British retail technology company, NearSt, today announces a new technology for UK convenience retailers that automatically connects their in-store inventory to major delivery platforms such as Uber Eats, Deliveroo, and Just Eat.

NearSt’s solution connects directly with convenience retailer's existing EPOS systems, ensuring their full in-store product range is displayed live on delivery apps. This delivers five key benefits to convenience retailers:

- Increased revenue – Display your full in-store product range across delivery apps, helping customers build bigger baskets and driving sales growth

- Minimise failed orders – Cut cancellations by over a third through real-time stock accuracy, boosting customer satisfaction and loyalty.

- Save valuable time – Eliminate hours of manual work and tedious data entry, freeing up time for you and your staff.

- Grow a local presence – Show all your products with high-quality images, titles and descriptions on any last-mile provider with ease.

- Get started quickly – Start seeing results immediately with simple integration to your existing systems.

Recent Mintel research shows 59% of UK consumers are now doing some grocery shopping online, so offering reliable last-mile delivery has become a competitive necessity for convenience stores. However, many retailers struggle with time-consuming manual updates, high failed order rates, and limited product offerings across last-mile menus.

"This technology represents an important step forward for convenience retail," says Nick Brackenbury, Co-founder and CEO of NearSt. "We're empowering local retailers with capabilities that were previously out of reach. With our extensive network of over 150 point-of-sale partners alongside our last-mile delivery integrations, we enable retailers to seamlessly transform their last-mile offering into a genuine competitive advantage and revenue driver."

Pricewatch Group’s results

Pricewatch Group - operating stores under Morrisons Daily, Nisa, Gulf, and BP brands - was the first retailer to leverage NearSt’s real-time local inventory feeds with delivery platforms, starting in September 2024. Since, Pricewatch has seen significant results in streamlining operations, enhancing customer experiences and improving staff productivity:

- 913% sales growth across last mile platforms (first 11 weeks)

- 233% increase in Just Eat sales alone

- 59 hours per month saved in menu management

- 37% reduction in failed orders weekly

- 115% expansion in product range on last-mile menus

"We tried multiple digital partners and previously spent hours manually uploading inventory data. Then NearSt just comes along and makes it work. We've saved so much time and been able to reallocate it elsewhere to get much more done. From an operational time-saving aspect, NearSt has been invaluable.” says Tom Buckley, General Manager at Pricewatch Group.

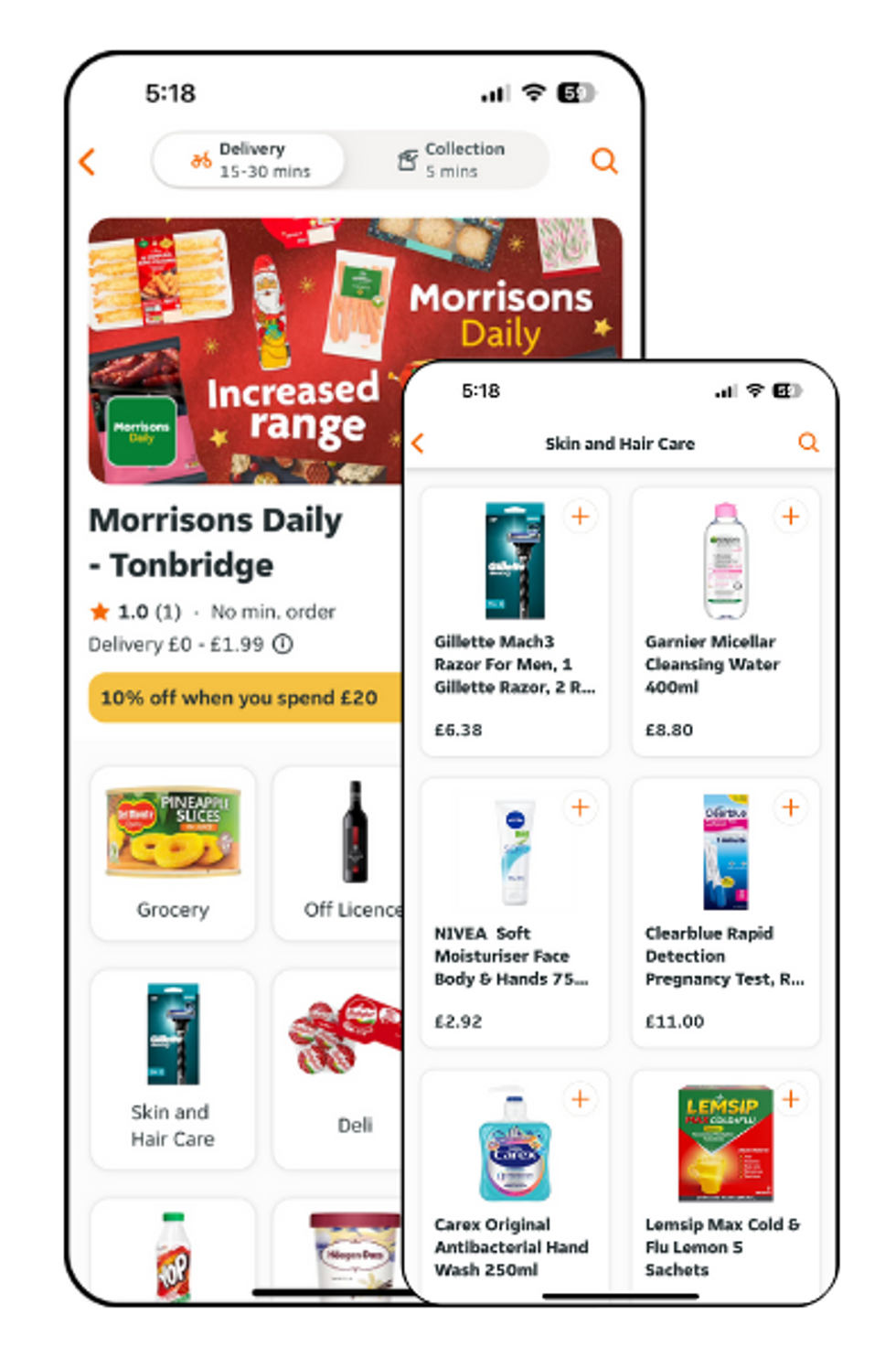

Pricewatch x Just Eat menu:

"NearSt has made it achievable for us to run a cost-effective last-mile operation that's saving us a huge amount of time and money," says Claire Goddard, Marketing Manager at Pricewatch Group. "We now have a flawless and professional menu that rivals those of the major supermarket chains making it a dream for our customers to shop and buy on."

![NearSt Founders, Nick Brackenbury [left) and Max Kreijn [right]](https://www.asiantrader.biz/media-library/nearst-founders-nick-brackenbury-left-and-max-kreijn-right.jpg?id=56408480&width=1200&height=800&quality=60&coordinates=1%2C0%2C1%2C0)