The trend for less alcohol per drink is certainly increasing, as higher sales of “No and Low” drinks – mostly beers to begin with but more so wine and spirits in recent years – goes to show. According to Alex Dullard, Head of Customer Marketing at BrewDog, the category is worth £1.6m in value, meaning +33 per cent vs the same time last year.

It is easy to think of many reasons why this is so, not least demographic salients such as the fact that the younger generation drinks less, just as they drive less often, the digital age having had an influence for more than a couple of decades now.

“Consumer demand for low and no alcohol products has been steadily growing over the past few years,” says Dan Harwood, Key Account Manager UK & Ireland at Schloss Wachenheim (owners of the Eisberg brand). “The trend of moderation and abstinence is continuing to rise, with more and more people choosing to cut down on how much alcohol they consume – whether it’s for health reasons, for charity, because they are driving, or simply because they don’t want to drink.”

At least four identifiable factors in the rise of No and Low should encourage retailers to consider widening their No and Low range. First, there is the fact that alongside a widening choice of drinks and brands, the drinks themselves have improved immeasurably from the early days as a result of brewing developments (not least reverse osmosis), that enable No and Low to retain the original flavours much better.

“Price, taste and availability have previously been the biggest barriers to consumption of low and no alcohol products,” Dullard explains. “Consumers expect the same level of experience that get from alcoholic drinks, but in the past, they have had to compromise.” No longer.

Second, we have had a pandemic and been largely spending time at home for two years. During that period very many people tried to curtail the all-too-easy “wine o’clock” habits that working from home encouraged, and decided to adopt a hybrid drinking formula, with alcohol at weekends or in limited amounts; buffered, as it were, by No and Low periods or No and Low “chasers”. Both ways, No and Low consumption went up.

Third, these drinking-at-home habits have persisted after the end of pandemic restrictions, partly because the population discovered the pleasantness of home drinking, which also made consuming No and Low easier. “The growth of alcohol-free beer has been huge in recent years, with the pandemic a catalyst for that,” confirmed Emma Gilleland, Director of Brewing, Carlsberg Marston’s Brewing Company. Alcohol consumption is arguably more normalised in a pub situation, and purse-strings are anyway being tightened in the face of inflation and recession, encouraging home drinking.

Added to that is the coming summer season and garden entertaining at BBQs (and BNI which just keeps growing), where the refreshing elements of No and Low are seen to advantage.

“The summer months are often filled with social gatherings and BBQs. This year is set to be more social than ever,” says Harwood. “The Queen’s Platinum Jubilee celebrations will be the perfect opportunity for families, friends and neighbours to come together.”

Coming up

“The importance of No/Low alcohol products is expected to increase in 2022, especially around social occasions and for those spending more time at home,” believes Tom Smith, Marketing Director – Europe, at Accolade Wines. “The growing category therefore offers an alternative option where full strength wine or alcohol isn’t always a choice, increasing opportunities to target new consumers.”

2022 is a key year for the expansion and firmer establishment of the No and Low category. "The industry has invested significantly into the quality and marketing behind new products, as well as education, meaning there is now more choice for shoppers than ever before, without having to compromise,” says BrewDog’s Alex Dullard.

In late 2021, brands had already began positioning themselves for the predicted upswing – Diageo, the company behind Guinness, was a prime example.

Last August, under the slogan “G0.0d things come to those who wait", Guinness relaunched its improved Guinness 0.0 in a 4x440ml can format. Lauren Priestley, Diageo’s Head of Category Development, Off Trade, promises that Guinness 0.0 shares the same “beautifully smooth taste, perfectly balanced flavour and unique dark colour” of regular Guinness, and that the brewers start it in the same way they do the alcoholic version. In the case of Guinness 0.0, a cold filtration process ensures the character is maintained and nothing is compromised: In short, “Guinness 0.0 offers Guinness with everything except alcohol.”

One of the huge attractions of No and Low is that it is much less fattening and so is a great way to slim down the beer-belly! Cans of No and Low can often have very low calorie count – roughly a third of regular beer and an underrated selling point. Guinness 0.0 has 17 calories per 100ml, so a standard can contains only 75 calories.

“We are incredibly pleased to have Guinness 0.0 back on shelves and in pubs and have put in place additional quality assurance measures to make sure this really is the best alcohol-free Guinness possible,” said Neil Shah, Head of Guinness GB. (RRP £3.50-£4.50 for a 4 Pack of 440ml cans.)

It joins the already impressive line-up of leading brands helping the Low and No area invitingly resemble the regular beer shelf. BBG have the best-selling Stella Artois Alcohol Free, Budweiser Zero and Becks Blue spearheading their No and Low effort. Meanwhile, Heineken’s 0.0 (just 69 calories in a 330 ml bottle) is ubiquitous.

A sign that more and more “regular” brands are joining the ranks of No and Low, Molson Coors Beverage Company has been adding many of its well-known alcoholic lines. “We currently offer drinkers alcohol-free options in lager, with Cobra Zero and Bavaria 0.0, cider, with Rekorderlig Alcohol Free and ale, with Doom Bar Zero, catering to a host of different tastes,” says Kevin Fawell, Off-Trade Sales Director.

“In 2021, we’ve seen sales of alcohol-free beer grow by 56.2 per cent, when compared with 2019,” said Emma Marston’s Gilleland. “We saw sales of our full range grow by 61.1 per cent - with San Miguel 0,0 growing an incredible 105.1 per cent, and number one alcohol-free speciality beer brand Erdinger sales up 41.1 per cent. Brooklyn Special Effects is now the number three alcohol-free craft beer brand, growing volume and value share significantly vs 2019.”

Fawell also notes that in recent years there has been an increase in the variety of options on the market, which appeal to a much broader set of consumers. “The range available has never been better, and with so much diversity, more and more people are starting to take notice. As a result, the number of people opting for non-alcoholic beer and wine when moderating their alcohol intake has increased gradually in each of the past three years, so having a good range of low-and no-alcoholic options is important.”

Doom Bar Zero, which Fawell says is the UK’s first widely available 0.0 per cent ABV amber ale, was another brew that launched last year with an eye on big sales for this. He affirms it stays true to the style of the successful Doom Bar brand while achieving 0.0 per cent alcohol – “Significantly more difficult to brew than 0.5 per cent,” he says. “It is growing ahead of the rest of the low-and-no category in terms of volume sales.”

Another brand that is fully aware of the No and Low revolution is BrewDog. The pioneering independent craft beer brand.

“Beer is one of the leading low & no alcohol categories and shoppers are looking for comparative flavours to alcoholic counterparts,” says Dullard. “BrewDog Punk AF single can (0.5 per cent ABV) is the only craft beer within the top 10 low alcohol beers, growing at 38.3 per cent YoY ahead of many mainstream and established products, and aligning to the main beer category where BrewDog Punk IPA is the number one craft beer brand.”

Also performing well in convenience is BrewDog’s original low alcohol beer, BrewDog Nanny State (0.5 per cent ABV) 4-pack can which is growing 6.8 per cent YoY. “A brigade of speciality malts and North American hops sends bitterness to the brink and back. Squeezing this many hops in, and the alcohol out, is a testament to our craft,” says Dullard.

“Finally, BrewDog’s latest foray into alcohol free beers sees us take our iconic Lost Lager and turn it into a crisp and refreshing 0.5 per cent crusher – BrewDog Lost AF.”

And of course, the premiumisation trend applies to No and Low too: "If the quality is there, shoppers are willing to pay extra,” Dullardconcludes.

Wine and spirits time

There has been a non-alcoholic wine option (beyond just “grape juice”) that has been around for a good time already, and that is Eisberg, by Schloss Wachenheim.

“Sales of alcohol-free wine are currently booming in the UK,” says Dan Harwood.“Recent research conducted by Eisberg revealed that Just under one-third (30 per cent) of people said they would drink less when enjoying an evening out with friends or family if there was a good supply of alcohol-free options, while 20 per cent said it would encourage them to have more completely alcohol-free nights [this from a nationally-representative survey of 1,500 18-65 year-olds undertaken by 3Gem Research & Insights in October 2021] – further suggesting that the demand for alcohol free is there and retailers need to keep up.”

He says it is clear that those choosing not to drink alcohol for whatever reason, don’t want to be restricted only to sugary pop or fruit juices, they want to feel included in the occasion. If wine is a popular alcoholic drink, why not a non-alcoholic one, if the taste is just as good?

“Those who are avoiding alcohol still want to be included in these occasions. Alcohol free wine provides a more grown up and low-calorie choice for non-drinkers. Eisberg has a fantastic range of alcohol-free wines, including Eisberg Alcohol Free Sparkling Blanc and Sparkling Rosé.”

Harwood sees 2022 as a prime opportunity for growing sales of brands such as Eisberg: “The lifting of all Coronavirus restrictions for the first time since 2020 means that this will be the first time that many people are coming together for some time – making this summer extra special.

Harwood concludes that retailers should anticipate sparkling wines and prosecco will be popular throughout 2022 as the Spring and Summer months are filled with celebrations.

Major wine distributor Accolade Wines has vast experience with regular alcoholic drinks, but is forging ahead into the non-alcoholic for several reasons.

“The work-life balance has blurred for many in the past couple of years with home becoming our headquarters,” says Tom Smith. “We’ve found that people have enjoyed a drink to transition between work and leisure at the end of the day, but want something lighter during the working week, which has been a strong opportunity for low and no alcohol.”

He explains that zero-alcohol wine is in 28.2 per cent YOY value growth (ahead of still wine), and is now worth over £39m, delivering 0.6 per cent of the total category: “This is driven by non-alcohol sparkling, which accounts for 38 per cent of total zero alcohol wine value.”

The last couple of years spent at home served as an opportunity for consumers to switch from soft drinks and opt for alternative low and no options, he continues, and this has opened the way for non-sparkling zero alcohol wines to also enter the market.

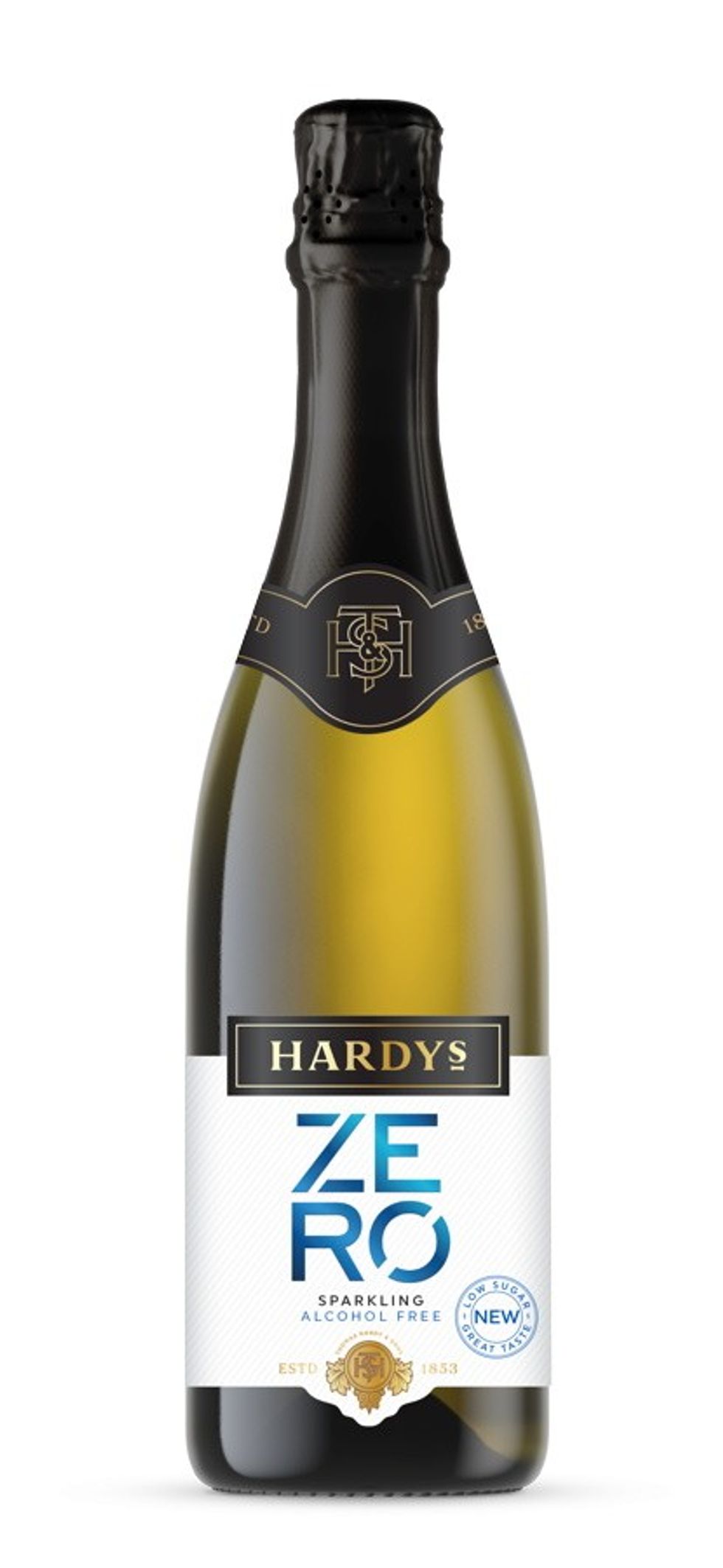

To this end, Accolade is launching Hardys Zero, a new non-alcoholic range that utilises cutting-edge de-alcoholising technology. Available in three classic varieties – Shiraz, Chardonnay, and of course Sparkling.

“Hardys Zero aims to make wine accessible and enjoyable for all, no matter the occasion,” says Tom, and the advance in taste is again due to improvements in production processes:

“Accolade Wines has first-to-market access to this world leading de-alcoholising technology, Zero Tech X," he says. “As a result of the new, gentler process to remove alcohol, Hardys Zero wines retain more of the aroma, body and flavour of full-strength wine and require less sugary additives versus traditional de-alcoholising techniques.”

Tom says that Hardys Zero is perfect for everyday occasions or for those looking to moderate their wine intake, without compromising on taste or quality. “While younger adults are more likely to be regular consumers of low/no alcohol products, we’re expecting Hardys Zero to perform well with shoppers aged 45+.” Hardys Zero is available from June across grocery (RSP: £5.50), convenience, wholesale and on-trade.

In terms of reduced alcohol, in March Accolade’s Echo Falls brand added a summer-inspired variety to its successful Fruit Fusion sparkling range – the 5.5 per cent ABV Passion Fruit and Sicilian Lemon Sparkling Fruit Fusion.

Echo Falls’ Fruit Fusion is now worth £46 million and already boasts the top-selling Summer Berries variety. The new edition has a slightly sweet but delicate and refreshing flavour, and is expected to appeal to loyal Echo Falls shoppers, as well as encourage the brand’s target audience of younger consumers (25-34 years) into the wine category.

The share of sparkling fruit flavoured wine within the flavoured wine category is up by 19 per cent in volume, compared to last year, as shoppers become more adventurous and look to expand their wine repertoire. To tap into this growth, we are extending our Fruit Fusion Sparkling range with this innovative product, which has already performed well in our consumer testing.

UK winery Black Tower has also introduced a new alcohol-free range of white wine and rosé, created through a “gentle alcohol extraction process.”

The white is characterized by fruity and punchy aromas of orange, passion fruit and peach, this de-alcoholised wine has a medium-sweet flavour and goes well with Asian cuisine, Vegetarian cuisine or white meat. The rosé is produced using the same extraction method and grape variety. It is defined by very sweet and smooth aromas of blackberry, strawberry and raspberry.

“We’ve been producing low and alcohol-free wines for many years,” said Esther Schumacher, brand manager of Reh Kendermann’s Black Tower. “They have become an important branch of our business and assist us in supplying our customers with an even larger selection of wines: Even those who don`t like to or can’t consume alcohol find a tasty alternative amongst our wine brands.”

Non-alcoholic spirits – a path blazed by zero-distillers Seedlip (in which Diageo acquired a majority stake, back in 2019) is developing more widely, partly piggy-backing off the gin craze in the first instance, but doubtless soon to expand across an ever-wider range of traditional spirit categories.

“Previously, a barrier to entry of the no and lower category was the taste of non-alcoholic options,” says Priestley. “However, with new innovations appearing regularly, this is beginning to change. Retailers can leverage well-known alcohol brands and stock their non-alcoholic counterparts to encourage people to enter the category. Gordon’s 0.0 per cent, for example, was the top selling non-alcoholic spirit in the off-trade in 2021 which is a testament to its quality.”

In February Diageo launched a Tanqueray 0.0 per cent, an alcohol-free spirit from the creators of Tanqueray.

“Our expert innovation team has combined years of expertise and historic Gin distilling knowledge to create a credible alcohol-free experience,” commented Terry Fraser, Tanqueray master distiller. “Tanqueray 0.0 per cent is created by distilling the same botanicals used in Tanqueray London Dry Gin. These botanicals are individually immersed in water, heated and then distilled before being expertly blended together to capture the essence of Tanqueray in a delicious alcohol-free alternative.”

With the No and Low category currently worth £150m RSV in the UK off-trade, and expected to deliver 23 per cent of total adult drinks growth over the next three years, the spirits giant is drinks driving innovation within the category.

“Our aim was to ensure that we retain Tanqueray’s distinctive flavours of piney juniper and faint lemon zest which when mixed with the perfect serve is exquisite in taste. Tanqueray 0.0 per cent delivers a truly authentic, vibrant alcohol-free experience that captures the spirit of Tanqueray perfectly,” said Anita Robinson, marketing director GB, Diageo.

Tanqueray 0.0 per cent launches in wholesale this month and the RRP for Tanqueray 0.0 per cent is £16 per 70cl bottle.

One for the road

As Drinkaware’s Adam Jones points out, substituting low alcohol, lower strength and alcohol-free drinks for higher ABV products can help customers reduce the amount of alcohol they drink and keep to the UK Chief Medical Officers’ low-risk drinking guidelines, which can bring many important health benefits.

“Drinking low alcohol and alcohol-free products can help people reduce their alcohol intake, providing a valuable moderation tool," says Jones. “However, the technique only works when used as substitution for higher strength alcoholic alternatives. Consuming low alcohol or alcohol-free drinks in addition to usual drinking, won’t see drinkers gain the benefits associated with reducing their alcohol intake.”

All the taste and none of the hangover can’t be bad.