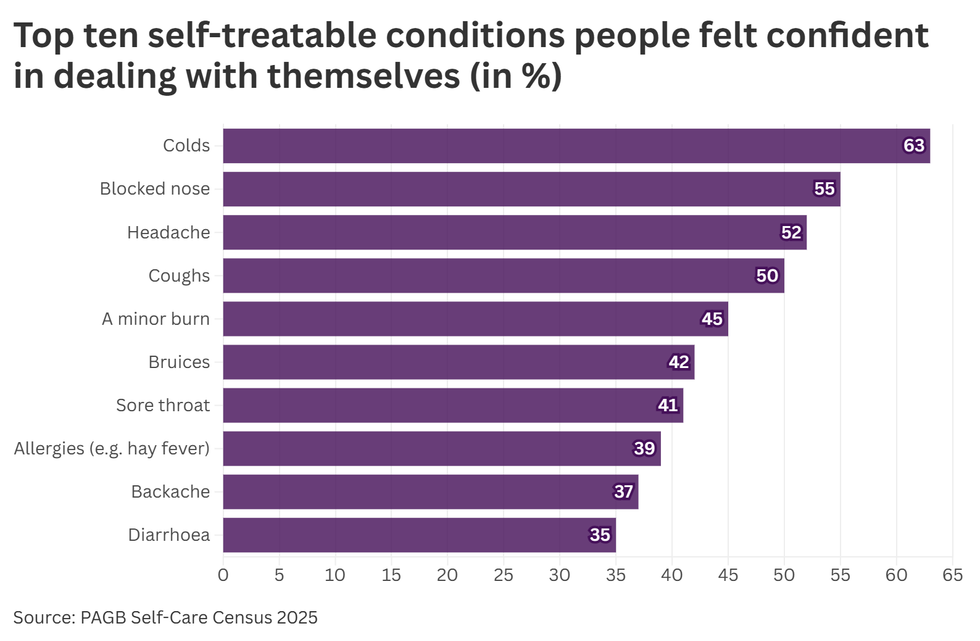

Over the last few years, winter remedy products have presented a significant opportunity for retailers, and this year is no different, particularly as demand for products remains high. This is shown by the 91 per cent of adults who used OTC medicines in the past year for self-treatable conditions [PAGB, 2025]. The strength of the OTC market is predicted to continue to grow as reports, such as the consumer healthcare association PAGB Self-Care Census 2025, highlight that 83 per cent of UK adults now manage minor ailments without seeing a GP, indicating the need for trusted products that consumers know are effective and help ease symptoms of minor ailments.

The broader OTC analgesics and cough, cold and flu remedies market in the UK has shown steady growth, with over five per cent increase in value sales in 2024 [Mintel]. Looking forward, forecasts suggest growth of more than six per cent in the foreseeable future, despite potential headwinds from inflation and supply chain challenges. The essential nature of these products ensures sustained demand regardless of broader economic conditions.

Seasonal factors further amplify this baseline demand. The “quad-demic” experienced in 2024, which saw simultaneous circulation of four common viral illnesses (flu, COVID-19, respiratory syncytial virus and norovirus), boosted cold and flu remedy sales significantly [Mintel]. Whilst such extreme conditions may not recur annually, they underscore the importance of maintaining well-stocked shelves to capture peak demand periods.

Sales in the cold, flu, and allergy category grew 11 per cent in value year-on-year in early 2025, supported by a return to in-person interactions, continued seasonal illness patterns, and consumer interest in functional remedies [Statista].

Understanding shopper behaviour

In-person purchases remain dominant in the OTC category. 98 per cent of OTC sales still occur offline, with community pharmacies, supermarkets and high street health stores playing a vital role in product access and shopper decision-making [Statista]. This presents a significant opportunity for convenience retailers to capture a larger share of this market by ensuring they stock the right products and merchandise them effectively.

Rachel Ramsden, Olbas Brand Manager, explains: “Self-care remains a key driver across the category. 83 per cent of UK adults now manage everyday health concerns without seeing a GP, while 69 per cent say they want greater access to products that help them treat symptoms at home [PAGB]. The cold and congestion category remains an essential part of this shift.”

As part of this category, congestion-related ailments remain widespread. In 2024, almost 40 per cent of UK adults experienced cold or flu symptoms at least twice over the course of the year, with nasal congestion ranking among the most common and disruptive symptoms [Statista]. An estimated 33 per cent of UK consumers said congestion impacted their ability to sleep or focus, indicating a significant ongoing need for reliable, accessible remedies [CircanaXGR].

Natural remedies opportunity

One of the most significant consumer trends in the winter remedies category is the growing preference for natural ingredients. Consumers continue to seek out natural remedies over alternatives. According to the PAGB's Self-Care Census, one in five UK adults actively prefer to manage minor health conditions using natural treatments, while 53 per cent say they want more OTC options made with natural ingredients. This makes decongestant products like Olbas, which are formulated with natural essential oils, especially relevant to today's OTC buyer.

This winter, Olbas is launching a brand-new product: Olbas Shower Gel (250ml, RRP £3.49). Made with natural essential oils including Eucalyptus and Peppermint, this shower gel's invigorating menthol vapours clear airways and eases congestion whilst cleansing, nourishing and moisturising the skin. The brand's marketing support includes a yearly winter campaign featuring TV ads, digital advertising and an educational PR campaign to highlight how the nation cares for themselves when suffering from ailments, and the benefits of Olbas's products.

Recent consumer research reveals concerning trends about winter illness severity. According to research commissioned by Puressentiel, a French, family-owned business that specialises in natural and aromatherapy products, 36 per cent of Britons experienced a cough in the past month, with 35 per cent suffering from a cold, and notably, a third of these respondents claimed their symptoms were worse and took longer to resolve than in previous years. These findings suggest consumers are actively seeking more effective solutions, creating an opening for products that approach symptom relief differently.

Natural remedies, including products containing essential oils and plant extracts, appeal to consumers seeking alternatives to synthetic medicines or those wanting to complement traditional treatments. The scientific backing for certain plant-based ingredients is substantial. Eucalyptus, for instance, helps clear mucus from airways and possesses antiseptic properties, whilst Scots pine encourages anti-inflammatory and antioxidant activity.

Speaking of the many essential oils shown to ease symptoms, Dr Tim Bond, natural health specialist and chemist and part of the Puressentiel expert hub, says: “Essential oils are highly concentrated plant extracts; one of the functions of essential oils in the plant include antiviral, antibacterial and antifungal properties as part of the plant’s immune system. As a result, any well-studied essential oil product, like the Puressentiel cough cold range is going to be great news for our immune health, vital for winter wellness needs.”

Consumer management strategies for winter ailments vary considerably. The research discovered that 45 per cent of Britons manage their cough and cold symptoms with at-home medicines, 41 per cent use painkillers and 40 per cent simply rest as much as possible [Puressentiel, 2025]. This diversity of approaches suggests retailers should stock a range of solution types to address various consumer preferences and philosophies around illness management.

Products combining multiple natural ingredients demonstrate particular appeal. Ranges featuring honey, which has well-documented soothing properties, alongside plant extracts such as elderberry, erysimum and natural essential oils, offer consumers multi-faceted symptom relief. The advantage of such formulations is that they address multiple symptoms simultaneously, appealing to consumers seeking comprehensive solutions rather than targeting individual complaints separately.

For convenience retailers, natural remedies present several commercial advantages. They typically command premium pricing, improving category margins whilst meeting consumer demand for perceived higher-quality, cleaner-label products. The positioning of natural remedies alongside traditional medicines creates a more comprehensive category offering that signals to consumers that the store takes health and wellness seriously.

The segment also benefits from being less seasonal than traditional cold remedies. Many natural wellness products position themselves as immune system support suitable for year-round use, providing more consistent sales patterns that justify permanent ranging decisions rather than seasonal stock-ins.

Flavours and sugar-free options

Retailers are being urged to pay attention to evolving consumer tastes in the medicated confectionery market as flavour innovation and sugar-free options take centre stage. Recent insights reveal that 62 per cent of UK lozenge buyers prioritise flavour over format [Kantar], making seasonal and limited edition launches a key driver for trial.

Elizabeth Hughes-Gapper, Jakemans Senior Brand Manager, says: “As we enter winter season where coughs and sore throats will be the result from common winter ailments, retailers should offer a strong selection of trusted brands like Jakemans. With a strong reputation for quality and high levels of consumer loyalty, Jakemans gives retailers the confidence to stock up, knowing the range will deliver strong sales.”

Jakemans is tapping into this trend with the recent launch of Limited Edition Spiced Cola, offering a warming twist on a retro classic, and adding Sugar Free Summer Berries to their permanent range, expanding their sugar free offering providing greater choice for consumers.

The rise of sugar-free products is also reshaping shopper behaviour, with 72 per cent of UK consumers actively limiting sugar intake for weight management, dental health, and cleaner-label preferences [Meticulous Research]. For retailers, stocking flavour-forward and sugar-free variants offers a timely opportunity to drive sales and meet consumer demands this season.

Hughes-Gapper adds: “Sugar free is a key growth area: 49 per cent of UK consumers now actively seek sugar-free or reduced-sugar sweets. These options should be clearly called out in-store to capture health-conscious and dietary-restricted shoppers.”

For convenience retailers, this presents a dual opportunity: to meet existing demand from health-conscious consumers whilst potentially attracting new shoppers who might not have previously considered purchasing throat lozenges or similar products. The expansion of sugar-free options beyond traditional medicinal formats into more appealing flavour profiles helps to blur the line between functional remedy and enjoyable consumption experience.

The trend towards targeted and specific solutions is also evident. Rather than reaching for generic pain relief, consumers are increasingly selecting products designed for particular ailments, whether that is headaches, menstrual discomfort or sinus pain, the Mintel report reveals. This specificity extends to cold and flu products, where consumers distinguish between remedies for different symptoms and stages of illness.

The power of trusted brands

When it comes to winter remedies, consumers are increasingly turning to brands they know and trust. Jon R. White, Regional Business Manager at Fisherman's Friend, explains: “You might reasonably expect OTC & Winter Remedies sales to correlate with cold and flu cases, which were down during last season. But, sales of Throat Sweets have exceeded those expectations over the last year as consumers turned to their favourite brands for comfort during the winter months, and then increasingly used them for relief from symptoms during the annual hay fever season.”

“For while the category stayed flat in volume (+0.1 per cent year-on-year), it rose by +3.8 per cent in value [AC Nielsen]. For Fisherman's Friend, the story has been even stronger. Our value sales are up +8.7 per cent, volume by +1.4 per cent, and our market share has grown to 3.4 per cent. We are one of the fastest-growing brands and we're helping to drive category growth.”

White continues: “Our success is built on heritage and trust. With 160 years of history and 10mg of menthol per lozenge – the highest in the market – we offer strength and relief that's tough to match. Shoppers know they're getting a no-nonsense lozenge that effectively supports easing cold and flu symptoms.”

The importance of brand trust extends across the entire category, with 93 per cent of OTC shoppers using brand names to help them navigate store shelves [PAGB]. This statistic reveals that brands serve not merely as marketing tools but as essential navigational aids that help consumers quickly identify products they trust to deliver relief.

Trust is particularly crucial in the medicines category, where efficacy is paramount and consumers are often feeling unwell when making purchasing decisions. The strength of this trust is reflected in market share data, with Jakemans holding the position as the number one cough and throat lozenge brand [Kantar]. Such market leadership is built upon consistent quality and consumer confidence accumulated over decades.

“With a strong reputation for quality and high levels of consumer loyalty, Jakemans gives retailers the confidence to stock up, knowing the range will deliver strong sales,” Hughes-Gapper emphasises. For convenience store operators managing limited shelf space and tight margins, this assurance of stock turn is commercially significant.

The brand's heritage plays into this trust equation. Established in 1907, Jakemans has been producing menthol confectionery for over 100 years, continually investing in technologically advanced equipment to ensure product quality. This combination of tradition and innovation provides consumers with reassurance whilst maintaining product development momentum.

Year-round relevance

While winter is traditionally the peak season for OTC remedies, forward-thinking retailers are recognising the year-round potential of these products. White explains: “What sets us apart is our year-round relevance. OTC sales typically peak during the cold and flu season, but people also reach for our lozenges for relief of hay fever symptoms, or just to freshen their breath. Retailers who recognise that Fisherman's Friend can perform beyond winter will see the most sales success. In fact, last year's hay fever season saw Fisherman's Friend's sales rise by 23 per cent in value and 15 per cent in volume [AC Neilsen]. This year-round versatility drives long-term loyalty.”

The total sales value of OTC hay fever remedies reached around £197 million in 2024 [Statista], demonstrating the significant opportunity beyond the traditional winter season.

Susan Nash, Trade Communications Manager at Mondelēz International, notes that relief candy sales peak in winter with the annual arrival of the traditional cough and cold season. However, in recent years the category has continued to justify and expand its place on store shelves all year round. Halls is a non-medicated relief candy brand and continues to lead the category as the number one relief candy [Nielsen].

Value for money

Economic pressures continue to influence consumer behaviour, making value for money increasingly important. White observes: “Offering value for money is also increasingly important. Our packs contain more lozenges than competitors’, offering shoppers a great bang for their buck – particularly important during ongoing economic uncertainty and cost of living pressures. In times like these, shoppers stick with what they know works – and that's Fisherman's Friend.”

The opportunity for own-label products has also grown significantly. Wholesaler Parfetts is stepping up its push into own-label medicines with the launch of Go Local Paracetamol Tablets, following the successful debut of its Go Local Ibuprofen line in January. Available in 16-pack tablets, the new SKU is positioned to give retailers industry-leading returns, with a profit on return of 62.1 per cent at a £1.00 RRP, which is more than double the average achieved on branded equivalents.

Cheryl Hope, trading director at Parfetts, said: “The team at Parfetts worked hard to ensure there is no compromise in quality across our full range. We want consumers to keep coming back for more. Own label is a key factor in increasing basket spend, and with products like our new paracetamol, we're giving retailers the tools to boost margins and offer real value to their shoppers.”

The tablets come in shelf-ready trays with sleek branded packaging and blister packs, giving them the look and feel of a branded product. Hope says shoppers will find real value without any compromise on medicinal content.

Ramsden adds: “Value is important for consumers, however brand trust is crucial. Shoppers rely on trusted names, particularly for remedies they consider essential for effective family care, such as Olbas, the nation's favourite decongestant oil.”

For convenience retailers, the strategic approach involves maintaining a core range of trusted branded products whilst selectively introducing own-label alternatives where they offer compelling value without compromising the category's credibility. The key is ensuring that own-label options meet quality standards that won't disappoint customers seeking effective relief.

Whilst the essential nature of remedies might suggest premium pricing opportunities, consumers are increasingly price-conscious and actively compare costs across retailers. An NHS guidance on keeping a well-stocked medicine cupboard for winter notes that “supermarket or pharmacy own brands work in exactly the same way and are often cheaper” than branded alternatives, signalling that official health sources are encouraging price awareness.

For convenience stores, competing on absolute price against supermarkets and pharmacies may be neither possible nor necessary. Instead, the convenience premium should be reasonable and justified by factors such as location, opening hours and immediate availability. Transparent pricing and good communication of value, whether through promotional mechanics or clear shelf-edge pricing, maintains customer trust.

Optimum merchandising

Effective merchandising is crucial for driving sales in the winter remedies category. Convenience and ease of purchase are important to consumers, meaning retailers should look to use shelf-ready packaging when merchandising to drive sales. They should also place winter ailments remedies in prominent locations to ensure products have the best visibility on shelf.

Hughes-Gapper explains: “Dual siting, by displaying menthol lozenges at both the till point and healthcare aisle, will help with convenience and ease of purchase, two key components for consumers and retail staff.”

The till-point placement catches customers who might not have initially intended to purchase but recognise their need when prompted, whilst the healthcare aisle positioning serves those specifically seeking remedies.

Clear in-store signposting, symptom-led shelving and brand blocking can help drive visibility. Jakemans soothing menthol lozenges distinctive packaging and broad range of flavours, provides choice and standout at shelf, allowing consumers to easily shop the fixture.

The packaging itself plays a functional merchandising role. Jakemans' range includes 73-gram bags in seven flavours, 160-gram bags in three flavours and 41-gram stick packs in two flavours, alongside 50-gram sugar-free options. This variety allows retailers to stock different sizes appropriate to their customer base and available space, with smaller formats working well at tills whilst larger bags suit the healthcare aisle.

Ramsden advises to stock a variety of format types – including oils, sprays, patches and inhalers – to ensure broader appeal and meet evolving preferences. “Formats that support 'on the go' use or multi-person households are showing consistent growth [Lanes Kantar].”

Nash adds that whether it be for menthol clearing or gentle soothing, shoppers look for brands they know and trust in-store. Singles are the most important format across the category as shoppers look for a readily available and tasty relief brand to help continue with their day and embrace the moments that matter.

“Halls boasts a vibrant and cohesive design across the portfolio, allowing consumers to find their chosen solution with confidence and ease,” she notes.

Channel-specific strategies

Different retail channels require different approaches. White explains: “We work closely with our retail partners across all channels to make the most of the growth opportunities in each, which is why we are performing strongly in retailers large and small.”

“In Impulse, our volume share stands at 37 per cent, compared to 28 per cent for the category [Nielsen, MAT], plus our ex-factory sales grew +12 per cent in the first half of 2025. Unlike most grocery categories in convenience stores, where products are typically bought on impulse, Winter Remedies like Throat Sweets are often purchased with intention. Shoppers head to these stores because they're more convenient, easier to shop and typically nearer home, which is ideal when you're sick. This is why Fisherman's Friend over-indexes in impulse. When people are unwell, they make a deliberate choice to buy our lozenges, especially our 25g packs, which are available in all eight variants.”

Convenience retailers who have embraced the winter remedies category are seeing strong results. Amy Sohal, of Ken's Convenience Store (Premier) in Winsford, Cheshire, says: “I stock Fisherman's Friend Original and it's merchandised at the front of the counter where all our cough sweets are to drive impulse sales. Sales are steady, and they particularly appeal to our older customers. If an elderly customer comes in unwell, they naturally gravitate towards products like Fisherman's Friend.

“We actively talk to our customers about the strength of the lozenge as this can help soothe their symptoms and is a key driver. Most of our sales are during the winter and our shoppers do choose Fisherman's Friend over its competitors. However, we notice summer sales, too. It's a year-round product.”

Sasi Patel, who runs a Go Local Extra store in Manchester, adds: “We stock the Original and Blackcurrant varieties of Fisherman’s Friend, and it is predominantly bought by our elderly customers. When someone comes in the store looking for a quick fix, we tell them about Fisherman’s Friend. It's a strong seller and a good soother for a tickly or sore throat.

“I’d recommend all retailers give it prominent counter space in winter, so that when someone sees it, they’re more likely to pick it up – just because it’s Fisherman’s Friend and they know and recognise it. Packaged in paper, Fisherman’s Friend has a premium feel.

Stocking the right range

For retailers looking to build a comprehensive winter remedies offering, stocking a mix of products across different categories is essential. Ramsden advises: “Retailers should stock a mix of standard and children's formulations. Olbas for Children, suitable from three months, continues to be a popular choice among parents who want natural, gentle relief for little noses.”

“Convenience also matters as shoppers are often looking for quick relief that fits seamlessly into daily life. For those on-the-go solutions include Olbas Inhaler Sticks, Olbas Breathe Easy Patches and Olbas Nasal Spray with added aloe vera. For family purchases where gentle, multi-use products are key, Olbas for Children comes in handy and for those focused on wellness, Olbas is not just for colds but also to support better sleep, focus and day-to-day breathing.”

Hughes-Gapper adds: “Innovation continues to be a key focus for the Jakemans brand. Further expanding its flavour offering, alongside Jakemans permanent range are flavours such as Throat & Chest, Throat & Chest Sugar Free, Honey & Lemon, Cherry, Peppermint, Blackcurrant, Menthol & Eucalyptus, and Blueberry.”

Expanding the category opportunity

Whilst cough and throat lozenges represent a core component of the winter remedies opportunity, the category extends considerably beyond this foundation. A holistic approach to winter wellness encompasses multiple product types that address the full spectrum of seasonal ailments.

Pain relief and fever reducers form an essential element of the range. Paracetamol and ibuprofen are recommended by NHS guidance as essential items for home medicine cupboards, providing effective relief for the headaches, body aches and fever often associated with colds and flu. The entry of own-label options into this segment, as demonstrated by Parfetts' new launches, provides retailers with improved margin opportunities whilst meeting consumer demand for affordable alternatives.

Decongestants, cough syrups and vapour rubs address specific respiratory symptoms. Preventative products, including vitamin supplements and immune system support, represent an adjacent opportunity. Whilst not remedies in the traditional sense, they appeal to consumers seeking to reduce their susceptibility to winter illness. The positioning of such products near winter remedies creates logical cross-merchandising opportunities.

First aid supplies, though not specifically winter-focused, complement the healthcare positioning that winter remedies establish. Plasters, bandages, antiseptic cream and basic first aid items are frequently purchased items that benefit from the increased footfall and category attention that winter remedies generate.

Throat sprays, nasal sprays and saline solutions provide alternative delivery formats for active ingredients. Some consumers prefer sprays to lozenges or tablets, and offering format choice within symptom solutions maximises the chance of meeting individual preferences.

Marketing support

Brand owners are investing heavily in marketing support to drive awareness and sales. Hughes-Gapper explains: “Marketing support remains a key priority for Jakemans. The brand has an integrated marketing approach, including a strong TV, radio, PR, digital and social campaigns approach ensuring the brand remains front of mind throughout winter, spring and other key seasonal moments.”

Jakemans' latest campaign highlights the importance of keeping voices soothed as we head into winter months. Research commissioned by Jakemans revealed that 84 per cent of under-30s start their day with a motivational prep talk, with 95 per cent often thinking about motivational memes or inspiring quotes to boost their mood. The campaign, featuring motivational speaker Dr Alison Edgar, positioned voice care as essential for effectively delivering motivational messages.

“It's clear how much, as a nation, we need those motivational moments to help us get through the day or offer that little boost of confidence when we need it most,” notes Hughes-Gapper. “Our voices are an incredibly powerful tool in communicating the motivation that we need. So, it's important to do our best to look after our voices, particularly as winter approaches and our vocal cords are impacted by sore throats.”

White meanwhile notes that Fisherman's Friend doesn’t need constant NPD to stay relevant on account of its core range that is so well known. “We haven't launched new flavour variants in the UK for six years, but we've kept growing. Our core range – led by Original Extra Strong, which makes up 59 per cent of our sales – remains the heart of the brand, with Blackcurrant (21 per cent) and Honey & Lemon (six per cent) also popular,” he says

“But we're not standing still. A major PR and influencer campaign is lined up for the 2025 cold and flu season, alongside fresh content across our social channels to keep Fisherman's Friend front of mind.”

Preparing for future opportunities

The winter remedies category presents a significant opportunity for convenience retailers who understand the market dynamics and consumer preferences. White concludes: “For Fisherman's Friend, innovation isn't just about launching new flavours for the sake of it – it's about reinforcing our core proposition. Our focus remains on format innovation and ensuring our packs meet shoppers' needs across all channels. Whether it's the convenience of a single 25g pack, the value of a multipack, or a bulk buy online, we're optimising our offering without diluting what the brand stands for.”

“Additionally, we're evolving how we engage consumers. Our latest PR and influencer campaigns are reshaping perceptions of Fisherman's Friend as not just a winter cold and flu essential, but a year-round go-to, especially with hay fever seasons getting longer and more severe. Ultimately, our commitment is clear: a high-menthol, great value, trusted product that delivers all year round.”

Ramsden adds: “A mix of branded and own-label products allow retailers to cater to price sensitive customers while meeting the expectations of brand-loyal shoppers looking for products they know and trust. Retailers should dedicate clear, well-signposted cold and flu shelves to encourage browsing. Must-stocks include multi-format products such as Olbas Oil, Olbas for Children (suitable from three months), Olbas Nasal Spray, Inhaler Sticks and Breathe Easy Patches.”

Hughes-Gapper concludes: “Medicated confectionery is one of the most dynamic and emotive subcategories in the wider OTC space. Consumers now view lozenges not only as remedies for coughs and colds but also as part of everyday wellness and self-care routines.”

The shift towards self-care shows no signs of reversing. If anything, ongoing pressures on GP services and pharmacy accessibility suggest this trend will accelerate. The government's 10 Year Health Plan indicates that the NHS App will signpost to well-evidenced consumer healthcare products, potentially driving more consumers towards OTC solutions. Convenience stores well-positioned to serve this demand will benefit from increased category significance.

By treating winter remedies as a strategic category rather than a peripheral offering, investing in appropriate ranges and merchandising execution, and staying attuned to evolving consumer preferences, convenience retailers can transform seasonal demand into sustained category growth and enhanced customer loyalty that extends well beyond the winter months.