New data released by the Food Foundation reports that 8.8 per cent of households (4.7 million adults) have experienced food insecurity in the past month. This has increased from 7.3 per cent six month ago (July 2021). 3.6 per cent (1 million adults) reported that they or someone in their household has had to go a whole day without eating in the past month because they couldn’t afford or access food (up from 2.6 per cent in July). The Foundation claimed this was evidence soaring energy and food prices, along with the removal of the £20 uplift to Universal Credit, were having a devastating impact on millions of people across the UK.

It found 62 per cent of UK households had experienced higher energy bills and 16 per cent were forced to cut back on the quality or quantity of food to afford other essentials (e.g. energy bills). Meanwhile 59 per cent of households are worried that increased energy prices will mean they have less money to afford enough food for themselves/their family.

The British Retail Consortium also warned prices will continue to rise – and at a faster rate – than last year.

Children’s food insecurity

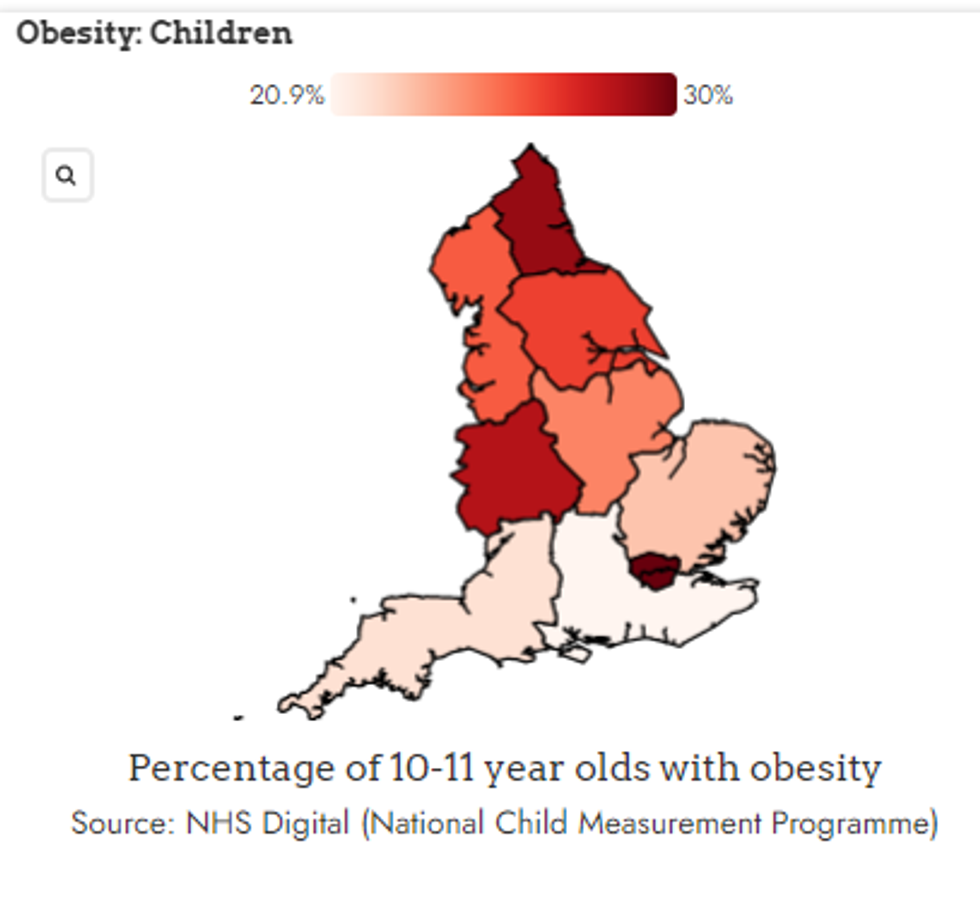

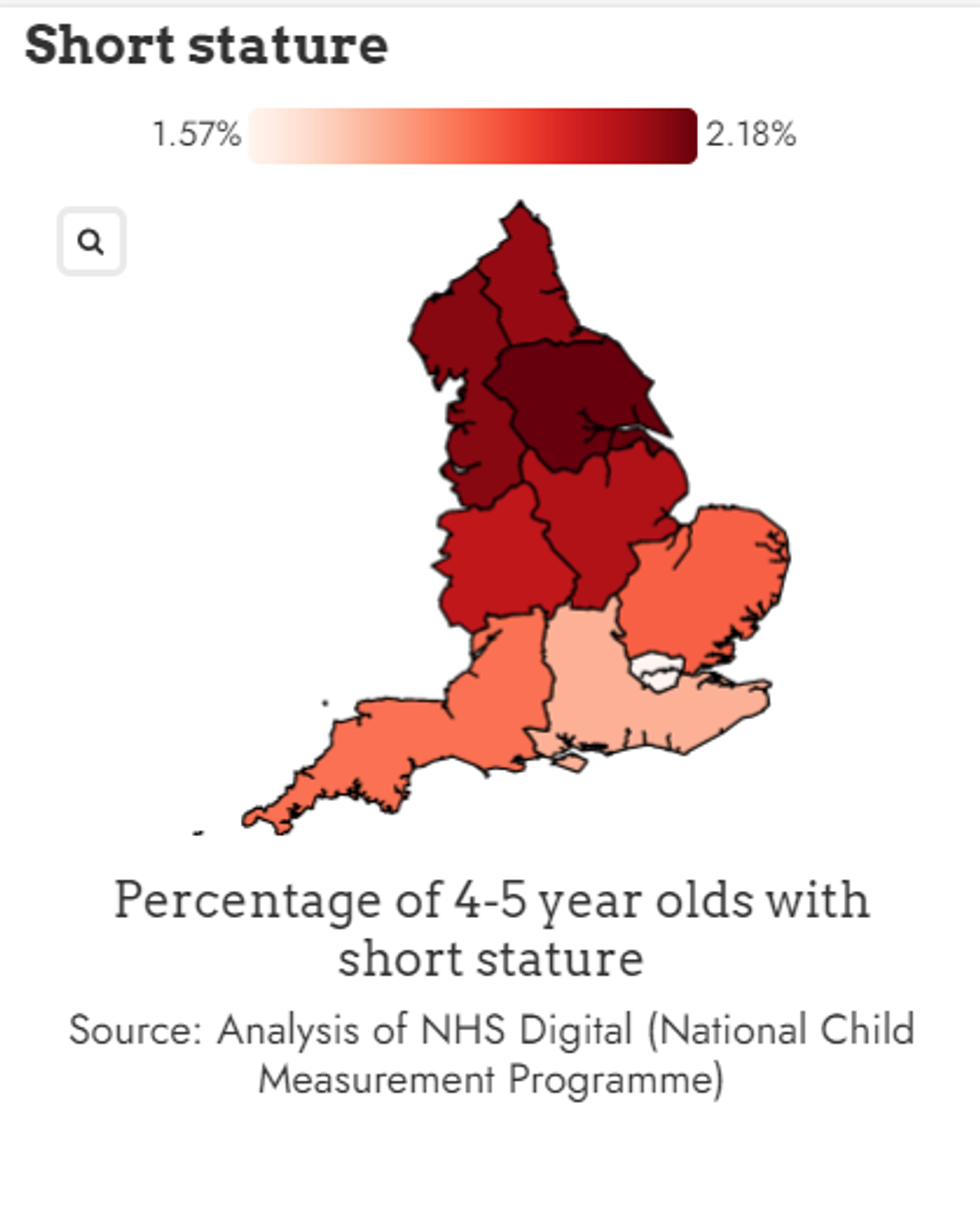

The Food Foundation also identified a significant rise in the number of households with children experiencing food insecurity in the past month, at 12.1 per cent, up from 11.0 per cent last July. This represents a total of 2 million children who live in households that do not have access to a healthy and affordable diet which puts them at high risk of suffering from diet related diseases, poor child growth and shorter lives.

Parents are also more worried about feeding their children school lunches now than they were 18 months ago, with 4.9 per cent of parents of children aged 8 to 16 in the household who are NOT registered for Free School Meals worried their children will have to go without lunch some days because they cannot afford school meals/packed lunches – compared with just 1.1 per cent in August 2020.

Levelling-up

The Food Foundation are calling on Government to make tackling food insecurity central to the levelling up agenda.

“The Levelling Up white paper commits to boosting productivity, pay and job security but does not commit to reducing food insecurity rates,” said Anna Taylor, Executive Director of The Food Foundation. “Food insecurity is a vital measure if we are to monitor severe material deprivation. It contributes not only to health inequalities and life expectancy, but also social wellbeing. If the Government wants to really get to grips with the issue, a comprehensive approach to levelling-up must tackle food insecurity head on.”

The Food Foundation said there is little doubt that the cost-of-living crisis is putting is “very real” pressure on the ability of many to afford a healthy diet and is set to widen health inequalities further unless the Government acts now.

At-risk groups

The data also shows worrying trends and identifies groups who are most at risk of food poverty as food prices rise. People limited a lot by disabilities are 5 times more at risk than people not limited by disabilities (31.1 per cent vs 6.4 per cent).

“The rapid escalation in Disabled people experiencing food poverty is truly shocking,” said Kamran Mallick, CEO of Disability Rights UK. “It is the disabled people facing the biggest barriers to independence and inclusion that are in the worst situation, how can this possibly be acceptable? With rising energy bills, increasing inflation and benefits pegged at a horrendously low level, millions of Disabled people are living in conditions comparable to the nineteenth-century workhouse.”

Another major concern highlighted by the latest data is that people who are currently on Universal Credit are five times more likely to have been food insecure in the past six months than those not on Universal credit. The Foundation concluded that this demonstrated that it is vital that Government moves to ensure that benefits are linked to the cost of a healthy diet and extends schemes such as Healthy Start and Free School Meals so they benefit all children in food insecure households.