Behind a record surge in cocoa prices this year, a corner of financial markets that drives the cost of chocolate underwent a seismic shift: the hedge funds that oiled its workings headed for the exit.

Confectionery prices, from candy bars to hot chocolate, are heavily influenced by futures contracts for cocoa beans. These financial instruments, traded in London and New York, allow cocoa buyers and sellers to determine a price for the commodity, forming a benchmark for sales across the world.

In the middle of last year, hedge funds - a class of investors that use privately pooled money to make speculative bets - started pulling back from trading cocoa futures because price swings in the market were raising their cost of trading and making it harder to make profits.

They accelerated their retreat in the first half of this year as cocoa prices hit a record in April, driven by supply issues in West Africa, according to Reuters calculations based on data from the US Commodity Trading Futures Commission (CFTC), which oversees the New York market, and ICE Futures Europe, an exchange that compiles figures for trading in London.

"This market became increasingly volatile," said Razvan Remsing, director of investment solutions at Aspect Capital, a $9.3 billion London-based fund that uses coding and algorithms to find trades. "Our system's response was to trim our positions."

Aspect slashed the exposure to cocoa in its Diversified Fund from nearly 5 per cent of its net asset value in January to less than one percent after April, according to a presentation reviewed by Reuters.

The departure of hedge funds and other speculators caused liquidity in the market to slump, making it harder to buy and sell, stoking volatility to record highs and fueling the price spike still further.

Reuters spoke to a dozen fund executives, cocoa market brokers and traders who said the retreat has left lasting strains on the market. That has resulted in greater gaps between the price at which cocoa can be bought and sold, and has prompted some industry players to seek alternative instruments, leaving a lasting impact on the sector.

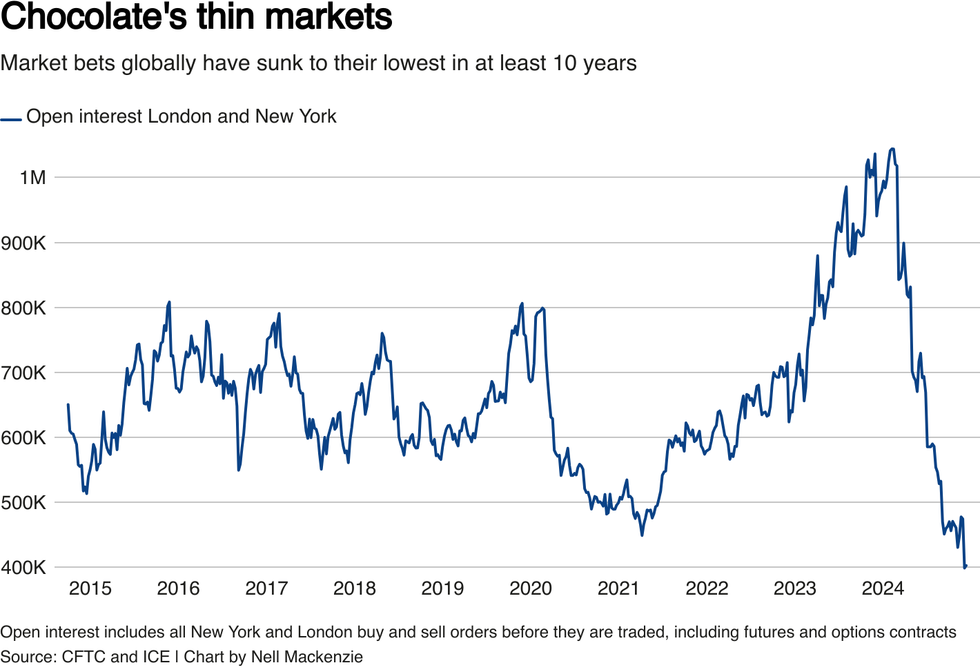

This month, the number of futures contracts held globally at the end of a given trading day - a key indicator of market health known as "open interest" - hit its lowest since at least 2014, the global figures show, a sign the futures market overall has shrunk significantly. Data prior to 2014 was not available.

On Wednesday, New York cocoa futures prices topped their April peak.

The futures market is a crucial cog in the cocoa industry, allowing producers and chocolate companies to hedge their exposure to swings in the price of beans.

Futures dictate income for the farmers and low-income nations that produce the world's cocoa - the majority of which comes from Ghana and Ivory Coast in West Africa.

Hedge funds and speculators have become bigger players in commodity markets over the past two decades as the value of their overall assets has grown. But, as purely financial investors, they have no need to remain in the market at times of stress.

The impact of hedge funds' exit illustrates how reliant trading has become on these lightly regulated funds that increasingly shape financial markets. Reuters has reported this year on how hedge funds are piling into the euro zone's $10 trillion government bond market, drawing regulatory scrutiny, and on their growing sway in European stock trading.

Contacted by Reuters, the CFTC declined to comment. A representative for Britain's regulator, the Financial Conduct Authority, said that, in line with its market supervision practice, "we have been working with trading venues and participants to monitor the orderliness of the market."

Bernhard Tröster, an economist at the Austrian Foundation for Development Research (ÖFSE) in Vienna, who last year co-authored a paper on the growing role of financial actors in commodities derivatives markets, said the withdrawal of hedge funds had helped fuel the crisis in cocoa markets.

"When markets became so volatile this year, it was clear how hedge funds and other financial actors have become so important," he said.

Supply issues hit prices

Hedge funds and other speculators' share of the market peaked at 36 per cent in May 2023, the highest in at least a decade, after which their retreat began, the global data calculated by Reuters show.

Then, at the start of this year, global cocoa prices soared after top producer Ivory Coast was hit by adverse weather and disease. Number two producer Ghana fared even worse, with smuggling, illegal gold mining on cocoa farms and sector mismanagement added to the mix.

In early February, cocoa prices surpassed a previous record high set in 1977. Executives at five hedge funds told Reuters they began to withdraw as volatility grew and the cost of trading increased.

When markets become too hot, exchanges require speculators to increase the amount of collateral they put down per futures contract, raising their costs. Lawrence Abrams, president of Absolute Return Capital Management in Chicago, said the cost of trading a single cocoa futures contract soared from $1,980 in January to $25,971 by June.

High prices and volatility, combined with falling liquidity, began to affect "our system's trading and risk management decisions," Abrams said, whose fund sold out before prices peaked in April. He declined to detail how much his fund managed, citing regulatory reasons.

Many hedge funds promise investors they will not exceed a certain amount of risk, meaning that if a certain market becomes too volatile they have to reduce their exposure.

The difference between prices offered and sought for futures, the so-called "bid-ask spread", soared following the hedge funds' withdrawal. That has made trading harder: lower liquidity and wider spreads mean traders struggle to execute large trades without moving overall prices.

"You need speculators," said Vladimir Zientek, a trading associate at brokerage firm StoneX, referring to hedge funds, which are not among his clients. "Without speculators in the market, you lose a lot of liquidity, which allows for these very wide and erratic market swings."

By mid-April, New York contracts CCc1 hit a then-record above $12,000, up three-fold from January, prompting hedge funds to sell down their positions.

"Trends don't last forever," said Remsing at Aspect Capital. "Stay too long in size and you stand to give back all your gains."

Hedge funds' share of the cocoa futures market dropped to 7 per cent in late May, its lowest in at least a decade, the global data show.

One European broker, who requested anonymity to discuss clients' trades, said that panic in the market increased in March and April as liquidity drained away.

Volatility in cocoa futures hit an all-time high in May, up five-fold from a year earlier, according to data from the London Stock Exchange Group (LSEG).

Daily average price swings that month neared $800, some 15 times the levels of a year earlier, according to a Reuters analysis of figures from market data provider PortaraCQG.

Riskier markets

For major trading houses that buy and sell cocoa beans - a group that includes Singapore's Olam, Switzerland’s Barry Callebaut, and US-based Cargill - the liquidity drain and associated price surge exacerbated the more than-$1 billion dollar hit they took on their futures positions.

The losses came earlier this year after Ghana, following a disastrous harvest in the October 2023 to September 2024 season, delayed delivery on nearly half the beans the nation had pledged to sell, upsetting cocoa traders' futures market strategies.

These traders typically use futures to lock in prices achieved for cocoa beans, or to hedge against the risk of falling prices.

But that strategy unraveled as Ghana delayed its deliveries. Traders were forced to liquidate, at steep losses, short positions for the month of expected delivery, and take new short positions.

The market turmoil has prompted some trading houses and producers to seek alternatives to futures.

Australian investment bank Macquarie, a big player in commodity markets, told Reuters it sold over-the-counter products to trading houses, processors and chocolate makers when cocoa volatility hit record levels this year, and demand remains high.

One major agri-commodities trader is now using such bespoke contracts, according to a source who requested anonymity citing sensitive commercial relationships. They declined to comment on the magnitude of the business.

Such products typically protect buyers against narrower price swings than is possible with futures, limiting their use, a European broker said, declining to be identified to freely discuss clients' activity.

'Cocoa tourists'

Some hedge funds have returned to the market. Along with other speculators that trade using investors' cash, they accounted for 22 per cent of futures trading this month, according to the global data. But buying and selling in the cocoa market's altered landscape has become harder.

Zientek, the trading associate at StoneX, said bid-ask spreads can now top 20 "ticks" - $200 per contract - compared to about 2-4 ticks before cocoa's rally to record highs.

"This makes larger orders tougher to execute without seeing an immediate distortion in the market," he said.

Daniel Mackenzie, managing director of Cocoa Hub, a UK-based company that sources and sells cocoa beans to artisan chocolate makers, said higher and more volatile prices were forcing small and medium-sized makers to decide between passing costs to clients or reducing product sizes.

One chocolate maker he worked with has been shuttered and another sold, he said, without providing further details.

As hedge funds exited, short-term investors such as day-traders – which buy and sell assets within a single trading day – have stayed in the market, the European broker and the broker at the agri-commodities bank said.

The cohort that includes day-traders this month accounted for 5 per cent of the market, about the same as the start of the year, the global data show.

Day-traders cannot fulfill the liquidity-provision role traditionally played by hedge funds, the two brokers said.

"I like to call them 'cocoa tourists' - they move in, hold a position for a day or two, then move out," the European broker said.

(Reuters)